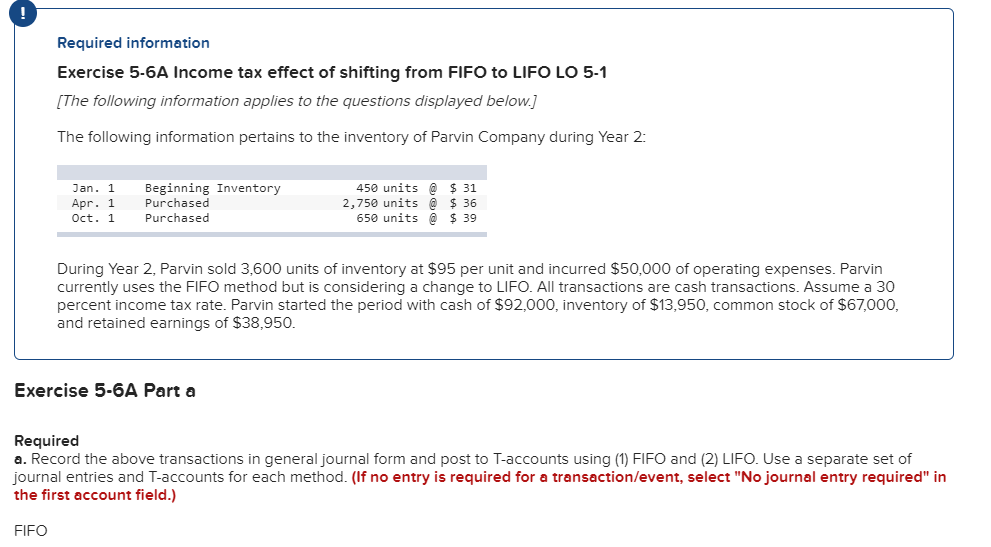

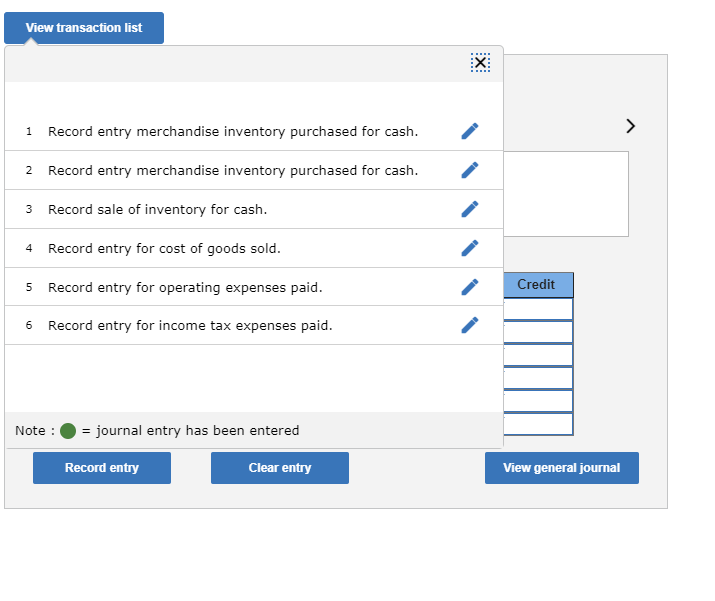

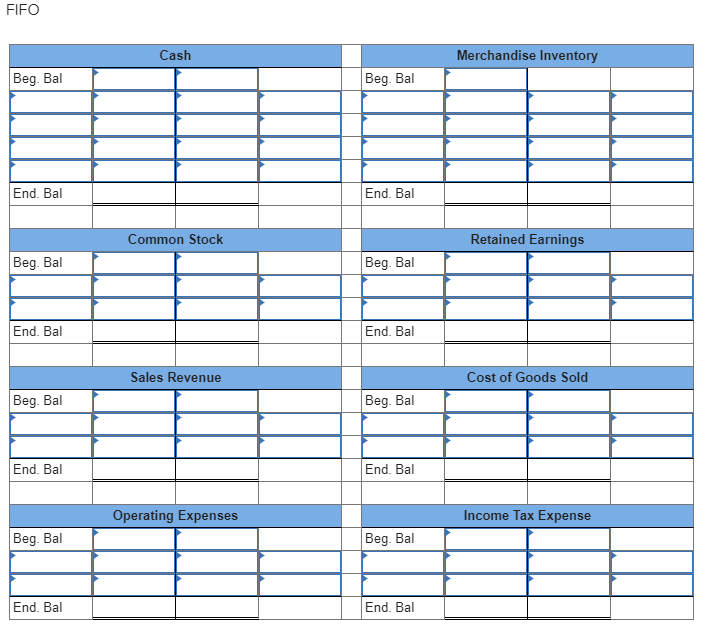

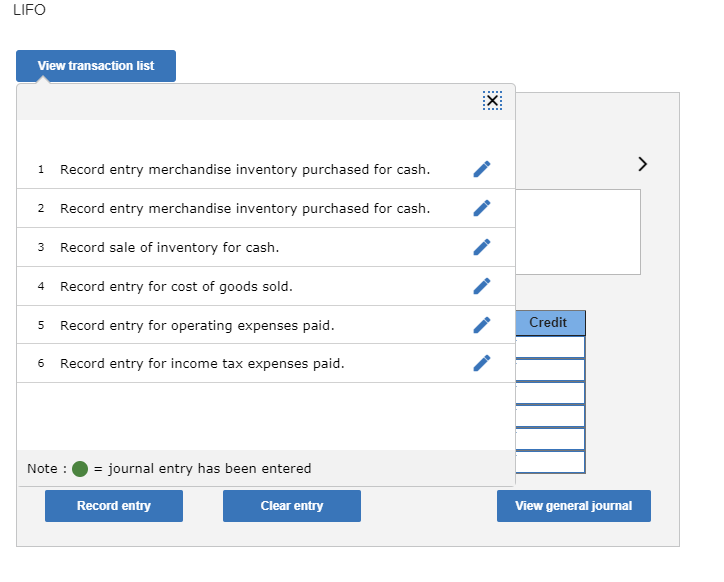

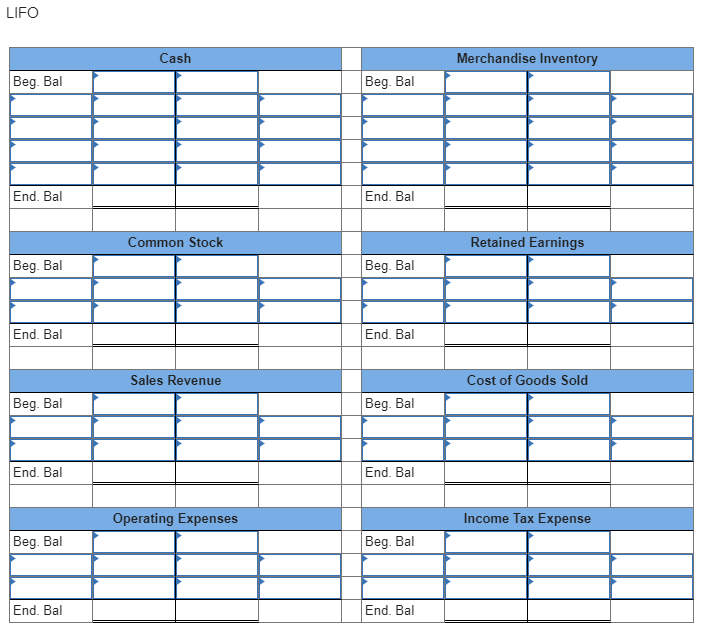

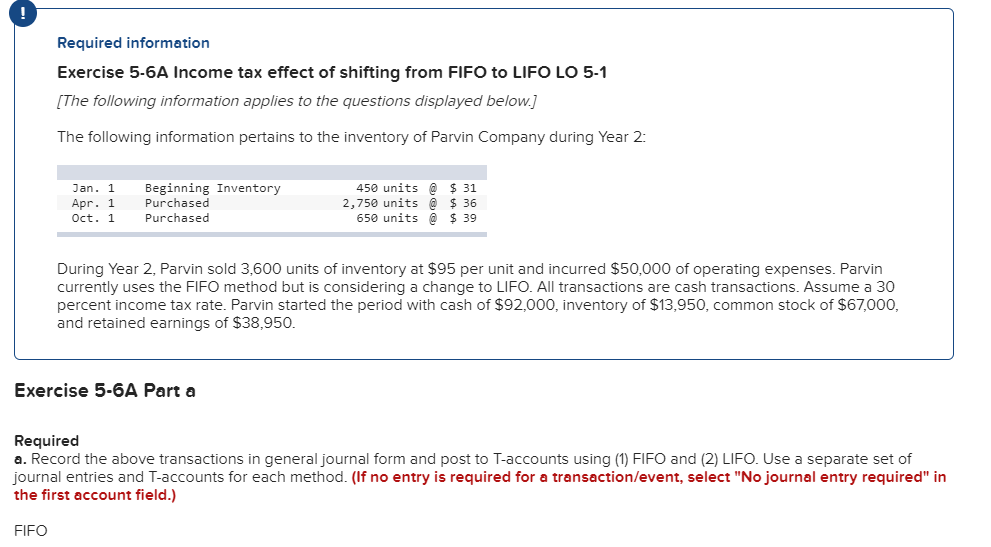

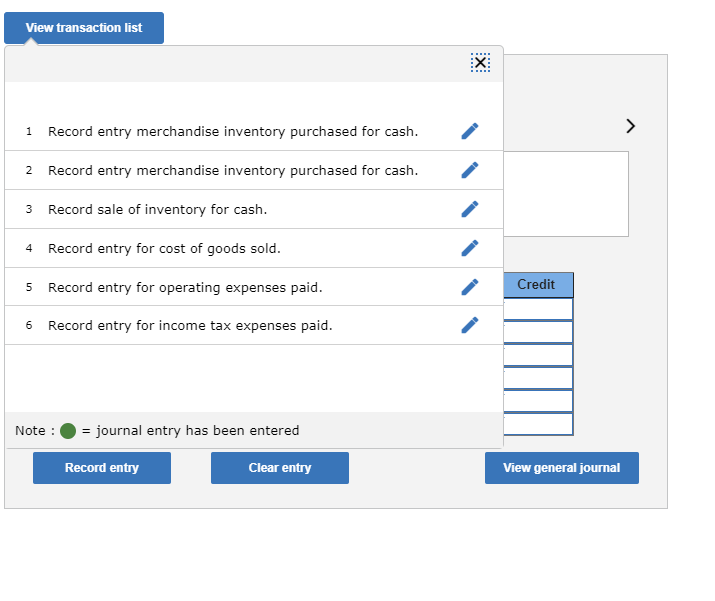

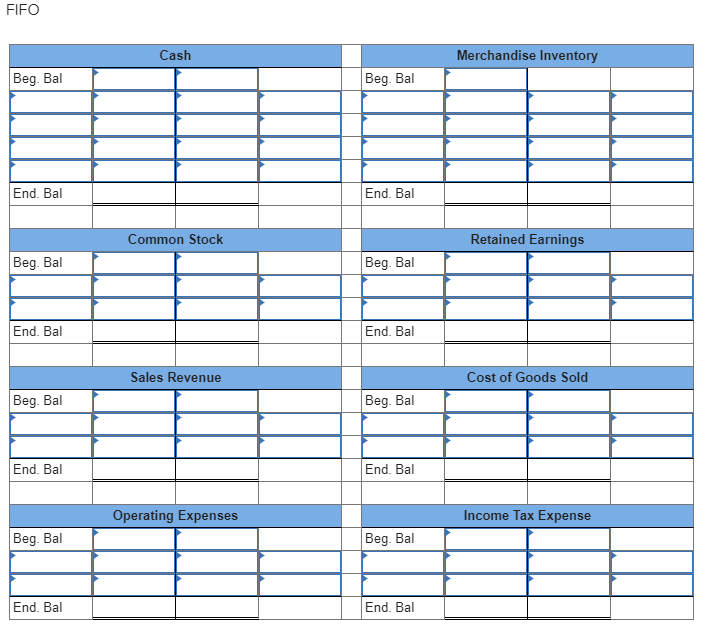

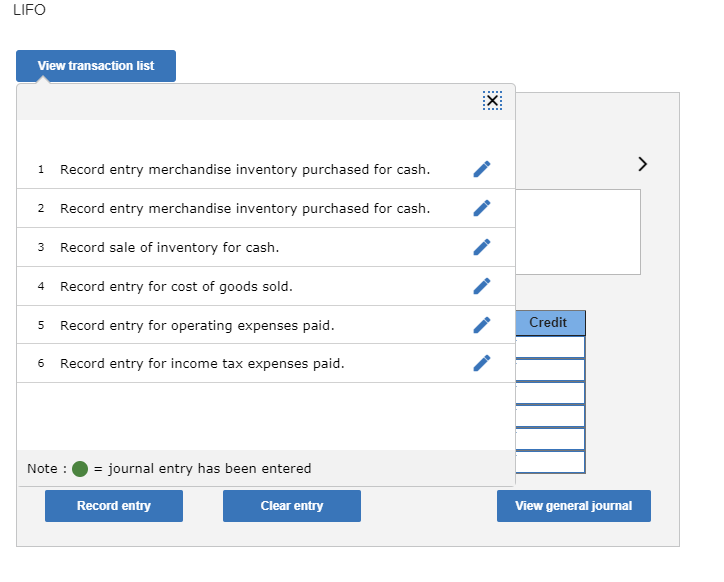

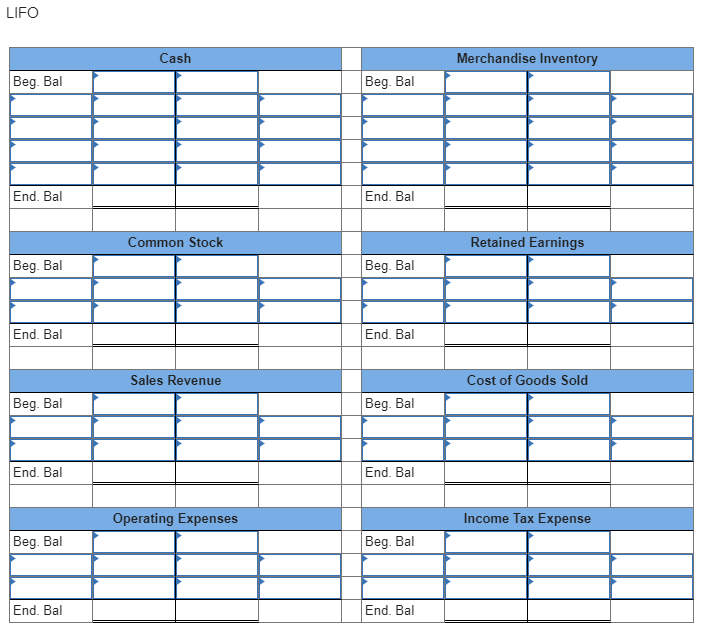

Required information Exercise 5-6A Income tax effect of shifting from FIFO to LIFO LO 5-1 [The following information applies to the questions displayed below.] The following information pertains to the inventory of Parvin Company during Year 2: Jan. 1 Apr. 1 Oct. 1 Beginning