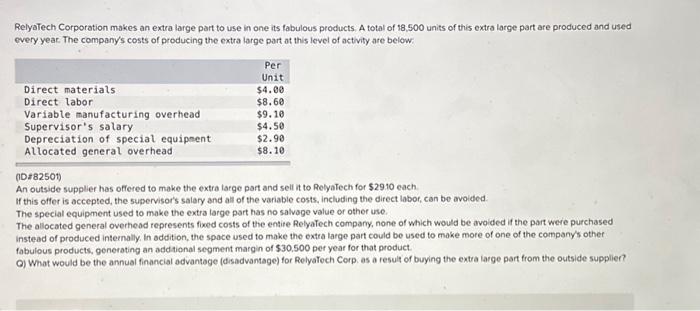

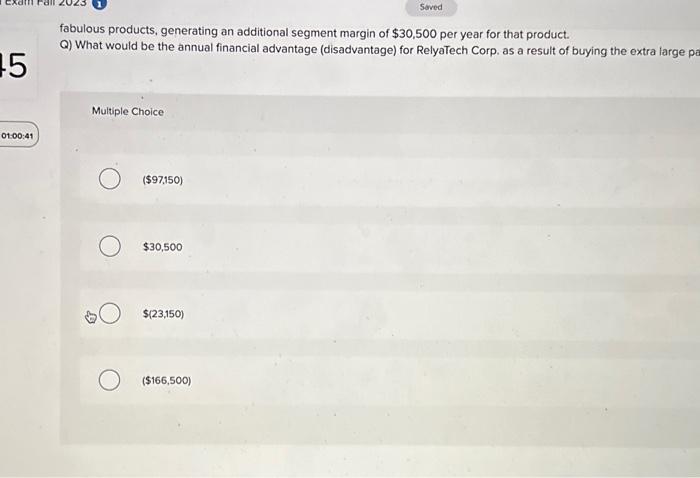

RelyaTech Corporation makes an extra large part to use in one its fabulous products. A total of 18,500 units of this extra large part are produced and used every year. The company's costs of producing the extra large part at this level of activity are below: (10:82501) An outside supplier has offered to make the extra iarge part and sell it to Relyatech for $2910 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including the direct labor, can be avoided: The special equipment used to make the extra large part has no salvage value or other use. The allocated general overheod represents fixed costs of the entite Relyafech company, none of which would be avoided if the part were purchased instead of produced internally, In addition, the space used to make the extra large part could be used to moke more of one of the company's other fabulous products, generating an addtional segment margin of $30,500 per year for that product. a) What would be the annual financial advantage (disadvantage) for Relyatech Corp. as a fesult of buying the extra large part from the outside supplier? fabulous products, generating an additional segment margin of $30,500 per year for that product. Q) What would be the annual financial advantage (disadvantage) for RelyaTech Corp. as a result of buying the extra large p Multiple Choice (\$97,150) $30,500 E. $(23,150) (\$166,500) RelyaTech Corporation makes an extra large part to use in one its fabulous products. A total of 18,500 units of this extra large part are produced and used every year. The company's costs of producing the extra large part at this level of activity are below: (10:82501) An outside supplier has offered to make the extra iarge part and sell it to Relyatech for $2910 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including the direct labor, can be avoided: The special equipment used to make the extra large part has no salvage value or other use. The allocated general overheod represents fixed costs of the entite Relyafech company, none of which would be avoided if the part were purchased instead of produced internally, In addition, the space used to make the extra large part could be used to moke more of one of the company's other fabulous products, generating an addtional segment margin of $30,500 per year for that product. a) What would be the annual financial advantage (disadvantage) for Relyatech Corp. as a fesult of buying the extra large part from the outside supplier? fabulous products, generating an additional segment margin of $30,500 per year for that product. Q) What would be the annual financial advantage (disadvantage) for RelyaTech Corp. as a result of buying the extra large p Multiple Choice (\$97,150) $30,500 E. $(23,150) (\$166,500)