Question

Required: a. Assume RP spent $296,000 of the proceeds to expand its inventory and the remaining $748,000 to purchase new residential real estate. Calculate RP's

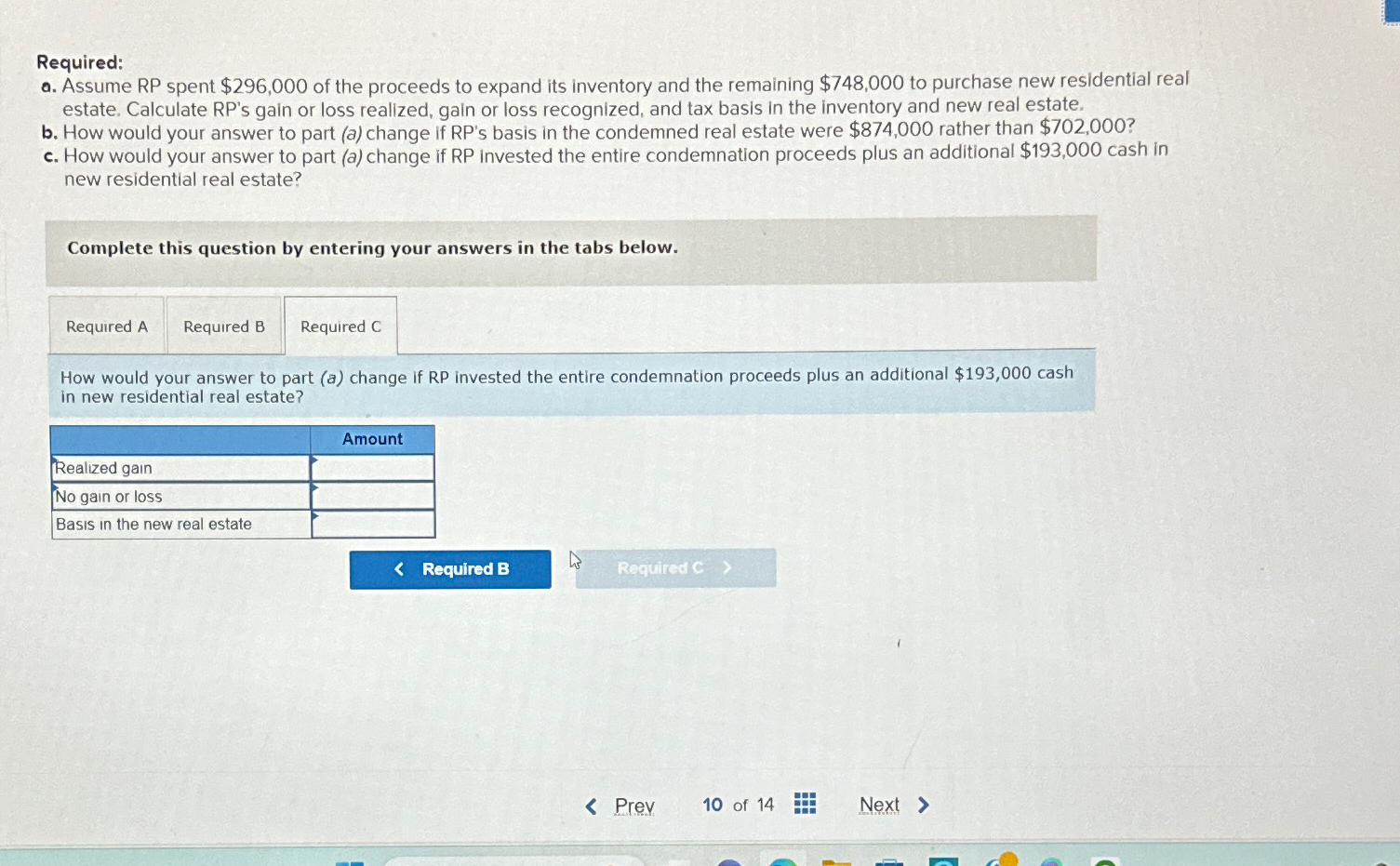

Required:\ a. Assume RP spent

$296,000of the proceeds to expand its inventory and the remaining

$748,000to purchase new residential real estate. Calculate RP's gain or loss realized, gain or loss recognized, and tax basis in the inventory and new real estate.\ b. How would your answer to part (a) change if RP's basis in the condemned real estate were

$874,000rather than

$702,000?\ c. How would your answer to part (a) change if RP invested the entire condemnation proceeds plus an additional

$193,000cash in new residential real estate?\ Complete this question by entering your answers in the tabs below.\ Required C\ How would your answer to part (a) change if RP invested the entire condemnation proceeds plus an additional

$193,000cash in new residential real estate?\ \\\\table[[,],[Realized gain,Amount],[No gain or loss,],[Basis in the new real estate,]]\ Prev\ 10 of 14\ Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started