Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information Potter Corp.(Potter) acquired 200 voting common shares of Slade Ltd.'s (Slade) on January 1, 2021 for cash of $8,000. At all relevant

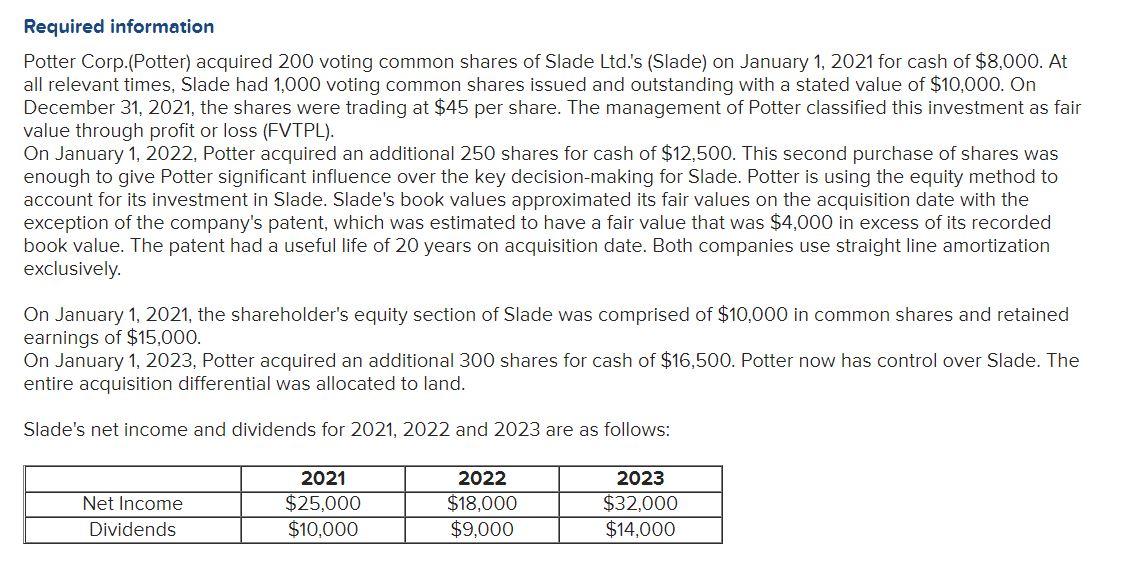

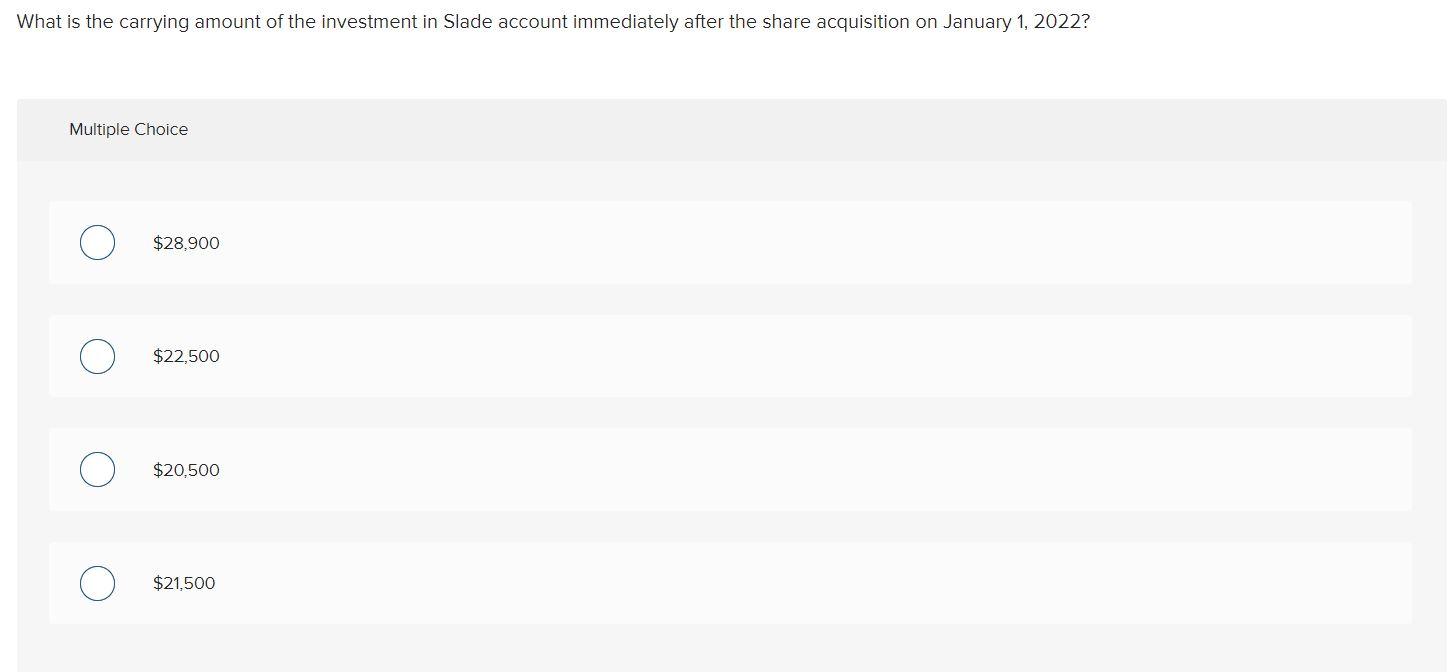

Required information Potter Corp.(Potter) acquired 200 voting common shares of Slade Ltd.'s (Slade) on January 1, 2021 for cash of $8,000. At all relevant times, Slade had 1,000 voting common shares issued and outstanding with a stated value of $10,000. On December 31, 2021, the shares were trading at $45 per share. The management of Potter classified this investment as fair value through profit or loss (FVTPL). On January 1, 2022, Potter acquired an additional 250 shares for cash of $12,500. This second purchase of shares was enough to give Potter significant influence over the key decision-making for Slade. Potter is using the equity method to account for its investment in Slade. Slade's book values approximated its fair values on the acquisition date with the exception of the company's patent, which was estimated to have a fair value that was $4,000 in excess of its recorded book value. The patent had a useful life of 20 years on acquisition date. Both companies use straight line amortization exclusively. On January 1, 2021, the shareholder's equity section of Slade was comprised of $10,000 in common shares and retained earnings of $15,000. On January 1, 2023, Potter acquired an additional 300 shares for cash of $16,500. Potter now has control over Slade. The entire acquisition differential was allocated to land. Slade's net income and dividends for 2021, 2022 and 2023 are as follows: Net Income 2021 $25,000 2022 $18,000 2023 $32,000 Dividends $10,000 $9,000 $14,000 What is the carrying amount of the investment in Slade account immediately after the share acquisition on January 1, 2022? Multiple Choice $28,900 $22,500 $20,500 $21.500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To find the carrying amount of the investment in Slade immediately after the share acquisition on January 1 2022 follow these steps Step 1 Initial Inv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started