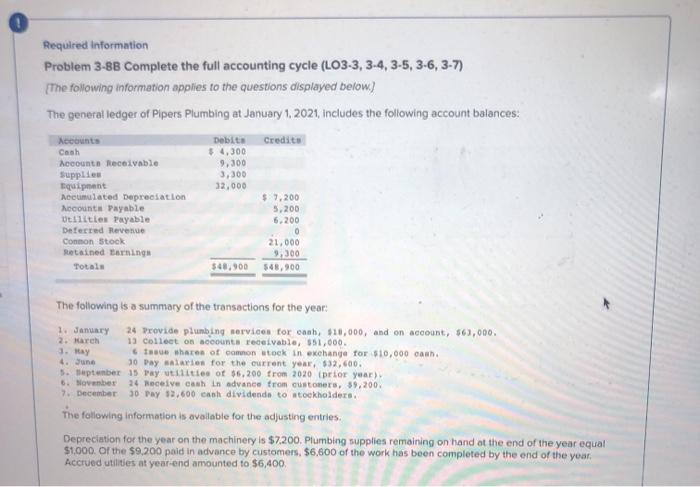

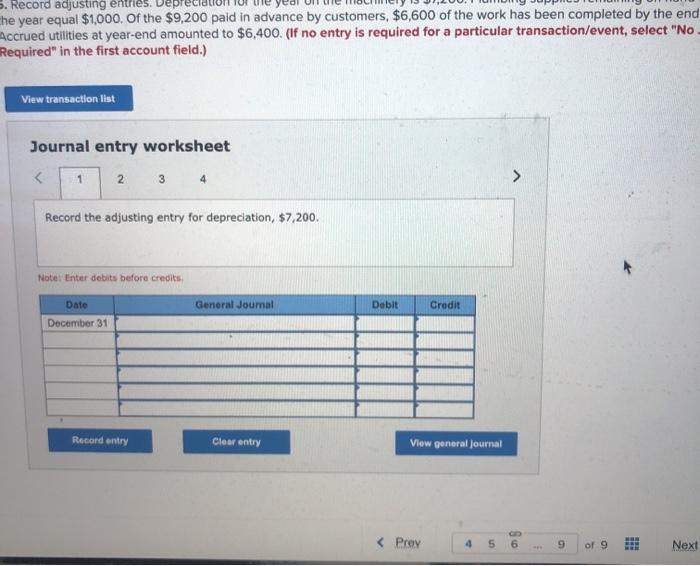

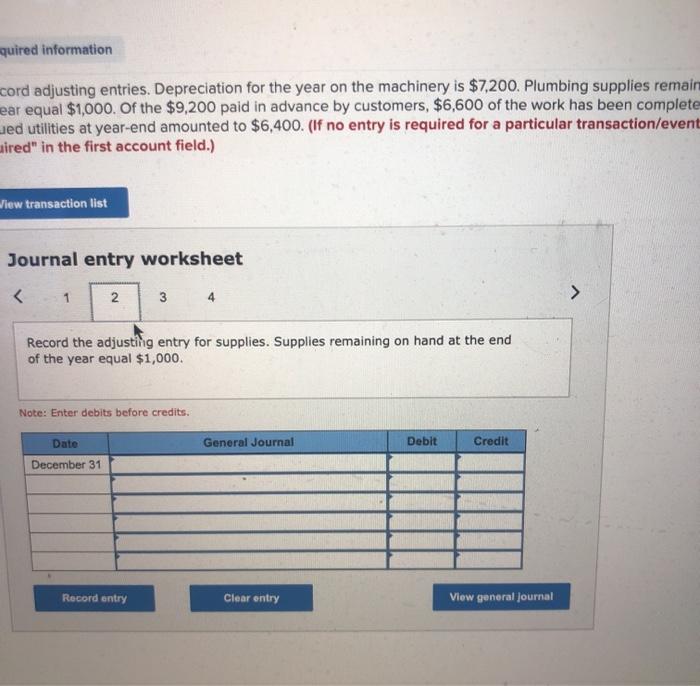

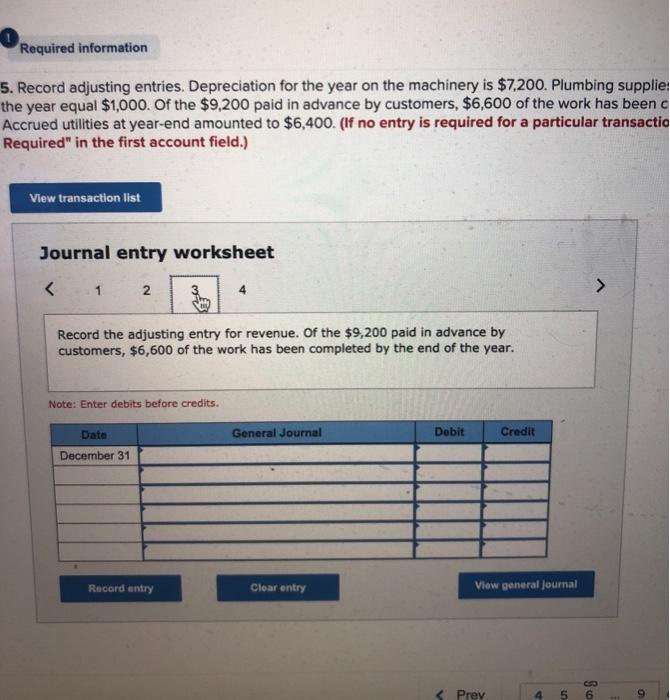

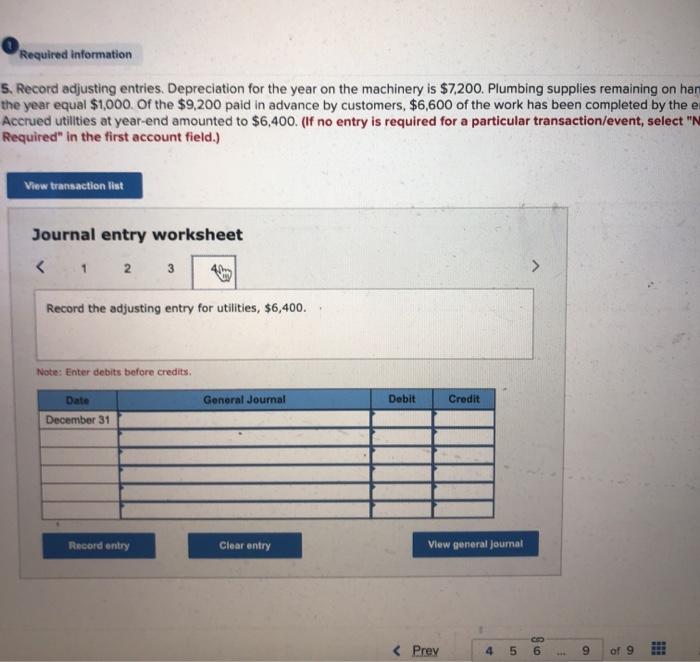

Required information Problem 3-8B Complete the full accounting cycle (L03-3, 3-4, 3-5, 3-6, 3-7) {The following information applies to the questions displayed below) The general ledger of Pipers Plumbing at January 1, 2021, Includes the following account balances: counts Debits Credita Cash $ 4,300 Accounts Receivable 9.300 Supplies 3,300 Equipment 32,000 Accumulated Depreciation $ 7.200 hccounts Payable 5.200 Utilities Payable 6.200 Deferred Revenue Connon Stock 21,000 Retained Earnings 9,300 Totals 548.900 $48.900 The following is a summary of the transactions for the year: 1. January 24 Provide plumbing services for cash $10,000, and on account, 363,000. 2. March 13 Collect on accounts receivable, 551,000. 3. Hay 6TH Whares of common stock in exchange for $10,000 ca 30 Paysalaries for the current year. $32,600 5. September 15 Pay utilities of $6.200 from 2020 prior year) 6. November 24 Receive cash in advance from customers, 39,200 7. December 30 Pay 13.600 cash dividenda to stockholders The following information is available for the adjusting entries. Depreciation for the year on the machinery is $7.200. Plumbing supplies remaining on hand at the end of the year equal $1.000. Of the $9,200 paid in advance by customers. $6,600 of the work has been completed by the end of the year Accrued utilities at year-end amounted to $6,400 5. Record adjusting entries. De the year equal $1,000. Of the $9,200 paid in advance by customers, $6,600 of the work has been completed by the end Accrued utilities at year-end amounted to $6,400. (If no entry is required for a particular transaction/event, select "No Required in the first account field.) View transaction list Journal entry worksheet Record the adjusting entry for supplies. Supplies remaining on hand at the end of the year equal $1,000. Note: Enter debits before credits. Date General Journal Debit Credit December 31 Record entry Clear entry View general Journal Required information 5. Record adjusting entries. Depreciation for the year on the machinery is $7,200. Plumbing supplie: the year equal $1,000. Of the $9,200 paid in advance by customers, $6,600 of the work has been a Accrued utilities at year-end amounted to $6,400. (If no entry is required for a particular transactio Required" in the first account field.) View transaction list Journal entry worksheet