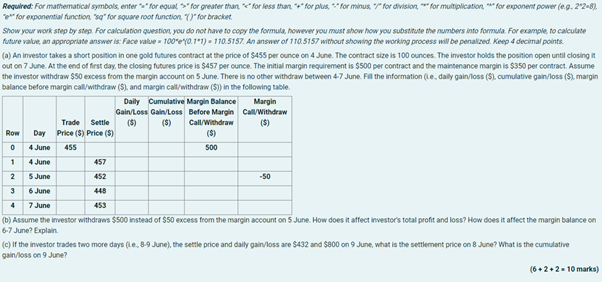

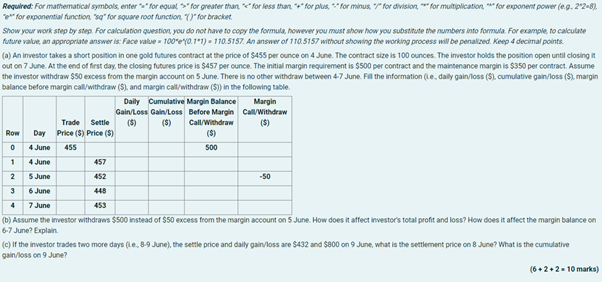

Required: For mathematical symbolsenter for equal for greater than for less thar forplus, for minus 7 for division. *** for multiplication for exponent power (e.g. 22-8). for exponential function "s" for square root function ()"for bracket Show your work step by step. For calculation question you do not have to copy the formule, however you must show how you substitute the numbers into formula. For example to calculate future value, an appropriate answer is: Face value - 100*10.1*1) - 110.5157. An answer of 110.5157 without showing the working process will be penalized. Keep 4 decimal points. (a) An investor takes a short position in one gold futures contract at the price of $455 per ounce on 4 June. The contract size is 100 ounces. The investor holds the position open until closing it out on 7 June. At the end of first day, the closing futures price is $457 per ounce. The initial margin requirement is $500 per contract and the maintenance margin is $350 per contract. Assume the investor withdraw $50 excess from the margin account on 5 June. There is no other withdraw between 4-7 June. Fill the information (Le daly gain/loss (S). cumulative gain/loss (5). margin balance before margin call/withdraw ($), and margin call/withdraw ($) in the following table. Daily Cumulative Margin Balance Margin Gain/Loss Gain/Loss Before Margin Call/Withdraw Trade Settle (5) Call/Withdraw ($) Row Day Price (5) Price (5) 0 4 June 455 500 1 4 June 457 2 5 June 452 -50 3 6 June 448 7 June 453 (b) Assume the investor withdraws $500 instead of $50 excess from the margin account on 5 June. How does it affect investor's total profit and loss? How does it affect the margin balance on 6-7 June? Explain (c) If the investor trades two more days (Le, 8-9 June), the settle price and daily gain/loss are $432 and $800 on 9 June, what is the settlement price on 8 June? What is the cumulative gain/loss on 9 June? (6+2+2 -10 marks) 4 Required: For mathematical symbolsenter for equal for greater than for less thar forplus, for minus 7 for division. *** for multiplication for exponent power (e.g. 22-8). for exponential function "s" for square root function ()"for bracket Show your work step by step. For calculation question you do not have to copy the formule, however you must show how you substitute the numbers into formula. For example to calculate future value, an appropriate answer is: Face value - 100*10.1*1) - 110.5157. An answer of 110.5157 without showing the working process will be penalized. Keep 4 decimal points. (a) An investor takes a short position in one gold futures contract at the price of $455 per ounce on 4 June. The contract size is 100 ounces. The investor holds the position open until closing it out on 7 June. At the end of first day, the closing futures price is $457 per ounce. The initial margin requirement is $500 per contract and the maintenance margin is $350 per contract. Assume the investor withdraw $50 excess from the margin account on 5 June. There is no other withdraw between 4-7 June. Fill the information (Le daly gain/loss (S). cumulative gain/loss (5). margin balance before margin call/withdraw ($), and margin call/withdraw ($) in the following table. Daily Cumulative Margin Balance Margin Gain/Loss Gain/Loss Before Margin Call/Withdraw Trade Settle (5) Call/Withdraw ($) Row Day Price (5) Price (5) 0 4 June 455 500 1 4 June 457 2 5 June 452 -50 3 6 June 448 7 June 453 (b) Assume the investor withdraws $500 instead of $50 excess from the margin account on 5 June. How does it affect investor's total profit and loss? How does it affect the margin balance on 6-7 June? Explain (c) If the investor trades two more days (Le, 8-9 June), the settle price and daily gain/loss are $432 and $800 on 9 June, what is the settlement price on 8 June? What is the cumulative gain/loss on 9 June? (6+2+2 -10 marks) 4