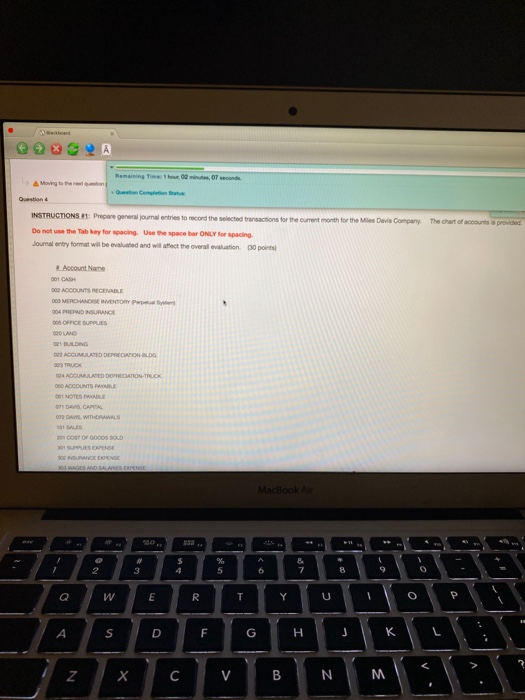

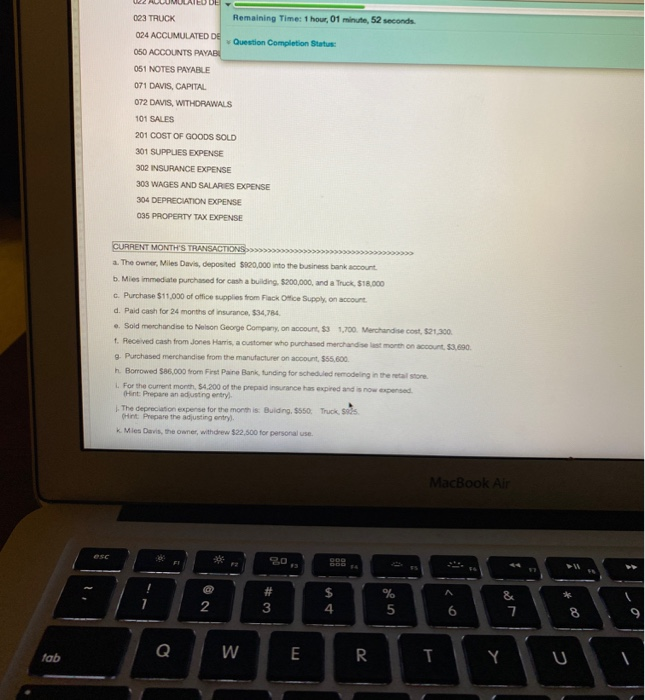

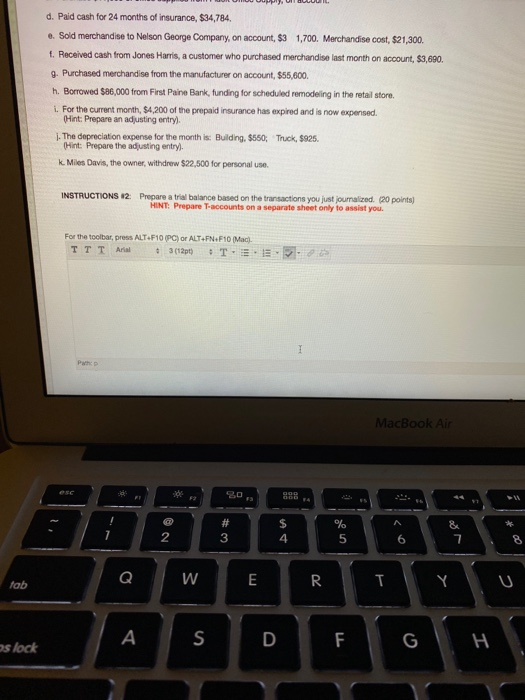

Remaining Timeshow 02, 07 seconds Moving to the nation for the Me Davis Company. The chart of account is provided INSTRUCTIONS #1: Prewe general journal entries to record the selected transactions for the cure Do not use the Tab kay for spacing. Use the space bar ONLY for spacing Journal entry format will be evaluated and will affect the overalvation. 30 points Account Name 001 CASH ACCOUNTS RECEIVABLE DE MERWISE INVENTORY 004 PREWO INSURANCE DOS OFICE SUPRUES OLAND 1 BUILDING 2 ACCUMURID DEPRECONDO TUOR 004 ACCUMULATED DEPRECATION TRUCK 050 ACCOUNTS POUR 05 NOTES PUBE S. CAPTA 072 AV THOMAS 201 COST OF 0000S SOLD NSURANCE DOENSE 300 WAGES AND SALARGUENSE MacBook AS $ 4 3 % 5 8 7 7 6 8 W E R T Y 0 P C S D F G H K > N X C V B N M 023 TRUCK Remaining Time: 1 hour, 01 minute, 52 seconds 024 ACCUMULATED DE Question Completion Status: 050 ACCOUNTS PAYAB 051 NOTES PAYABLE 071 DAVIS, CAPITAL 072 DAVIS, WITHDRAWALS 101 SALES 201 COST OF GOODS SOLD 301 SUPPLIES EXPENSE 302 INSURANCE EXPENSE 303 WAGES AND SALARIES EXPENSE 304 DEPRECIATION EXPENSE 035 PROPERTY TAX EXPENSE CURRENT MONTH'S TRANSACTIONS a. The owner, Miles Davis, deposited $20,000 into the business bank account b. Mies immediate purchased for cash a building, 5200,000, and a Truck, $18.000 c. Purchase $11,000 of office supplies from Fick Mice Supply on account d. Paid cash for 24 months of insurance, 534,784 .. Sold merchandise to Nelson George Company, on account, $3 1,700 Merchandise cost $21,300 1. Received cash from Jones Harris, a customer who purchased merchandiselust morth on account. 53.690 9. Purchased merchandise from the manufacturer on account, $56.600 h. Borrowed $86,000 from First Paine Bank, tunding for scheduled remodeling in the retail store For the current month $4,200 of the prepaid insurance has expired and is now censed Hint Prepare an adjusting entry! 1. The depreciation expense for the month is: Bulding, $550, Truck & Hint Prepare the adjusting entry K Mies Davis, the owner, withdrew $22.500 for personal use. MacBook Air 30 80 . @ # * 2 $ 4 % 5 & 7 Q fab W E R T T Y d. Paid cash for 24 months of insurance, $34,784. . Sold merchandise to Nelson George Company, on account, $3 1,700. Merchandise cost $21,300. t. Received cash from Jones Harris, a customer who purchased merchandise last month on account, $3,690. g. Purchased merchandise from the manufacturer on account, $55,600. h. Borrowed $86,000 from First Paine Bank, funding for scheduled remodeling in the retail store. i. For the current month, $4,200 of the prepaid insurance has expired and is now expensed. (Hint: Prepare an adjusting entry) 1. The depreciation expense for the month in: Bulding, $550; Truck, $925. (Hint: Prepare the adjusting entry) k. Miles Davis, the owner, withdrew $22,500 for personal use. INSTRUCTIONS 12 Prepare a trial balance based on the transactions you just joumalized. (20 points) HINT: Prepare T-accounts on a separate sheet only to assist you. For the toolbar, press ALT F10 (PC) or ALT+FN:F10 (Mac). Arial 3(121) T.EE 18 1 MacBook Air 900 & # 3 2 % 5 4 6 7 8 Q 3 tab E R T Y S D F as lock G H H