Answered step by step

Verified Expert Solution

Question

1 Approved Answer

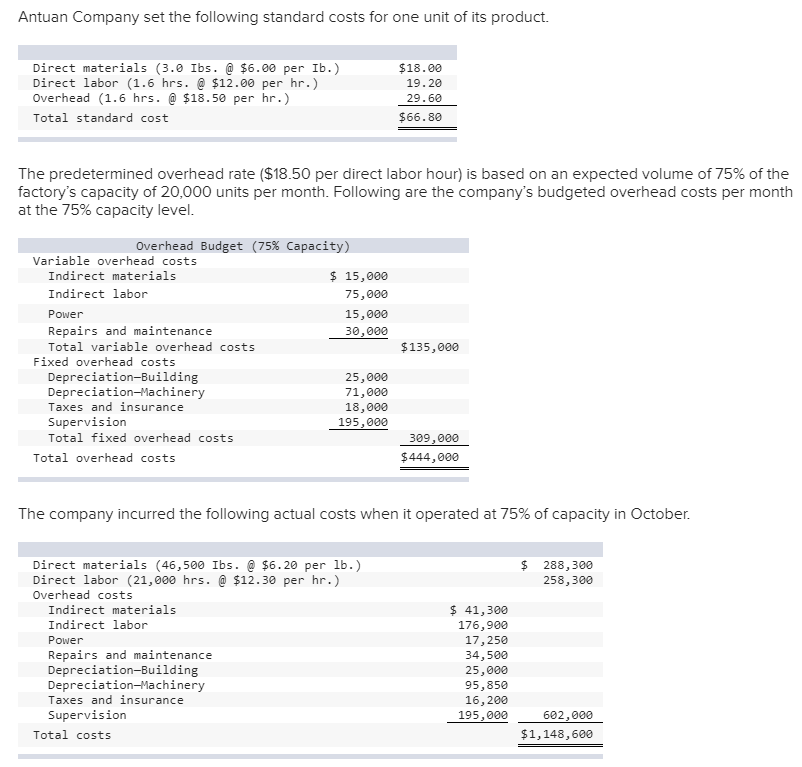

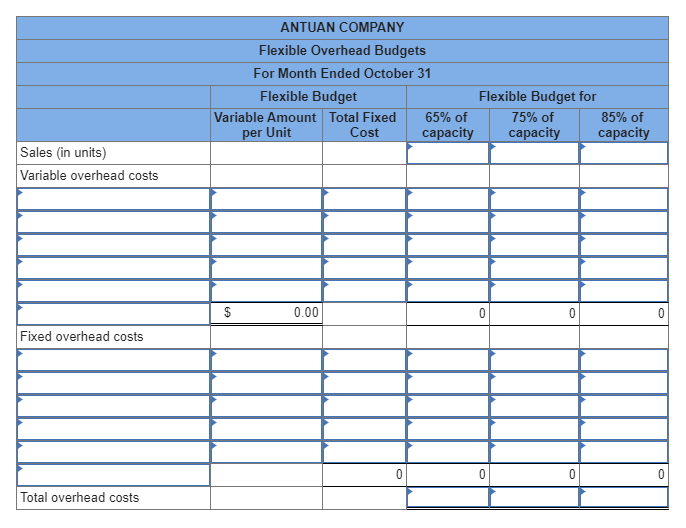

Required: 1&2. Prepare flexible overhead budgets for October showing the amounts of each variable and fixed cost at the 65%, 75%, and 85% capacity levels

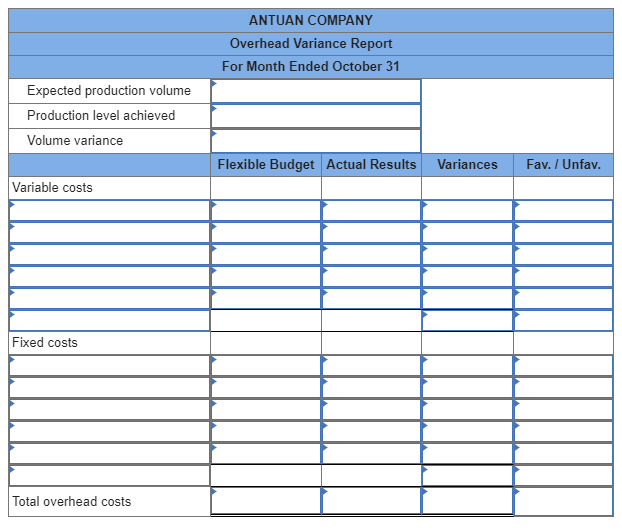

Required:

1&2. Prepare flexible overhead budgets for October showing the amounts of each variable and fixed cost at the 65%, 75%, and 85% capacity levels and classify all items listed in the fixed budget as variable or fixed

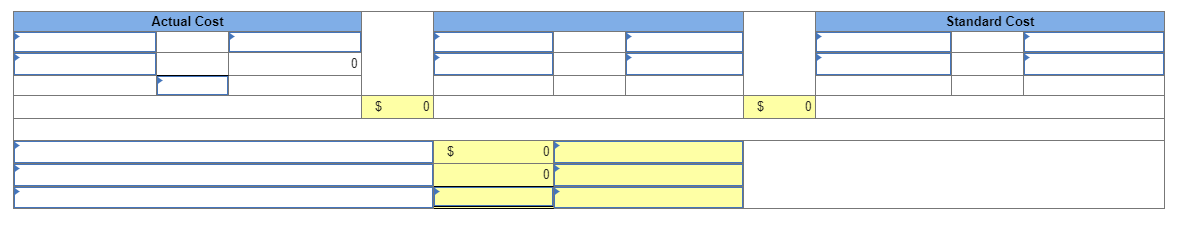

3. Compute the direct materials cost variance, including its price and quantity variances

4. Compute the direct labor cost variance, including its rate and efficiency variances

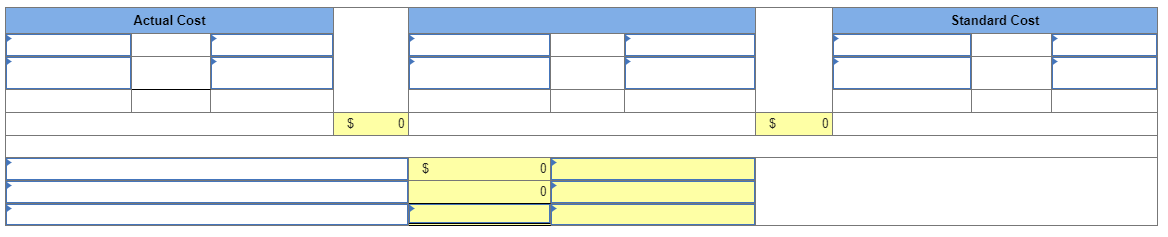

5. Prepare a detailed overhead variance report that shows the variances for individual items of overhead

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started