Question

Required (Do not round down in calculations until the final answer at two decimal point.) 1. Prepare a gross margin table based on traditional costing

Required (Do not round down in calculations until the final answer at two decimal point.)

1. Prepare a gross margin table based on traditional costing method with sales and COGS in total dollars for 2018 for both product lines.

2. Prepare a gross margin table based on activities method with sales and COGS in total dollars for 2018 for both product lines.

3. What does the information in both 2018 tables tell you?

4. Prepare a gross margin table based on activities method with sales and COGS in total dollars for 2019 for both product lines.

5. Calculate the fixed cost and variable cost components of COGS for the two clients using the least squares regression method. Show your work and write out the regression model equation for each client.

6. Discuss the two clients COGS in terms of fixed cost and variable cost according to special specifications.

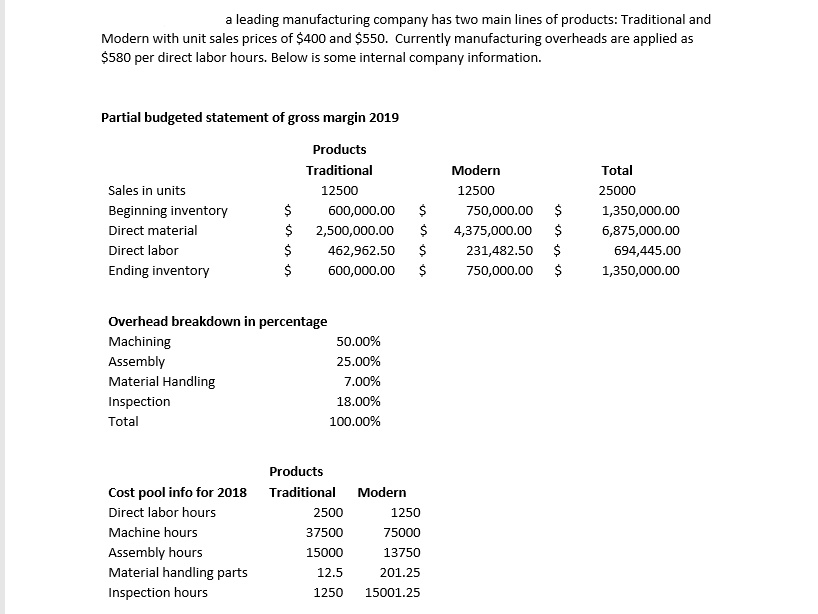

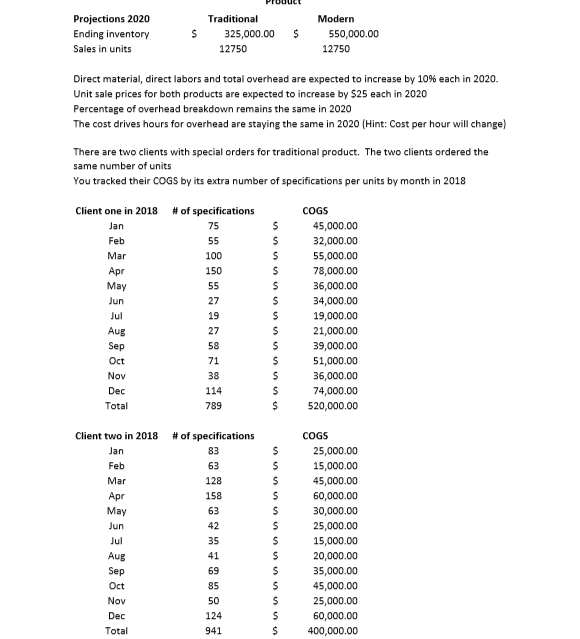

a leading manufacturing company has two main lines of products: Traditional and Modern with unit sales prices of $400 and $550. Currently manufacturing overheads are applied as $580 per direct labor hours. Below is some internal company information. Partial budgeted statement of gross margin 2019 Products Traditional 12500 Modern Sales in units Beginning inventory Direct material Direct labor Ending inventory Total 25000 1,350,000.00 6,875,000.00 12500 600,000.00 750,000.00 $ $2,500,000.00 $4,375,000 S462,962.50$ $600,000.00 $ 231,482.50 $ 750,000.00 $ 694,445.00 1,350,000.00 Overhead breakdown in percentage Machining Assembly Material Handling Inspection Total 50.00% 25.00% 7.00% 18.00% 100.00% Products Cost pool info for 2018 Direct labor hours Machine hours Assembly hours Material handling parts Inspection hours Traditional Modern 2500 37500 15000 12.5 1250 75000 13750 201.25 1250 15001.25 Projections 2020 Ending inventory Sales in units Traditional 325,000.00 $550,000.00 12750 12750 Direct material, direct labors and total overhead are expected to increase by 10% each in 2020. Unit sale prices for both products are expected to increase by $25 each in 2020 Percentage of overhead breakdown remains the same in 2020 The cost drives hours for overhead are staying the same in 2020 (Hint: Cost per hour will change) There are two clients with special orders for traditional product. The two clients ordered the same number of units You tracked their COGS by its extra