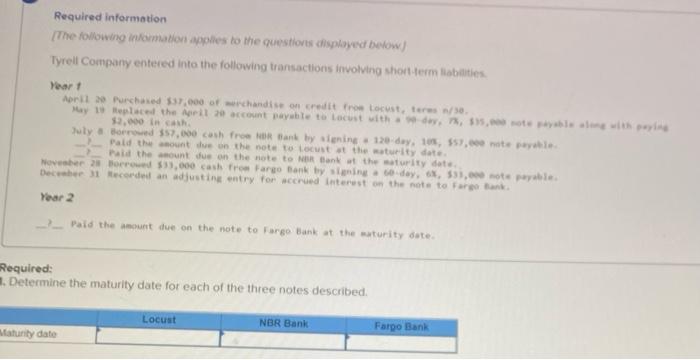

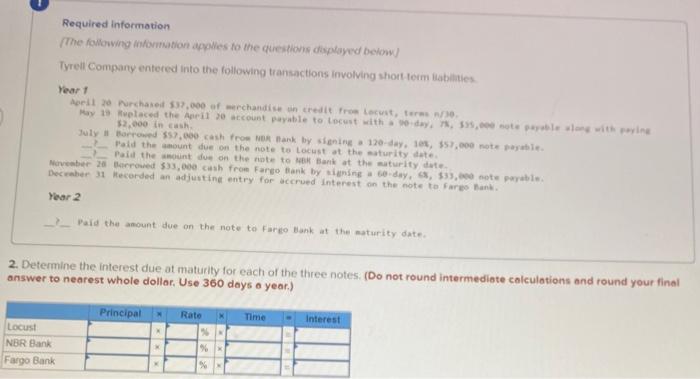

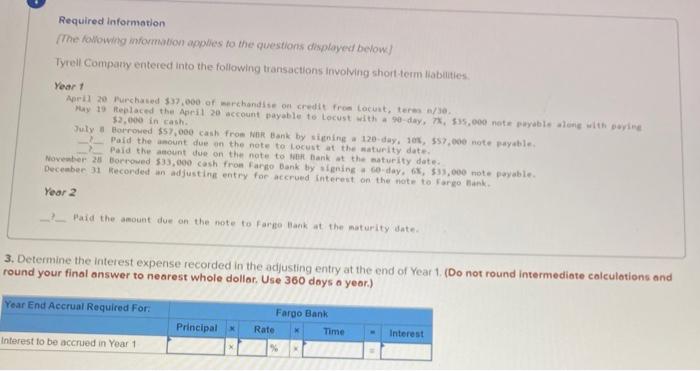

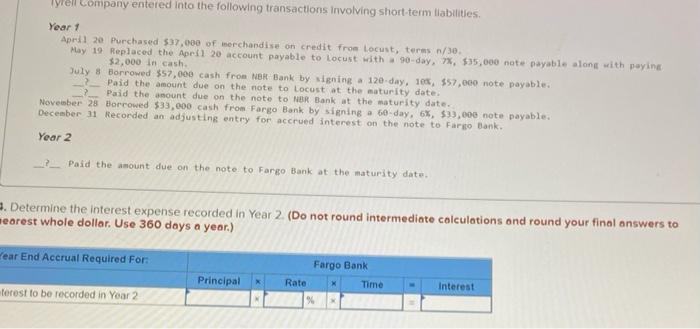

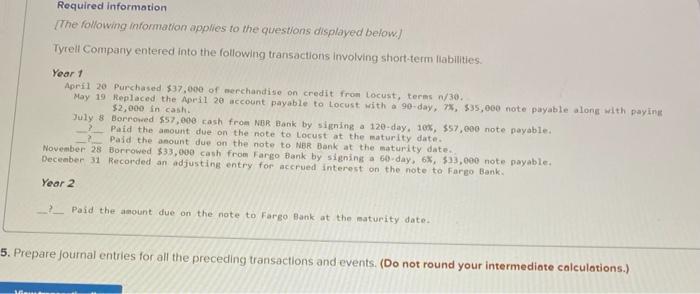

Required information. [The following intormatien applies to the questions displojed berow) Tyrell Company entered into the following transactions involving thoit-term Habitities. Year t Aprit ao Rurchased \$31,000 of werchandise on credit from Locust, teres n/30. 32, 000 in eath. Pald the swownt dise on the note to tocust at the waturity dates. Vear2 - Paid the anount due on the note to Fargo bank at the maturity dote. Required: Determine the maturity date for each of the three notes described. Required information The following information apples to the questions doplayed betonw) Tyreil Company entered into the following trankactions involving thort teim liabitities Year 1 Aoel1 20 Nrchaseit 837,000 of mechandise in tredit troe tocust, teras n/le. wely ill the woo in eash. Paid the aabount due on the note to lochst at the asturity deste. tax2 - Paid the amount due on the note to Fargo Bank at the maturity date. Determine the interest due at maturity for each of the three notes. (Do not round intermediate calculations and round your final nswer to nearest whole dollar, Use 360 days o year.) Required information The foulowitg information applies to the questions displayed below] Tyreil Comparty entered into the following transactions involying short term liabilities Year t April 20 Rurchased 337,000 of merchandis on credit froe tacist, teres a/3e. 3win a f2,000 in cash. Paid the anount due in the note to locust at the waturity date. Pard the astount due on the note to lieth fank at the maturity date. Deceaber 31 beconded an adjusting entry for accrued interest on the note to fargo hank. Yeor 2 -1. Paid the asount due on the note to fargo liank at the maturity date. 3. Determine the interest expense recorded in the adjusting entry at the end of Year 1 . (Do not round intermediate calculotions and ound your final answer to nearest whole dollar. Use 360 days a year.) Year 1 April 20 Purchased 537,000 of merchandise on credit froe Locust, terms n/39. May 19 Replaced the Apefl 20 account payable to Locust with a 90day, 7x, $35, 600 nate nayable along with poying 32,000 in cash. July \& Borrowed \$57,003 cash fron tieh- Bank by signing a 120-day, 100,$57,000 note payable. ? Paid the amount due on the note to Locust at the maturity date. Noveober 29 . Bocrowed $33, due on the note to Nitr fank at the maturity date. Decesber is freconded an, $300 cash from Fargo Bank by signing a 60 -day, 6x,$33, 000 note payable. Year 2 P. Paid the amount due on the note to Fargo Bank at the maturity date. Determine the interest expense recorded in Year 2 (Do not round intermediate colculations ond round your final answers to earest whole dollar. Use 360 days a year.) Required information The following information applies to the questions displayed below) Tyrell Company entered into the following transactions imvolving short-tem liabilities. Year 1 Apni1 20 Purchased \$37, 000 of merchandise on credit from tocust, terms n/30. May 19 Replaced the April 20 account payable to tocust with a 90 -day, 78,$335,000 note payable along with paying $2,000 in cash. July 8 Borrowed 557,000 cash from NBR Bank by signing a 120 -day, 105, 557,090 note payable. ? Paid the amount due on the note to locust at the maturity date. November 28 Borrowed 333,000 cash from note to Ner Bank at the maturity date. Deceaber 31 Recorded an adjusting entry for bank by signing a 60-day, 6., 333 , 000 note payable. Year 2 -?. Paid the amount due on the note to Fargo Bank at the maturity date. Prepare journal entries for all the preceding transactions and events. (Do not round your intermediate calculotions.)