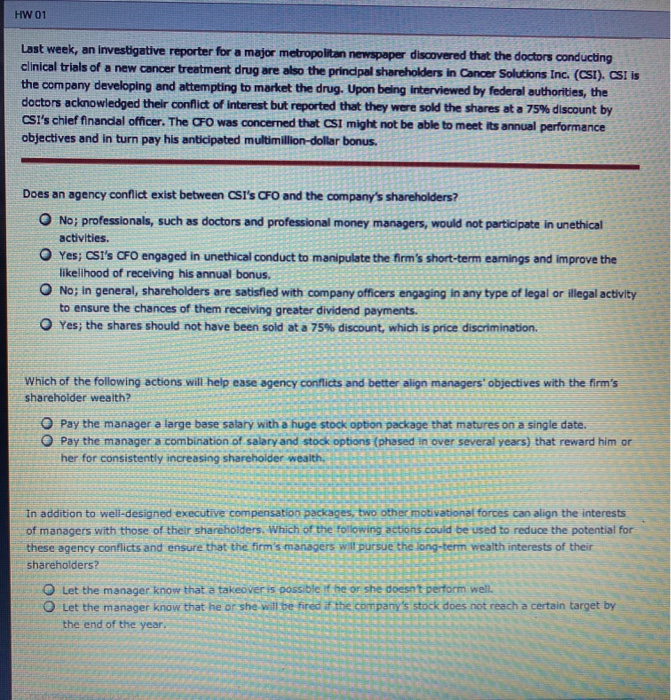

Remember, an agency relationship cadence homogenito n tasba mwer that is not In the best nterest of his or her principal laye r s, the conflictsmest frequently involve the enrichment of the film's executives morgers (in the ford mong r eg o r poner and prestige) at the expense of the company shareholders. This supig r ation stercholder alth is mostly to cu when shareholdes de net have sufident information to the decisions and being made by the firm's management Cornide the following scenario and determine whethemagen conflictext: Last week, an investigative reporter for a major metropolitan R e discovered that the doctors conducting dinical trials of a new cancer treatment drugare is the principal shareholders in Cancer Solutions Inc. (CSI). Gatis the company developing and attempting to market the drug Upon being interviewed by federal authorities, the doctors acknowledged their conflict of interest but more that they are said the shares at 79% discount by OSIS chief financial office. The OORS Ened the Oright not be able to meet annual performance objectives and in tur pay his anticipated multimilion-dolar bonus Does an agency conflict exist between ISO and the company's shareholders? Ne; professionals, such as doctors and professional money managers, would not participate in unethical activities Yus; CN CO engaged in unethical conds to manipulate the short-term rings and improve the Ikelihood of reiving his annual bonus O Ne; in general, shareholders are satisfied with castigaging in any type of Ings or legal activity to ensure the chances of the r ing der yes; the shares should not have bumi a t stich is prima dimination Which of the following actions will help as agency shareholder wealth and be a rer hjectives with the fir's O O Pay the manager a large base salary with the Pay the manager a comition of salary and t her for consistently increasing rather stat stond th the matures on a single date several years that read him or o e In addition to all-designed exsctv tom o ndat t a l forces can align the interests of raragers with those of the shareholder och othe r actions could be used to reduce the potential for these agency borlicts and ensure that the m a nagers use the long-term wealth interests of the thrcheid Out the tracer know that is the sheepers O at the racer know that he or she h ad the sto ne rechtertartet by the end of the ye HW 01 Last week, an investigative reporter for a major metropolitan newspaper discovered that the doctors conducting clinical trials of a new cancer treatment drug are also the prindpal shareholders in Cancer Solutions Inc. (CSI). CSI is the company developing and attempting to market the drug. Upon being interviewed by federal authorities, the doctors acknowledged their conflict of interest but reported that they were sold the shares at a 75% discount by CSI's chief financial officer. The CFO was concerned that CSI might not be able to meet its annual performance objectives and in turn pay his anticipated multimillion-dollar bonus. Does an agency conflict exist between CSI's CFO and the company's shareholders? No; professionals, such as doctors and professional money managers, would not participate in unethical activities. Yes; CSI's CFO engaged in unethical conduct to manipulate the firm's short-term earnings and improve the likelihood of receiving his annual bonus. No; in general, shareholders are satisfied with company officers engaging in any type of legal or illegal activity to ensure the chances of them receiving greater dividend payments. Yes; the shares should not have been sold at a 75% discount, which is price discrimination. Which of the following actions will help ease agency conflicts and better align managers' objectives with the firm's shareholder wealth? Pay the manager a large base salary with a huge stock option package that matures on a single date. e Pay the manager a combination of salary and stock options (phased in over several years) that reward him or her for consistently increasing shareholders ht In addition to well-designed executive compensation packages, two other motivational forces can align the interests of managers with those of their shareholders. Which of the following actions could be used to reduce the potential for these agency conflicts and ensure that the firm's managers will pursue the long-term wealth interests of their shareholders? Let the manager know that a takeover is possible if he or O Let the manager know that he or she will be fired at the company's stock does not reach a certain target by the end of the year. perform well