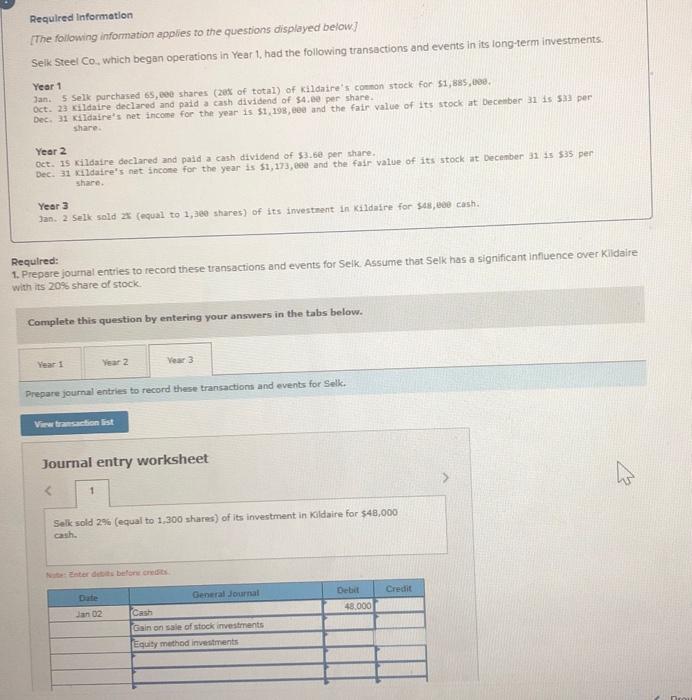

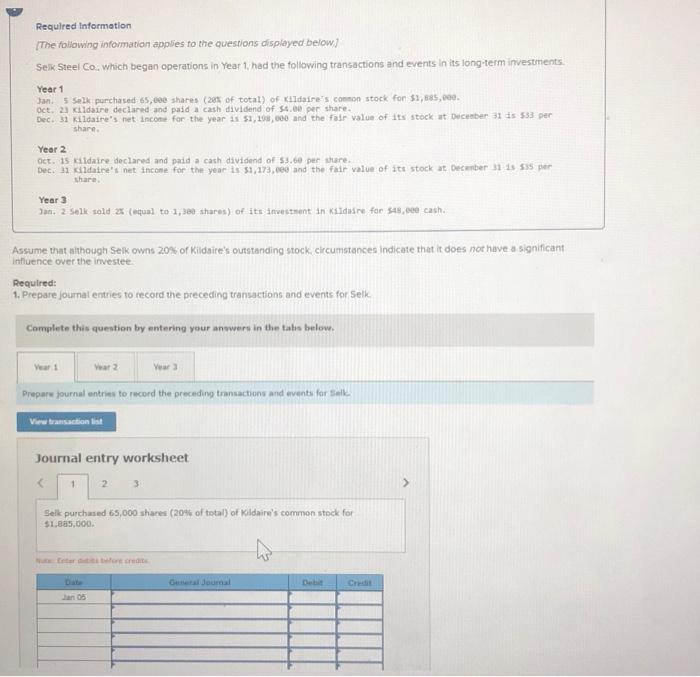

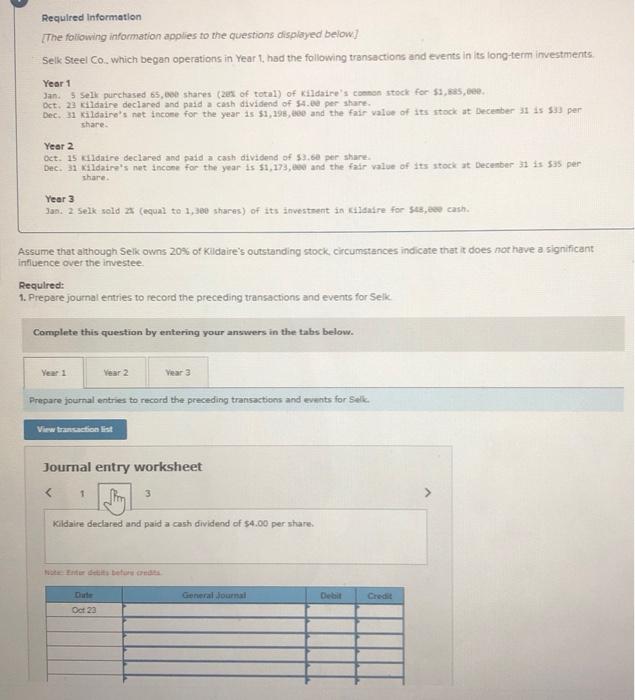

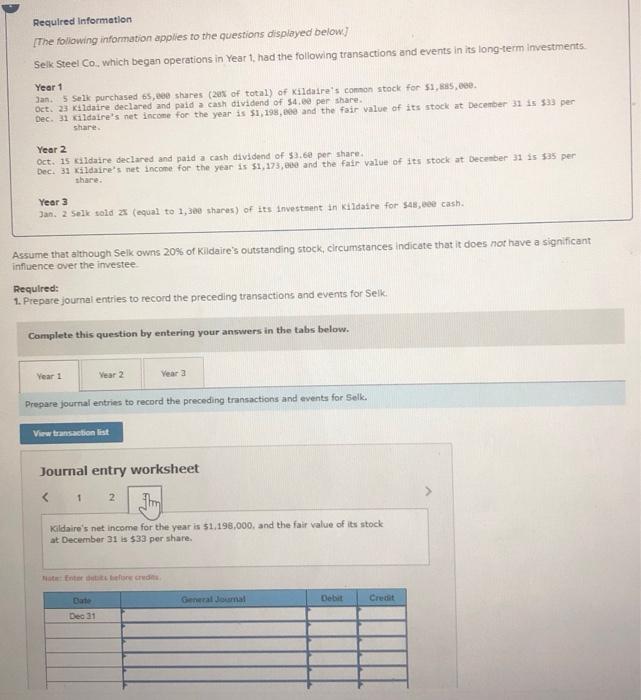

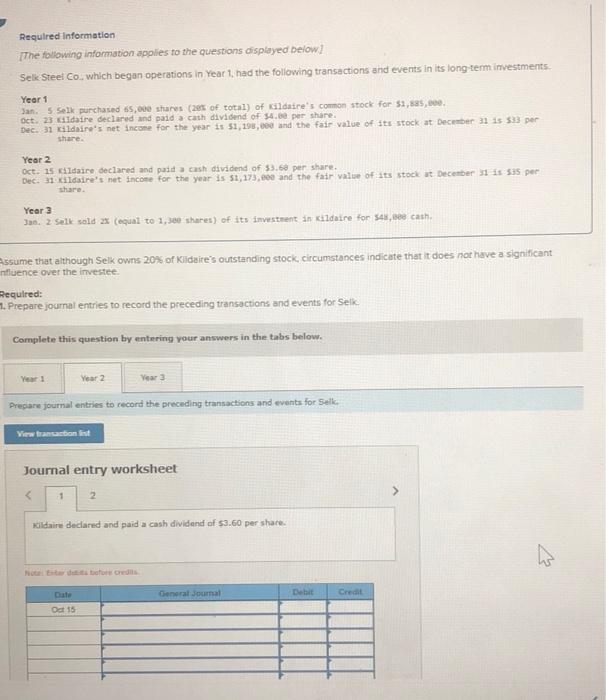

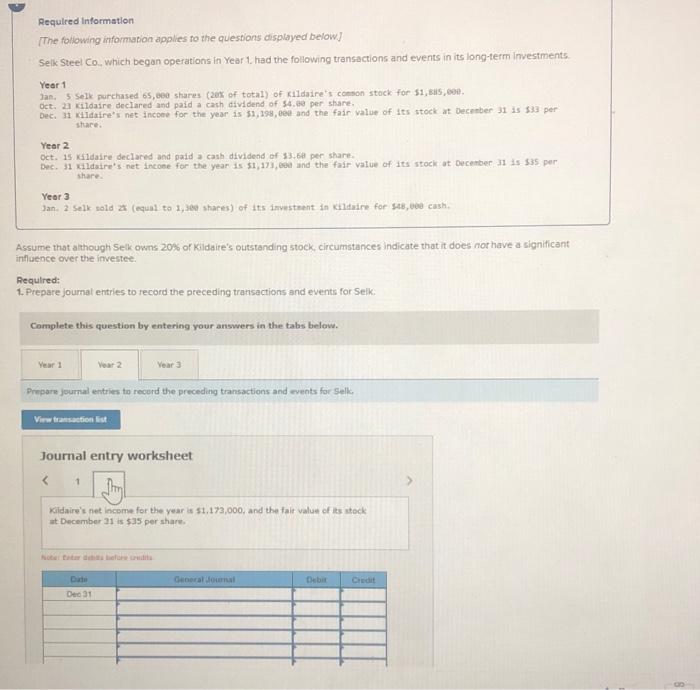

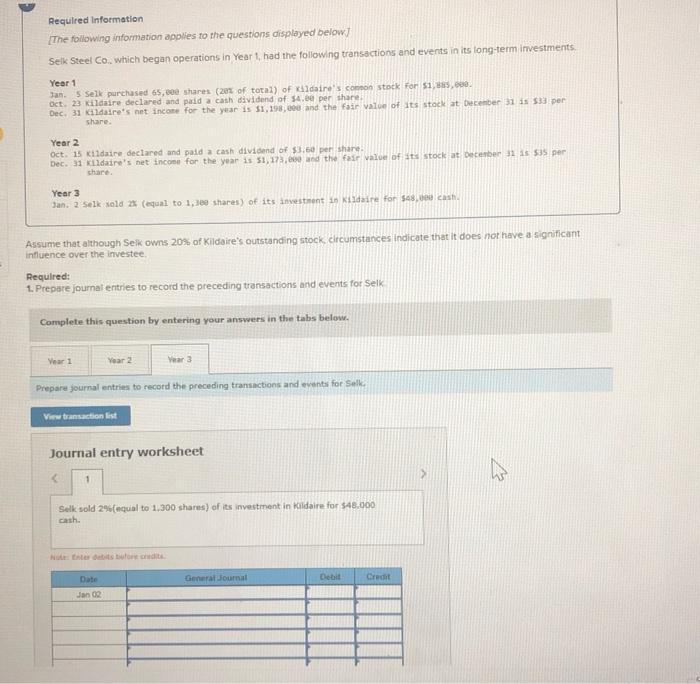

Required Information [The following information applies to the questions displayed below) Seik Steel Co, which began operations in Year 1, had the following transactions and events in its long-term investments. Year 1 Jan 5 Selk purchased 65,000 shares (20% of total) of Kildaire's common stock for 51,885,000. Oct. 23 Kildare declared and paid a cash dividend of $4.00 per share Dec. 31 daire's net income for the year is $1,198,000 and the fair value of its stock at December 31 is 533 per share Year 2 Oct. Is Kildaire declared and paid a cash dividend of $3.60 per share. Dec. 31 daire's net income for the year is 51,173,ce and the fair value of its stock at December 315 535 per Share Year 3 Jan. 2 Selk sold 24 equal to 1,300 shares) of its investment in Kildaire for 548, ce cash. Required: 1. Prepare journal entries to record these transactions and events for Selk. Assume that Selk has a significant influence over Kildaire with its 20% share of stock Complete this question by entering your answers in the tabs below. Year 1 Year 2 Year 3 Prepare journal entries to record these transactions and