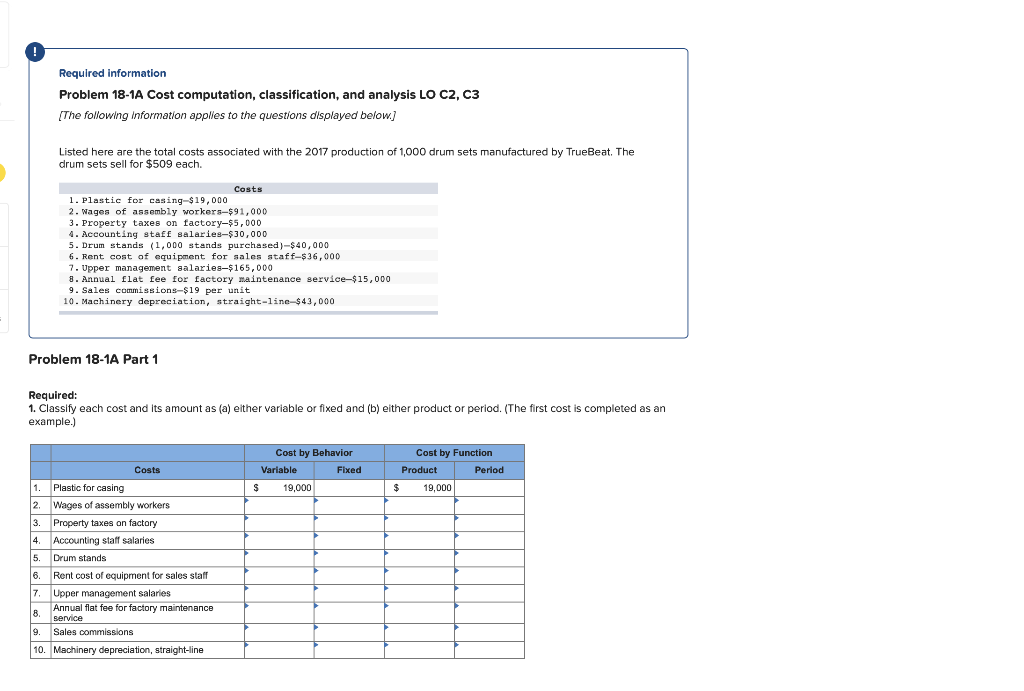

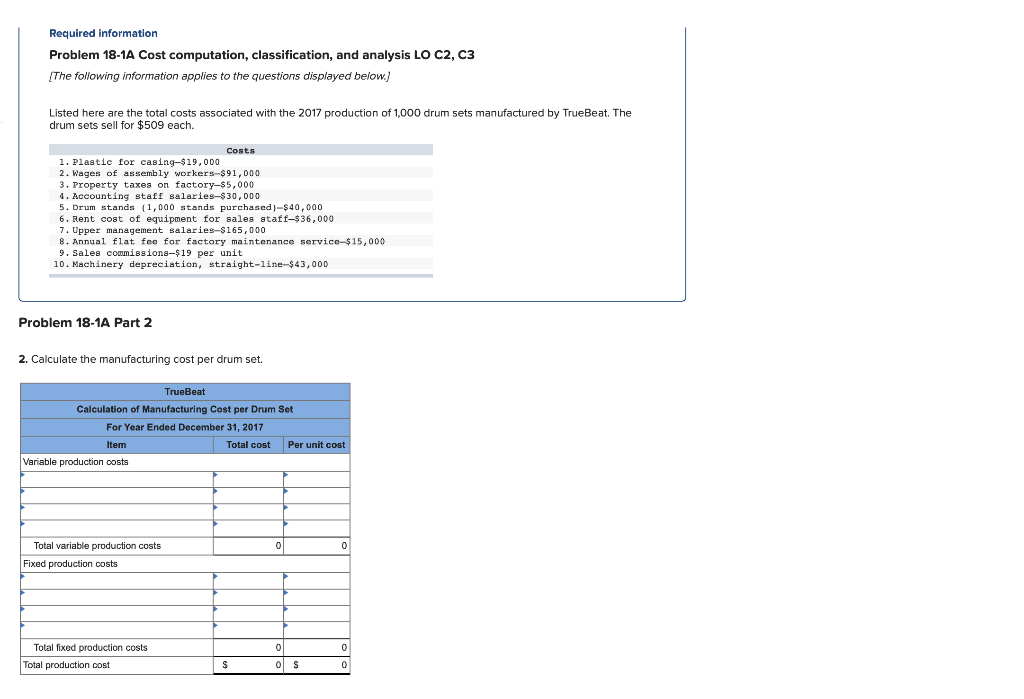

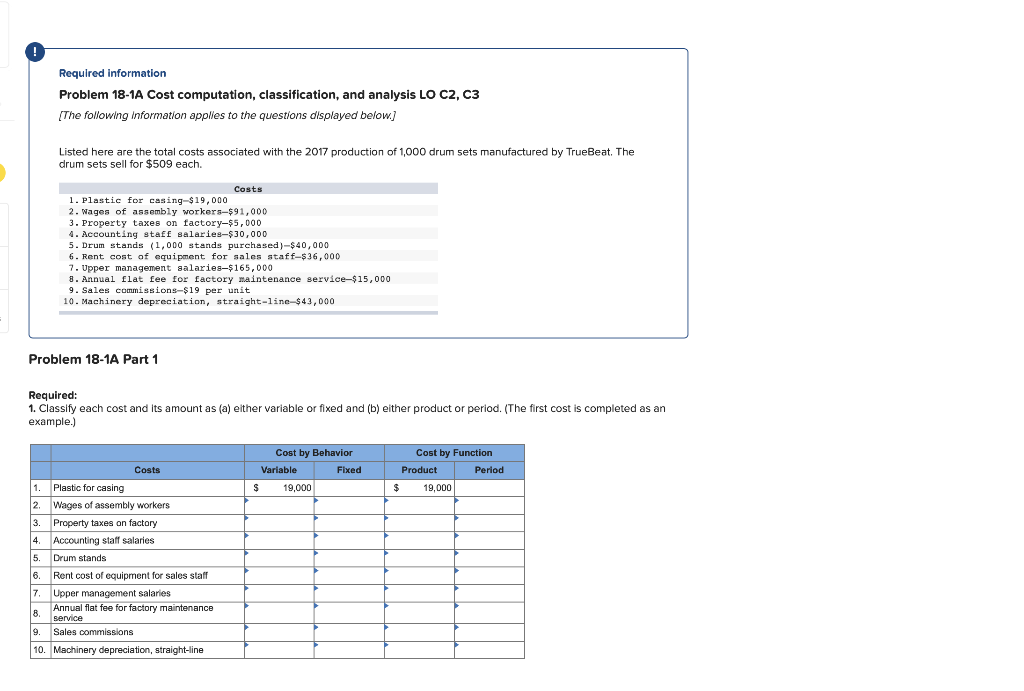

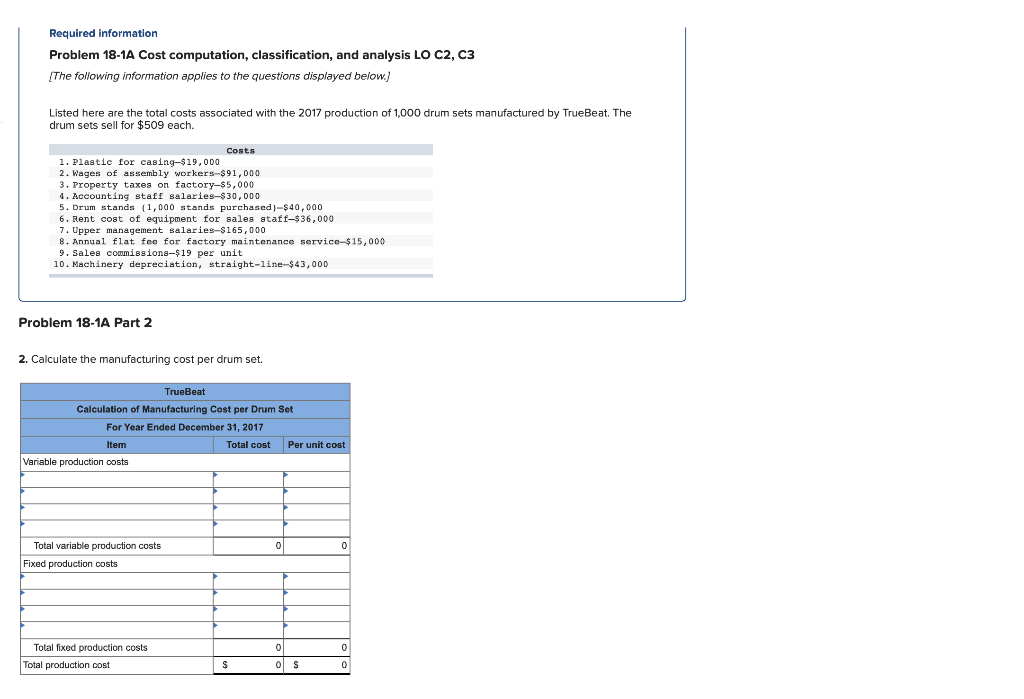

Required information Problem 18-1A Cost computation, classification, and analysis LO C2, C3 The following information applies to the questions displayed below] Listed here are the total costs associated with the 2017 production of 1,000 drum sets manufactured by TrueBeat. The drum sets sell for $509 each. Costs 1. Plastic for casing-$19,000 2. Wages of assembly workers $91,000 3. Property taxes on factory-$5,000 4. Accounting staff salaries-$30,000 5. Drum stands (1,000 stands purchased)-$40,000 6. Rent cost of equipment for sales staff-$36,000 7. Upper management salaries-$165,000 8. Annual flat fee for factory maintenance service-$15,000 9. Sales commissions-$19 per