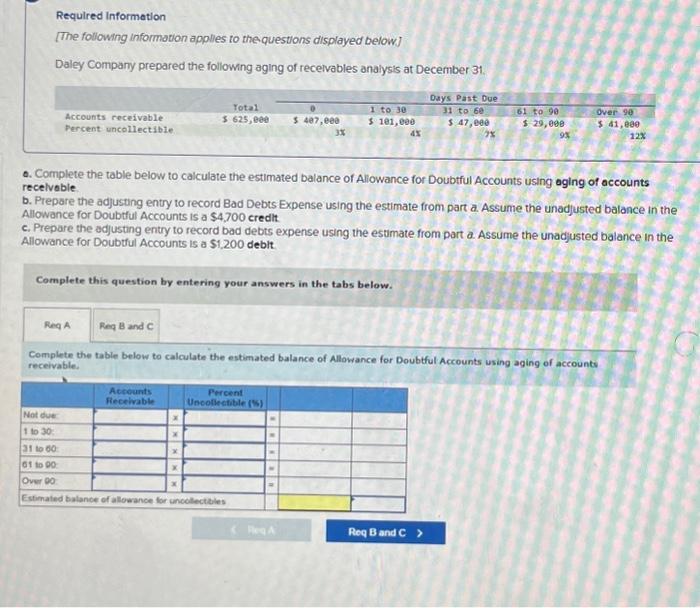

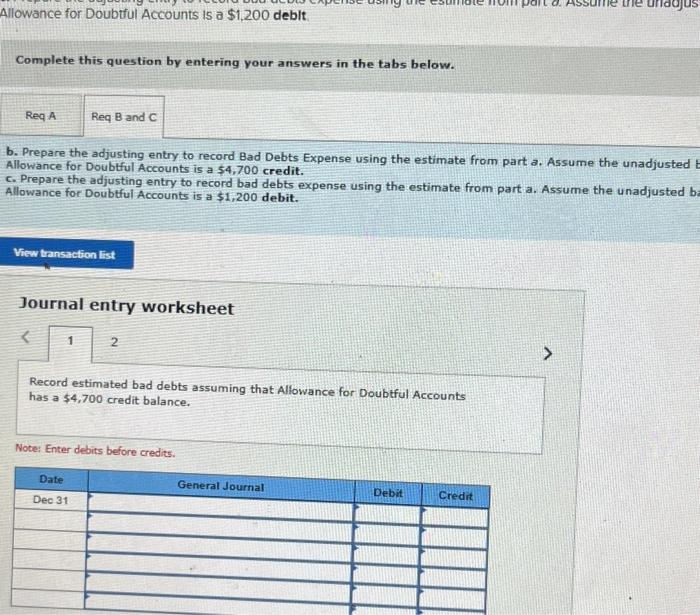

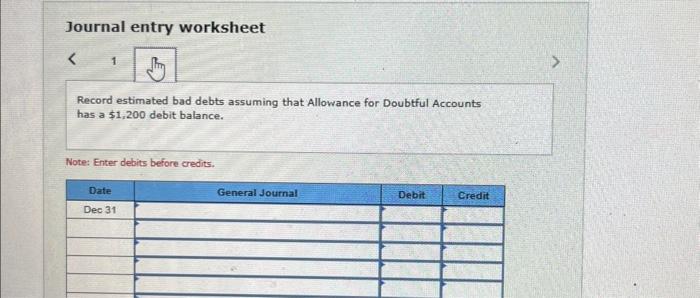

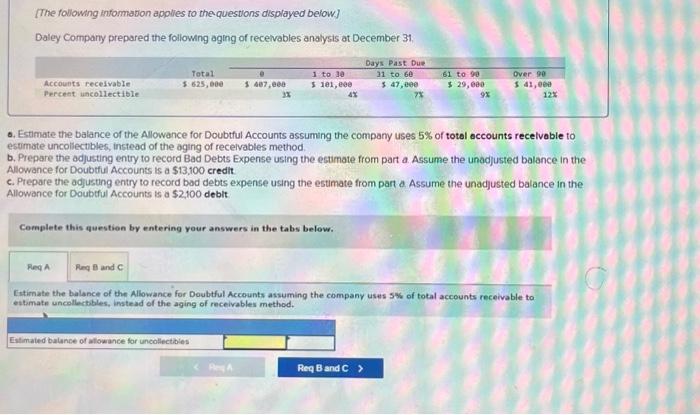

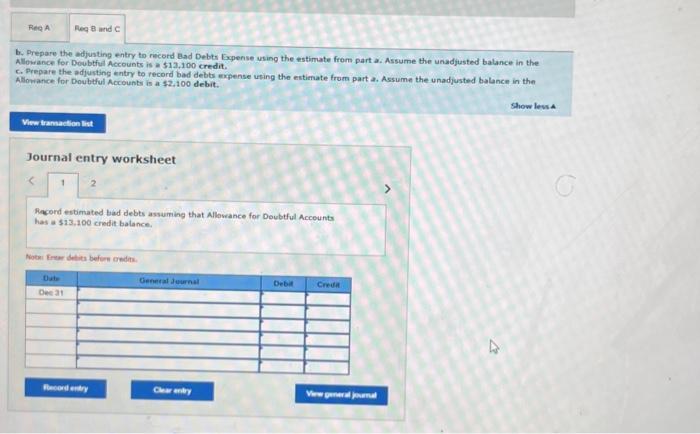

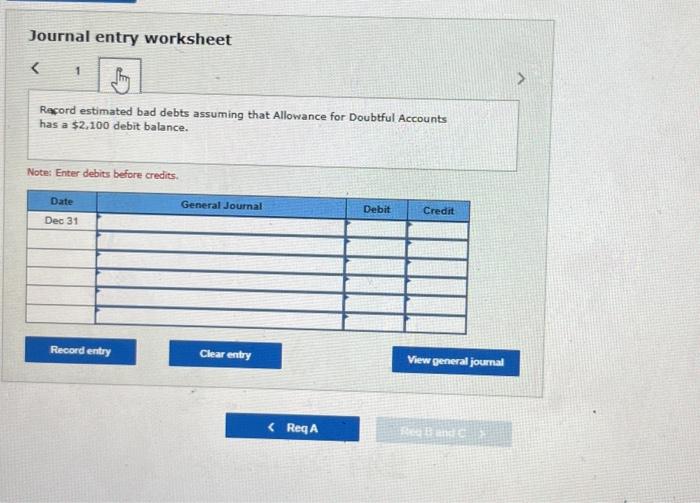

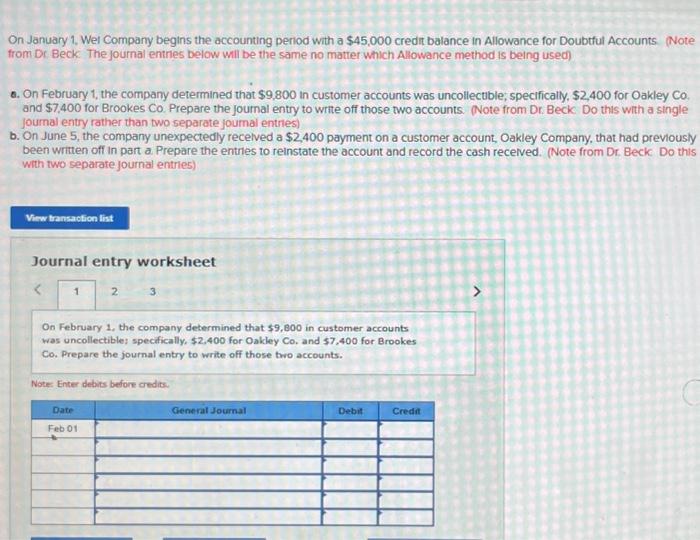

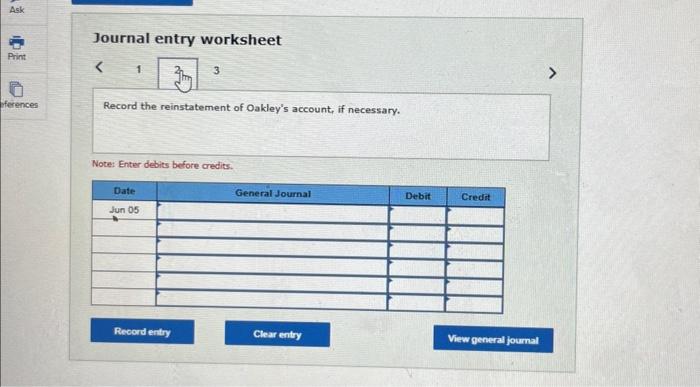

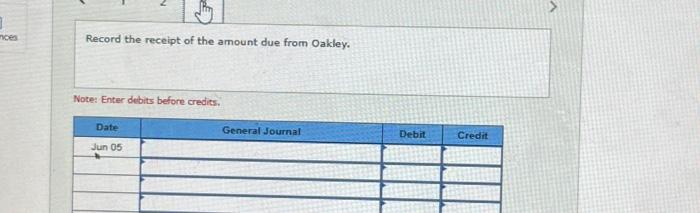

Required Informetion [The following informotion applles to thequestions displayed below] Daley Company prepared the following aging of recelvables analysis at December 31. . Complete the table below to calculate the estimated balance of Aliowance for Doubtful Accounts using oging of accounts ecelvable. 2. Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $4,700 credit. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Ullowance for Doubtul Accounts is a \$1,200 deblt. Complete this question by entering your answers in the tabs below. Complete the table below to calculate the estimated balance of Allowance for Doubtful Accounts using aging of accounts receivable. Complete this question by entering your answers in the tabs below. b. Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. Assume the unadjusted Allowance for Doubtful Accounts is a $4,700 credit. c. