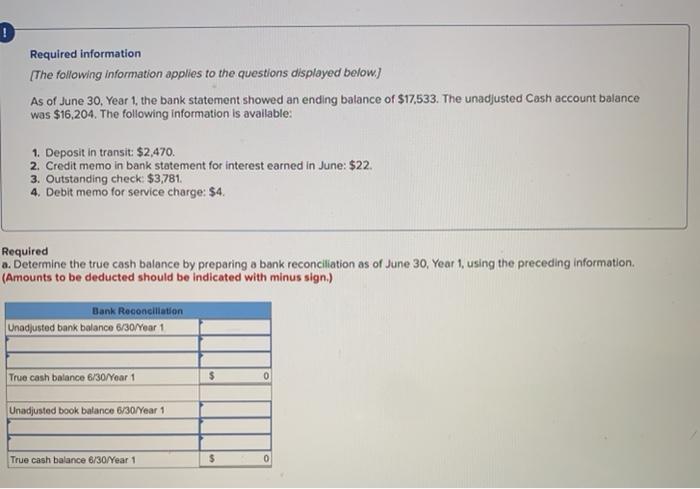

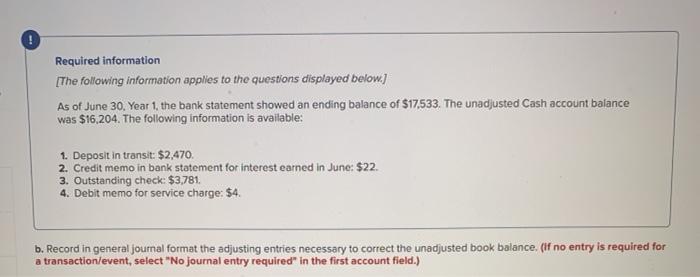

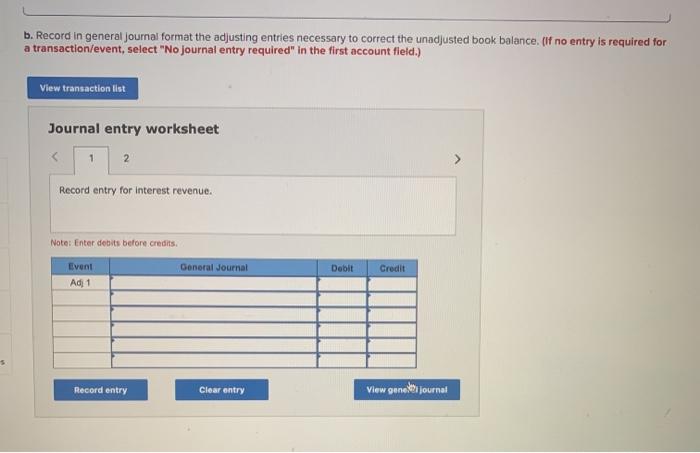

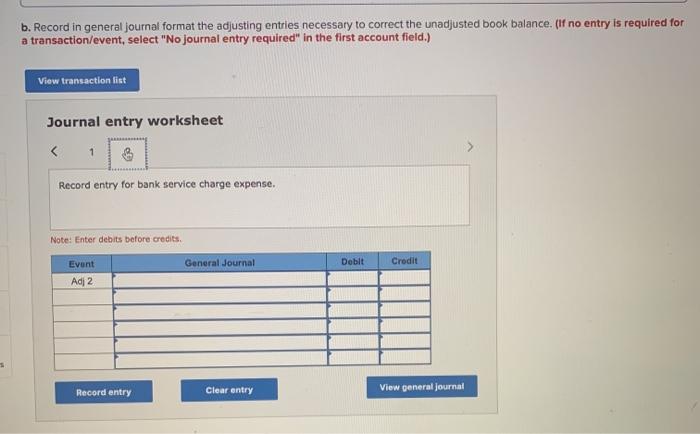

! Required information [The following information applies to the questions displayed below) As of June 30, Year 1, the bank statement showed an ending balance of $17,533. The unadjusted Cash account balance was $16,204. The following information is available: 1. Deposit in transit $2,470. 2. Credit memo in bank statement for interest earned in June: $22. 3. Outstanding check $3,781. 4. Debit memo for service charge: $4. Required a. Determine the true cash balance by preparing a bank reconciliation as of June 30, Year 1, using the preceding information (Amounts to be deducted should be indicated with minus sign.) Bank Reconciliation Unadjusted bank balance 6/30/Year 1 True cash balance 6/30/Year 1 $ 0 Unadjusted book balance 6/30/Year 1 True cash balance 6/30/Year 1 $ 0 Required information [The following information applies to the questions displayed below.) As of June 30, Year 1, the bank statement showed an ending balance of $17,533. The unadjusted Cash account balance was $16,204. The following information is available: 1. Deposit in transit: $2,470. 2. Credit memo in bank statement for interest earned in June: $22. 3. Outstanding check: $3,781. 4. Debit memo for service charge: $4 b. Record in general journal format the adjusting entries necessary to correct the unadjusted book balance. (if no entry is required for a transaction/event, select "No journal entry required in the first account field.) b. Record in general Journal format the adjusting entries necessary to correct the unadjusted book balance. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 Record entry for interest revenue. Note: Enter debits before credits. General Journal Dobit Credit Event Ad 1 Record entry Clear entry View genet journal b. Record in general journal format the adjusting entries necessary to correct the unadjusted book balance. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet