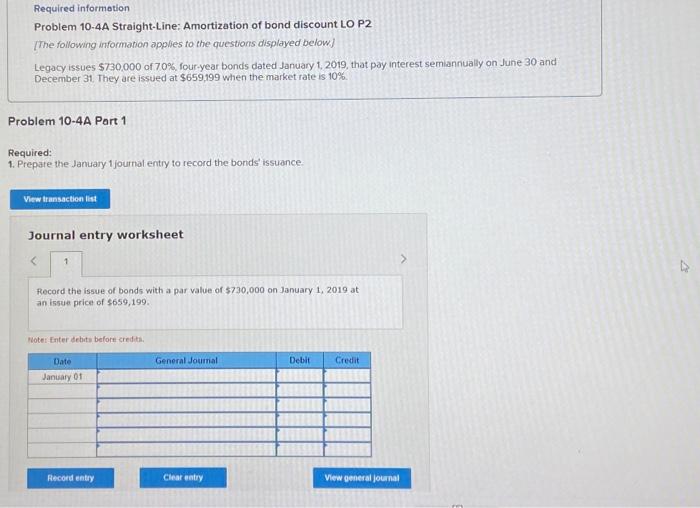

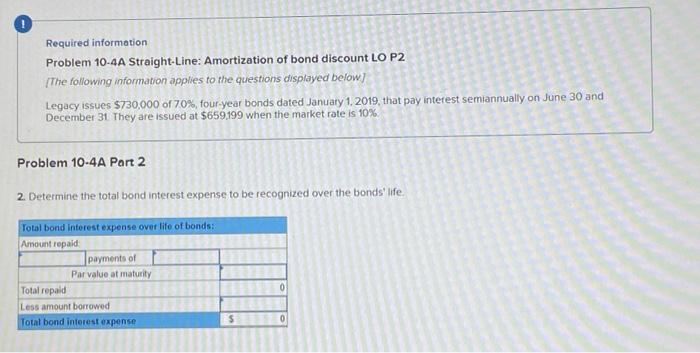

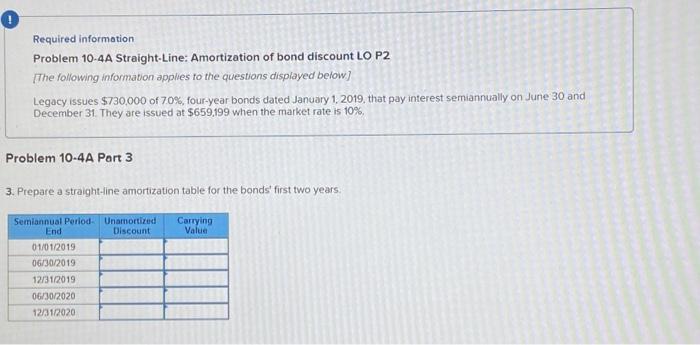

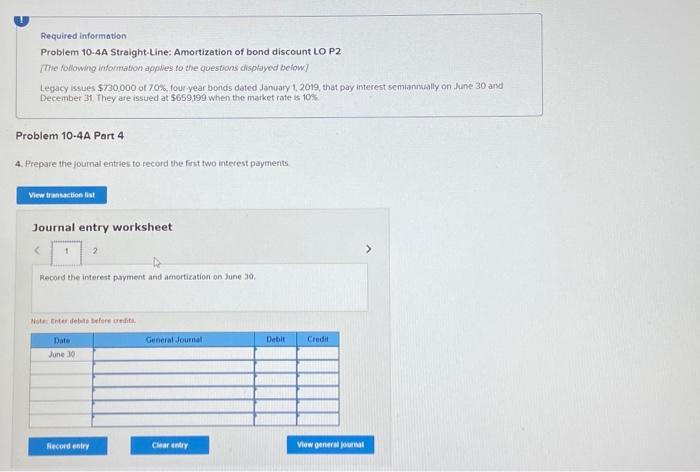

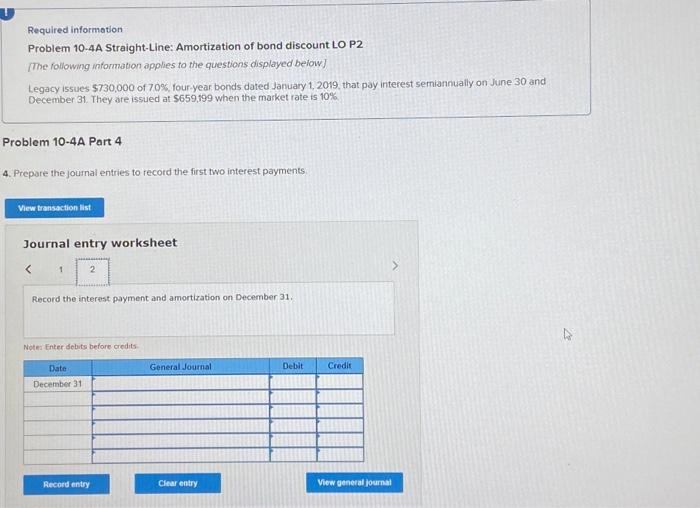

Required information Problem 10-4A Straight-Line: Amortization of bond discount LO P2 [The following information applies to the questions displayed below]. Legacy issues $730,000 of 70%, four-year bonds dated January 1, 2019, that pay interest semiannually on June 30 and December 31 , They are issued at $659,199 when the market rate is 10%. Problem 104A Part 1 Required: 1. Prepare the January 1 joumal entry to record the bonds' issuance. Journal entry worksheet Record the issue of bonds with a par value of $730,000 on January 1,2019 at an issue price of 5659,199 . Notei Enter debit before crediti. Required information Problem 10-4A Straight-Line: Amortization of bond discount LO P2 [The following information applies to the questions displayed below] Legacy issues $730,000 of 70%, four-year bonds dated January 1,2019 , that pay interest semiannually on June 30 and December 31 . They are issued at $659.199 when the market rate is 10% Problem 10-4A Part 2 2. Determine the total bond interest expense to be recognized over the bonds' life. Required information Problem 10-4A Straight-Line: Amortization of bond discount LO P2 [The following information applies fo the questions displayed below] Legacy issues $730,000 of 70%, four-year bonds dated January 1, 2019, that pay interest semiannually on June 30 and December 31 . They are issued at $659,199 when the market rate is 10%. Problem 10.4A Part 3 3. Prepare a straight-line amortization table for the bonds' first two years. Required information Problem 10-4A Straight-Line: Amortization of bond discount LO P2 [The foblowing information applies to the questions displayed beiow] Legacy issues $730,000 of 70 os four year bonds dated January 1, 2019, that pay interest semiannually on June 30 ard December 3. They are issued at 5659199 when the market rate is 1093 Problem 10-4A Part 4 4. Prepare the joumal entries to fecord the first two interest payments Journal entry worksheet Aecord the imterest payment and amortization on June 30. Required information Problem 10-4A Straight-Line: Amortization of bond discount LO P2 [The following information applies to the questions displayed beiow] Legacy issues $730,000 of 70%, four-year bonds dated January 1, 2019, that pay interest semiannually on June 30 and December 31. They are is sued at $659,199 when the market rate is 10% Problem 10-4A Part 4 4. Prepore the journal entries to record the first two interest payments: Journal entry worksheet Record the interest payment and amortization on December 31. Notes Enter debits before credits