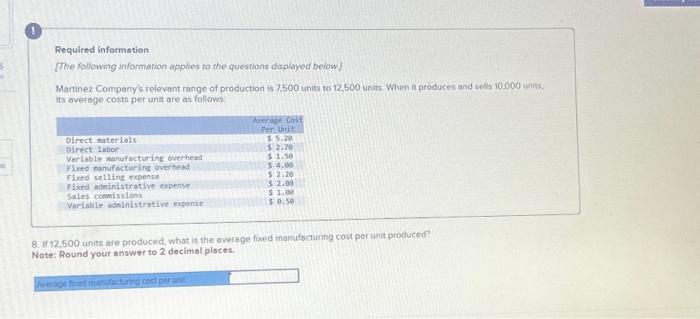

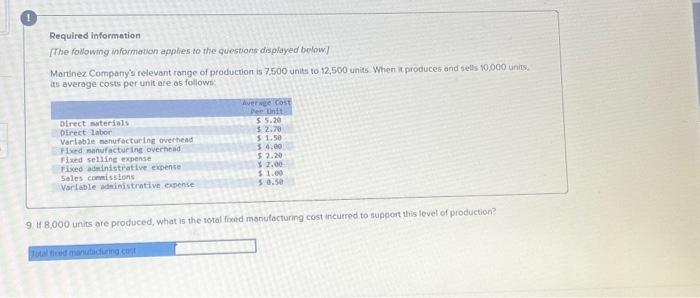

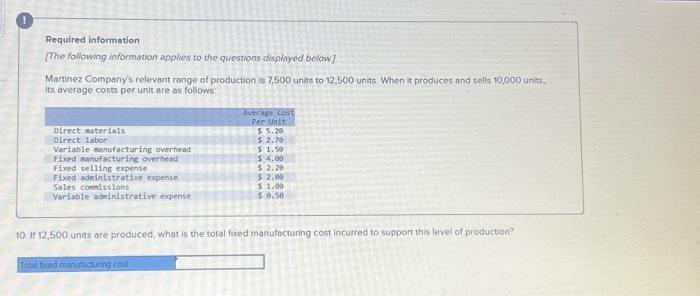

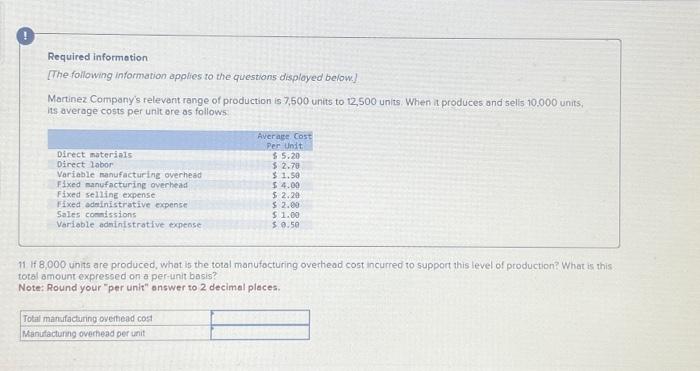

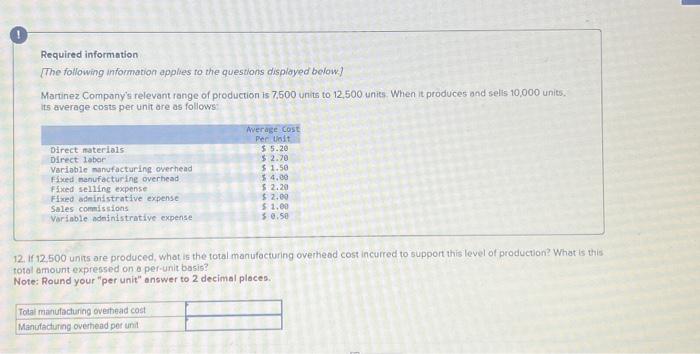

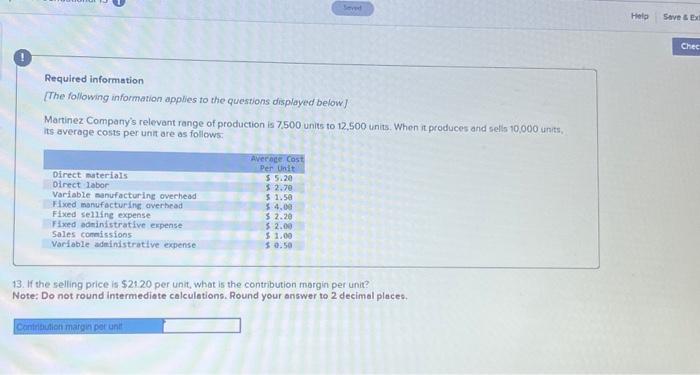

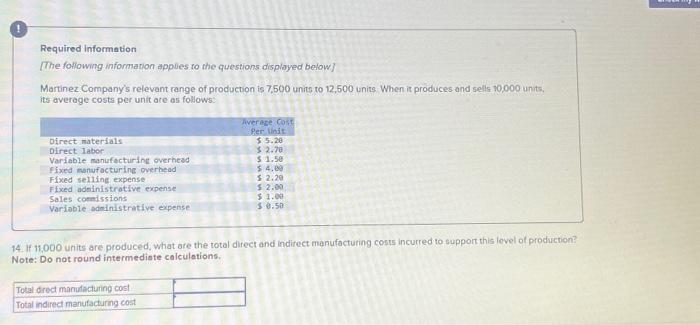

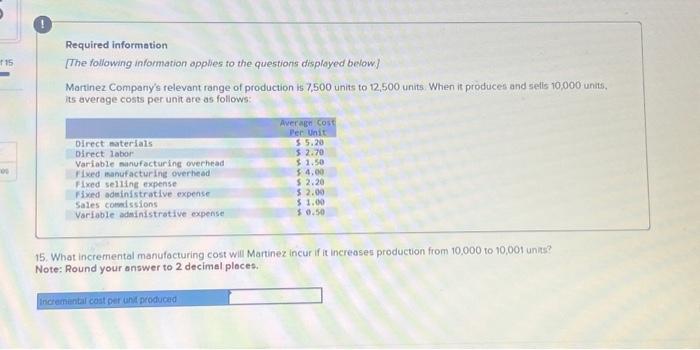

Required information [The following information applies to the questions displayed below] Martinez Company's relevant range of production is 7,500 units to 12,500 units. When if produces and selis 10,000 uniss. its averoge costs per unit are as follows 8. If 12,500 units are produced, what is the average foxpd inonufocturing cost per unit produced? Note: Round your answer to 2 decimal ploces. Required information The following information applies to the questions displayed below] Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units. its average costs per unit are os follows: 9. If 8,000 units are produced, what is the total fored manufocturing cost incurred to support this level of production? Required information The following information applies to the questions displayed belowj Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: 10. If 12,500 units are produced, what is the total fued manufacturing cost incurred to support this level of production? Required information [The following information applies to the questions displayed below.] Martinez Company's relevant range of production is 7,600 units to 12,500 units. When i produces and selis 10,000 units, its average costs per unit ore as follows. 11 If 8,000 units are produced, what is the total manufocturing overhead cost incurred to support this level of production? What is this cotal amount expressed on a per-unit basis? Note: Round your \"per unit\" onswer to 2 decimal places. Required information [The following information applies to the questions displayed bolow] Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units. its average costs per unit are as follows: 12. If 12,500 units are produced, what is the total manufacturing overhead cost incurred to support this level of production? What is this total amount expressed on a per-unit basis? Note: Round your \"per unit\" answer to 2 decimal ploces. Requited information [The following information applies to the questions displayed below] Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 unts, its average costs per unit are as follows: 13. If the selling price is \\( \\$ 21: 20 \\) per unit, what is the contribution margin per unit? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Required information [The following information applies to the questions displayed below] Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 70,000 units: its average costs per unit are as follows: 14. If 11,000 units are produced, what are the total direct and indirect manufacturing costs incurred to support this level of production? Note: Do not round intermediate calculations. Required information [The following information opplies to the questions disployed below] Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and selis 10,000 units. its average costs per unit are as follows: 15. What incremental manufacturing cost will Martinez incur if it increases production from 10,000 to 10,001 unins? Note: Round your answer to 2 decimal ploces