events for Selk. Vibration list Journal entry worksheet 1 Selk sold 2 (equal to 1.300 shares) of its investment in Kildaire for $48,000 ter det before Credit Date Debut 48.000 Jan 02 General Journal Cash Gain on sale of stock investments Equity method investments Required Information The following information applies to the questions displayed below) Selk Steel Co, which began operations in Year 1, had the following transactions and events in its long-term investments. Year 1 Jan 5 salk purchased 65,000 shares (20% of total) of Kildaire's common stock for $1,885,000 Oct. 23 aldire declared and paid a cash dividend of $4.00 per share Dec. 31 Kildaire's net income for the year 1 51,108,000 and the fair value of its stock at December 31 533 per share Year 2 Oct. 15 kildaire declared and paid a cash dividend of 53.60 per share. Dec. 11 dates net income for the year 1951/173,000 and the fair value of its stock at December 31 is 5 per share Year 3 Jan. 2 Sulk sold 2% (equal to 1,30 shares) of its investment in Kildare for $48, cath. Assume that although Selk owns 20% of Kildaire's outstanding stock, circumstances indicate that it does not have a significant Influence over the investee. Required: 1. Prepare Journal entries to record the preceding transactions and events for Selk, Complete this question by entering your answers in the tabs below. Prepare journal entries to record the