Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: A. Calculate the minimum Net Income For Tax Purposes for Kalex for 2020 with a reconciliation that begins with the net accounting income

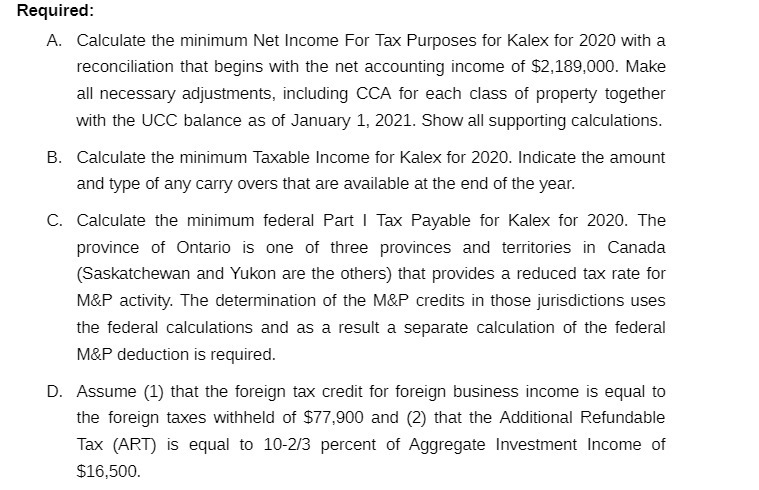

Required: A. Calculate the minimum Net Income For Tax Purposes for Kalex for 2020 with a reconciliation that begins with the net accounting income of $2,189,000. Make all necessary adjustments, including CCA for each class of property together with the UCC balance as of January 1, 2021. Show all supporting calculations. B. Calculate the minimum Taxable Income for Kalex for 2020. Indicate the amount and type of any carry overs that are available at the end of the year. C. Calculate the minimum federal Part I Tax Payable for Kalex for 2020. The province of Ontario is one of three provinces and territories in Canada (Saskatchewan and Yukon are the others) that provides a reduced tax rate for M&P activity. The determination of the M&P credits in those jurisdictions uses the federal calculations and as a result a separate calculation of the federal M&P deduction is required. D. Assume (1) that the foreign tax credit for foreign business income is equal to the foreign taxes withheld of $77,900 and (2) that the Additional Refundable Tax (ART) is equal to 10-2/3 percent of Aggregate Investment Income of $16,500.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started