Answered step by step

Verified Expert Solution

Question

1 Approved Answer

! Required information Stock options are one of the riskiest and potentially lucrative financial instruments available to investors. Stock options give the investor the right

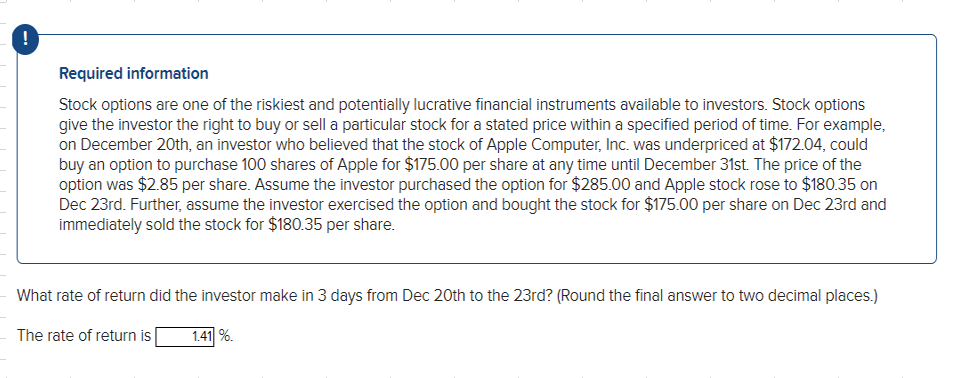

Required information Stock options are one of the riskiest and potentially lucrative financial instruments available to investors. Stock options give the investor the right to buy or sell a particular stock for a stated price within a specified period of time. For example, on December th an investor who believed that the stock of Apple Computer, Inc. was underpriced at $ could buy an option to purchase shares of Apple for $ per share at any time until December st The price of the option was $ per share. Assume the investor purchased the option for $ and Apple stock rose to $ on Dec rd Further, assume the investor exercised the option and bought the stock for $ per share on Dec rd and immediately sold the stock for $ per share. What rate of return did the investor make in days from Dec th to the rdRound the final answer to two decimal places. The rate of return is

Required information

Stock options are one of the riskiest and potentially lucrative financial instruments available to investors. Stock options

give the investor the right to buy or sell a particular stock for a stated price within a specified period of time. For example,

on December th an investor who believed that the stock of Apple Computer, Inc. was underpriced at $ could

buy an option to purchase shares of Apple for $ per share at any time until December st The price of the

option was $ per share. Assume the investor purchased the option for $ and Apple stock rose to $ on

Dec rd Further, assume the investor exercised the option and bought the stock for $ per share on Dec rd and

immediately sold the stock for $ per share.

What rate of return did the investor make in days from Dec th to the rdRound the final answer to two decimal places.

The rate of return is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started