Inventory Purchased Purchased 450 units @ $ 31 2,750 units @ $ 36 650 units @ $ 39 During Year 2, Parvin sold 3,600 units of inventory at $95 per unit and incurred $50,000 of operating expenses. Parvin currently uses the FIFO method but is considering a change to LIFO. All transactions are cash transactions. Assume a 30 percent income tax rate. Parvin started the period with cash of $92,000, inventory of $13,950, common stock of $67,000, and retained earnings of $38,950. Exercise 5-6A Part a Required a. Record the above transactions in general journal form and post to T-accounts using (1) FIFO and (2) LIFO. Use a separate set of journal entries and T-accounts for each method. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) FIFO View transaction list X: 1 Record entry merchandise inventory purchased for cash. > 2 Record entry merchandise inventory purchased for cash. 3 Record sale of inventory for cash. 4 Record entry for cost of goods sold. 5 Record entry for operating expenses paid. Credit 6 Record entry for income tax expenses paid. Note : = journal entry has been entered Record entry Clear entry View general journal FIFO Cash Merchandise Inventory Beg. Bal Beg. Bal End. Bal End. Bal Common Stock Retained Earnings Beg. Bal Beg. Bal End. Bal End. Bal Sales Revenue Cost of Goods Sold Beg. Bal Beg. Bal End. Bal End. Bal Operating Expenses Income Tax Expense Beg. Bal Beg. Bal End. Bal End. Bal LIFO View transaction list X 1 Record entry merchandise inventory purchased for cash. 2 Record entry merchandise inventory purchased for cash. 3 Record sale of inventory for cash. 4 Record entry for cost of goods sold. 5 Record entry for operating expenses paid. Credit 6 Record entry for income tax expenses paid. Note : = journal entry has been entered Record entry Clear entry View general journal LIFO Cash Merchandise Inventory Beg. Bal Beg. Bal End. Bal End. Bal Common Stock Retained Earnings Beg. Bal Beg. Bal End. Bal End. Bal Sales Revenue Cost of Goods Sold Beg. Bal Beg. Bal End. Bal End. Bal Operating Expenses Income Tax Expense Beg. Bal Beg. Bal End. Bal End. Bal