unit 10. Machinery depreciation, straight-line-$43,000 Problem 18-1A Part 1 Required: 1. Classify each cost and its amount as (a) either variable or fixed and (b) either product or period. (The first cost is completed as an example.) Costs Cost by Behavior Variable Fixed 19,000 Cost by Function Product Period $ 19,000 $ 1. Plastic for casing 2. Wages of assembly workers 3. Property taxes on factory 4. Accounting staff salaries 5. Drum stands 6. Rent cost of equipment for sales staff 7. Upper management salaries Annual flat fee for factory maintenance service 9. Sales commissions 10. Machinery depreciation, straight-line Required information Problem 18-1A Cost computation, classification, and analysis LO C2, C3 {The following information applies to the questions displayed below.) Listed here are the total costs associated with the 2017 production of 1,000 drum sets manufactured by TrueBeat. The drum sets sell for $509 each. Costs 1. Plastic for casing-$19,000 2. Wages of assembly workers-$91,000 3. Property taxes on factory-$5,000 4. Accounting staff salaries-$30,000 5. Drum stands (1,000 stands purchased)-$40,000 6. Rent cost of equipment for sales staff-$36,000 7. Upper management salaries-$165,000 8. Annual flat fee for factory maintenance service-$15,000 9. Sales commissions-$19 per unit 10. Machinery depreciation, straight-line-$43,000 Problem 18-1A Part 2 2. Calculate the manufacturing cost per drum set. TrueBeat Calculation of Manufacturing Cost per Drum Set For Year Ended December 31, 2017 Item Total cost Per unit cost Variable production costs Total variable production costs Fixed production costs Total fixed production costs Total production cost S 0S 0