preceding transactions and events for salk View transaction list Journal entry worksheet 1 2 > Sell purchased 65,000 shares (20% of total) of Kildaire's common stock for $1.Bas.000 Gradournal Jan 06 Required Information The following information applies to the questions displayed below! Selk Steel Co. which began operations in Year 1, had the following transactions and events in its long-term investments Year 1 Jan. 5 Selk purchased 65,000 shares (zus of total) of Kildaire's common stock for $1,885,000 Oct. 23 Kildare declared and paid a cash dividend of 54.00 per share Dec. 31 Kildaire's net income for the year is $1,198, and the fair value of its stock at December 31 is 533 per share. Year 2 Oct. 15 kildaire declared and paid a cash dividend of $3.60 per share Dec. 31 Kildaire's net income for the year is $1,173, and the fair value of its stock st December 31 is 59 per share. Year 3 Jan. 2 selk sold 2 (equal to 1,300 shares) of its investeent in intre for $48,00 cash. Assume that although Selk owns 20% of Kildaire's outstanding stock, circumstances indicate that it does not have a significant Influence over the investee Required: 1. Prepare journal entries to record the preceding transactions and events for Selk Complete this question by entering your answers in the tabs below. Year Year 2 Year 3 Prepare journal entries to record the preceding transactions and events for