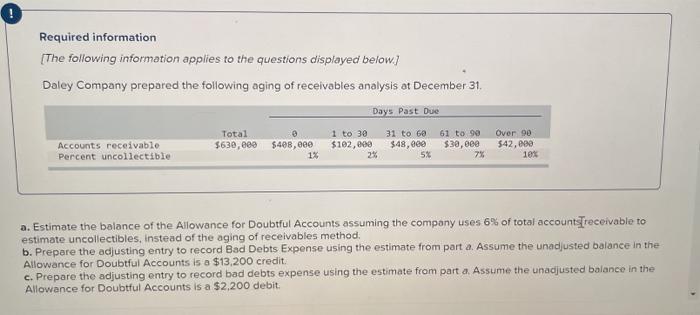

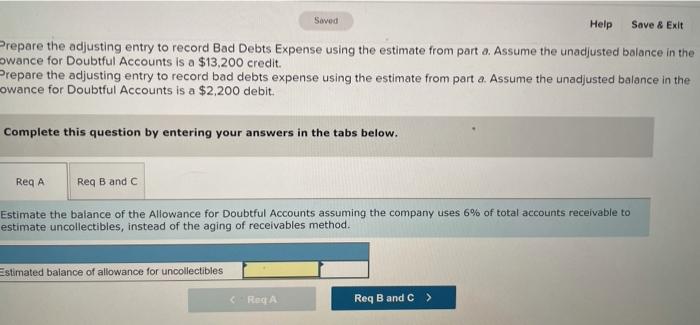

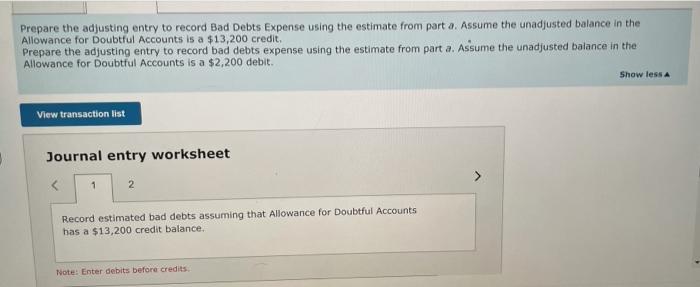

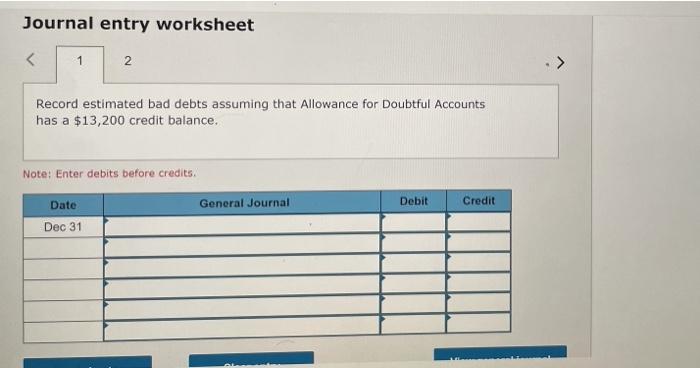

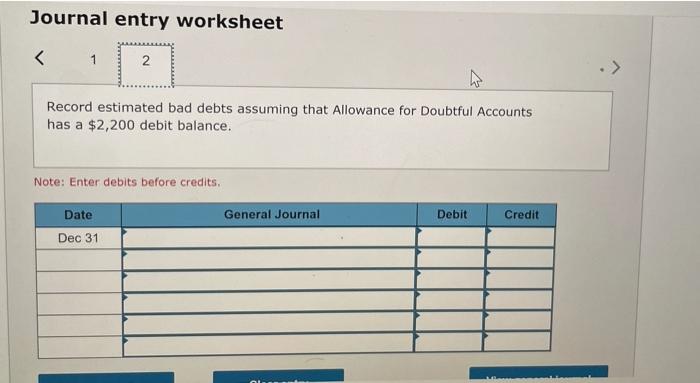

! Required information [The following information applies to the questions displayed below.) Daley Company prepared the following aging of receivables analysis at December 31. Days Past Due Total $630,000 Accounts receivable Percent uncollectible $400,000 1% 1 to 30 $102,000 25 31 to 60 $48,000 5% 61 to 90 $30,000 7% Over 90 542,000 10% a. Estimate the balance of the Allowance for Doubtful Accounts assuming the company uses 6% of total accounts[receivable to estimate uncollectibles, instead of the aging of receivables method: b. Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $13,200 credit c. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $2,200 debit Saved Help Save & Exit Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. Assume the unadjusted balance in the owance for Doubtful Accounts is a $13,200 credit. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the owance for Doubtful Accounts is a $2,200 debit Complete this question by entering your answers in the tabs below. Reg A Reg B and C Estimate the balance of the Allowance for Doubtful Accounts assuming the company uses 6% of total accounts receivable to estimate uncollectibles, instead of the aging of receivables method. Estimated balance of allowance for uncollectibles (RecA Req B and C> Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $13,200 credit, Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $2,200 debit Show less View transaction list Journal entry worksheet 2 1 Record estimated bad debts assuming that Allowance for Doubtful Accounts has a $13,200 credit balance. Note: Enter debits before credits Journal entry worksheet 1 2 > Record estimated bad debts assuming that Allowance for Doubtful Accounts has a $13,200 credit balance. Note: Enter debits before credits. General Journal Debit Credit Date Dec 31 Journal entry worksheet