Answered step by step

Verified Expert Solution

Question

1 Approved Answer

( Related to Checkpoint 1 5 . 1 ) ( Calculating capital structure weights ) Winchell Investment Advisors is evaluating the capital structure of Ojai

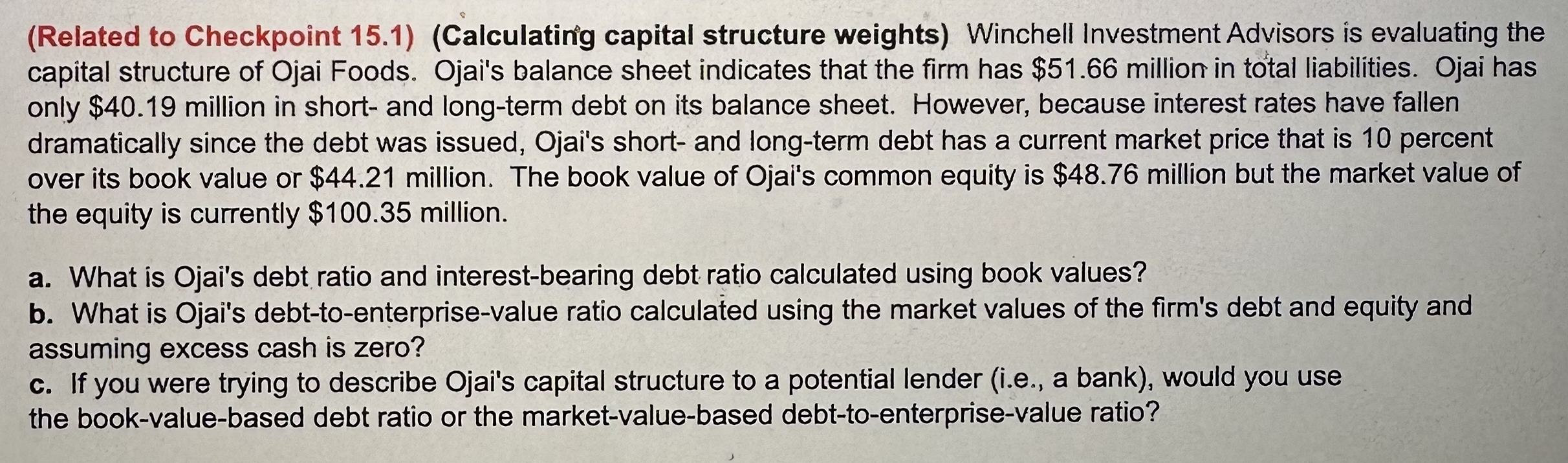

Related to Checkpoint Calculating capital structure weights Winchell Investment Advisors is evaluating the capital structure of Ojai Foods. Ojai's balance sheet indicates that the firm has $ million in total liabilities. Ojai has only $ million in short and longterm debt on its balance sheet. However, because interest rates have fallen dramatically since the debt was issued, Ojai's short and longterm debt has a current market price that is percent over its book value or $ million. The book value of Ojai's common equity is $ million but the market value of the equity is currently $ million.

a What is Ojai's debt ratio and interestbearing debt ratio calculated using book values?

b What is Ojai's debttoenterprisevalue ratio calculated using the market values of the firm's debt and equity and assuming excess cash is zero?

c If you were trying to describe Ojai's capital structure to a potential lender ie a bank would you use the bookvaluebased debt ratio or the marketvaluebased debttoenterprisevalue ratio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started