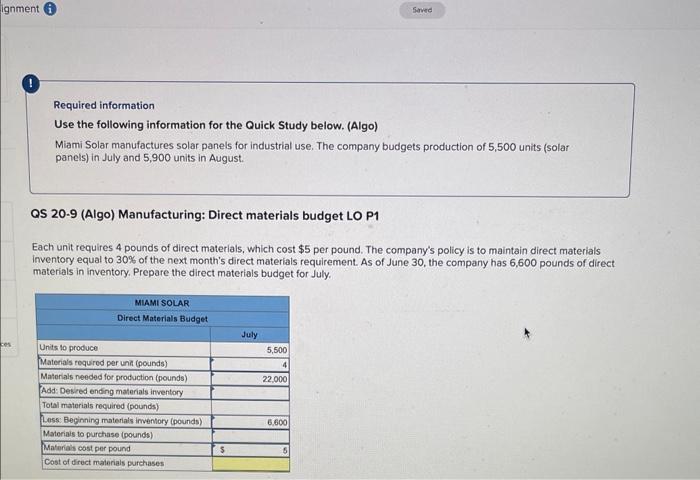

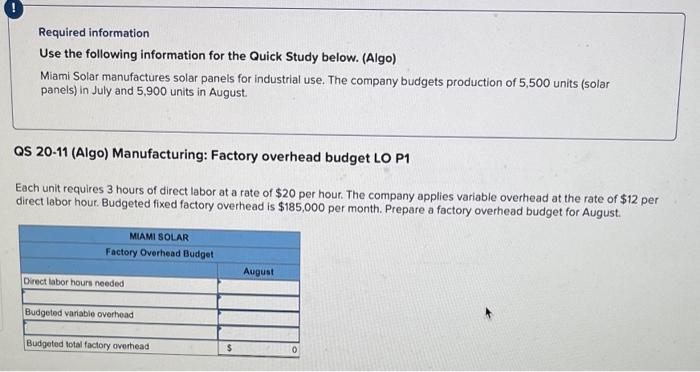

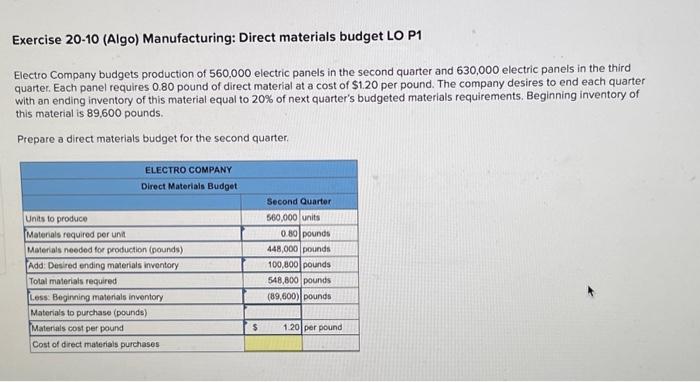

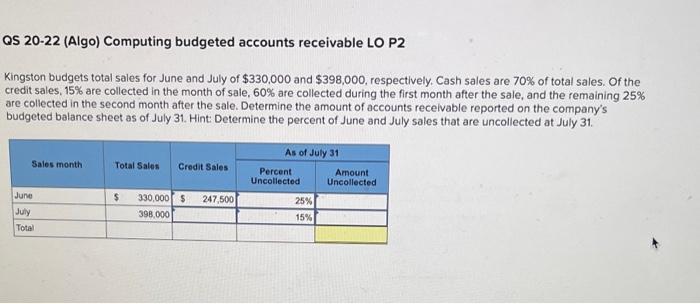

Required information Use the following information for the Quick Study below. (Algo) Miami Solar manufactures solar panels for industrial use. The company budgets production of 5,500 units (solar panels) in July and 5,900 units in August. QS 20-9 (Algo) Manufacturing: Direct materials budget LO P1 Each unit requires 4 pounds of direct materials, which cost $5 per pound. The company's policy is to maintain direct materials inventory equal to 30% of the next month's direct materials requirement. As of June 30 , the company has 6,600 pounds of direct materials in inventory. Prepare the direct materials budget for July. Required information Use the following information for the Quick Study below. (Algo) Miami Solar manufactures solar panels for industrial use. The company budgets production of 5,500 units (solar panels) in July and 5,900 units in August. QS 20-11 (Algo) Manufacturing: Factory overhead budget LO P1 Each unit requires 3 hours of direct labor at a rate of $20 per hour. The company applies variable overhead at the rate of $12 per direct labor hour. Budgeted fixed factory overhead is $185,000 per month. Prepare a factory overhead budget for August. Exercise 20-10 (Algo) Manufacturing: Direct materials budget LO P1 Electro Company budgets production of 560,000 electric panels in the second quarter and 630,000 electric panels in the third quarter. Each panel requires 0.80 pound of direct material at a cost of $1.20 per pound. The company desires to end each quarter with an ending inventory of this material equal to 20% of next quarter's budgeted materials requirements. Beginning inventory of this material is 89,600 pounds. Prepare a direct materials budget for the second quarter. QS 20-22 (Algo) Computing budgeted accounts receivable LO P2 Kingston budgets total sales for June and July of $330,000 and $398,000, respectively. Cash sales are 70% of total sales. Of the credit sales, 15% are collected in the month of sale, 60% are collected during the first month after the sale, and the remaining 25% are collected in the second month after the sale. Determine the amount of accounts recelvable reported on the company's budgeted balance sheet as of July 31. Hint: Determine the percent of June and July sales that are uncollected at July 31