Selk. View transaction list Journal entry worksheet Kildare declared and paid a cash dividend of $3.60 per share w w General Journal Debit Credit Oct 15 Required Information The following information applies to the questions displayed below) Selk Steel Co., which began operations in Year 1. had the following transactions and events in its long-term investments Year 1 Jan 5 Selk purchased 65,000 shares 20% of total) of Kildaine's conson stock for $1,5,600 Oct. 23 Kildare declared and paid a cash dividend of $4.00 per share Dec. 31 Klidaire's net income for the year is 51,198,000 and the fair value of its stock at December 31 is 533 per share Year 2 Oct. 15 Kildare declared and paid a cash dividend of 33.68 per share Dec. 31 xildaire's net incone for the year is $1,173, and the fair value of its stock at December 1 is $35 per share. Year 3 Jan. 2 sell sold 2 (equal to 1,300 shares) of its investment in kazduine for sts, es cash Assume that although Selk owns 20% of Kildaire's outstanding stock, circumstances indicate that it does not have a significant influence over the investee. Required: 1. Prepare journal entries to record the preceding transactions and events for Selk. Complete this question by entering your answers in the tabs below. Year 1 Vear 2 Year 3 Prepare journal entries to record the preceding transactions and events for sulk Viw transaction list Journal entry worksheet