number of specifications per units by month in 2018 Client one in 2018 of specifications 75 COGS 45,000.00 32,000.00 55,000.00 78,000.00 36,000.00 34,000.00 19,000.00 21,000.00 39,000.00 51,000.00 36,000.00 74,000.00 $520,000.00 Feb Mar 100 150 May 27 19 27 58 Jul Dec Total 38 114 789 Client two in 2018 of specifications COGS 83 63 128 158 63 42 35 41 69 85 50 124 941 25,000.00 15,000.00 45,000.00 60,000.00 30,000.00 25,000.00 15,000.00 20,000.00 35,000.00 45,000.00 25,000.00 60,000.00 400,000.00 Feb Mar May Nov Dec Total a leading manufacturing company has two main lines of products: Traditional and Modern with unit sales prices of $400 and $550. Currently manufacturing overheads are applied as $580 per direct labor hours. Below is some internal company information. Partial budgeted statement of gross margin 2019 Products Traditional 12500 Modern Sales in units Beginning inventory Direct material Direct labor Ending inventory Total 25000 1,350,000.00 6,875,000.00 12500 600,000.00 750,000.00 $ $2,500,000.00 $4,375,000 S462,962.50$ $600,000.00 $ 231,482.50 $ 750,000.00 $ 694,445.00 1,350,000.00 Overhead breakdown in percentage Machining Assembly Material Handling Inspection Total 50.00% 25.00% 7.00% 18.00% 100.00% Products Cost pool info for 2018 Direct labor hours Machine hours Assembly hours Material handling parts Inspection hours Traditional Modern 2500 37500 15000 12.5 1250 75000 13750 201.25 1250 15001.25 Projections 2020 Ending inventory Sales in units Traditional 325,000.00 $550,000.00 12750 12750 Direct material, direct labors and total overhead are expected to increase by 10% each in 2020. Unit sale prices for both products are expected to increase by $25 each in 2020 Percentage of overhead breakdown remains the same in 2020 The cost drives hours for overhead are staying the same in 2020 (Hint: Cost per hour will change) There are two clients with special orders for traditional product. The two clients ordered the same number of units You tracked their COGS by its extra number of specifications per units by month in 2018 Client one in 2018 of specifications 75 COGS 45,000.00 32,000.00 55,000.00 78,000.00 36,000.00 34,000.00 19,000.00 21,000.00 39,000.00 51,000.00 36,000.00 74,000.00 $520,000.00 Feb Mar 100 150 May 27 19 27 58 Jul Dec Total 38 114 789 Client two in 2018 of specifications COGS 83 63 128 158 63 42 35 41 69 85 50 124 941 25,000.00 15,000.00 45,000.00 60,000.00 30,000.00 25,000.00 15,000.00 20,000.00 35,000.00 45,000.00 25,000.00 60,000.00 400,000.00 Feb Mar May Nov Dec TotalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started