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted b. Allowance for Doubtful Accounts is a $1,200 debit. Journal entry worksheet 2 Record estimated bad debts assuming that Allowance for Doubtful Accounts has a $4,700 credit balance. Note: Enter debits before credits. Journal entry worksheet Record estimated bad debts assuming that Allowance for Doubtful Accounts has a $1,200 debit balance. Note: Enter debits before credits. [The following information applies to the questions displayed below] Daley Company prepared the followng aging of recelvables analysis at December 31 5. Estimate the balance of the Allowance for Doubtful Accounts assuming the company uses 5% of total accounts recelvable to estumate uncoliectibles, instead of the aging of recelvables method. 2. Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. Assume the unadjusted balance in the Wllowance for Doubtiul Accounts is a $13,100 credit. . Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $2,100 debit: Complete this question by entering your answers in the tabs below. Catimate the balance of the Allowance for Doubtful Accounts assuming the company uses sw of total accounts receivable to estimate uncollectibles, instead of the aging of receivables method. b. Prepare the adfusting entry to rucord Bad Debts Expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtiul Accounts is a $13,100 credit. c. Prepare the adjusting entry to record bad debts expense uning the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtul Accounts is a $2,100 debit. Journal entry worksheet 2 Racond estimated bad debts assuming that Allowance for Doubtful Acceunts has a 513,100 credit balance. Notni frem detita befors ondits. Journal entry worksheet Rexord estimated bad debts assuming that Allowance for Doubtful Accounts has a $2,100 debit balance. Note: Enter debits before credits. On January 1, Wel Company begins the accounting period with a $45,000 credit balance in Allowance for Doubtful Accounts. (Note from Dr Beck. The journal entres below will be the same no matrer which Allowance method is belng used? 0. On February 1, the company determined that $9,800 in customer accounts was uncollectuble, specifically, $2,400 for Oakley Co, and $7,400 for Brookes Co. Prepare the journal entry to wrte off those two accounts. Note from Dr. Beck. Do this with a single joumal entry rather than two separate joumal entries) b. On June 5, the company unexpectedly recelved a $2,400 payment on a customer account, Oakley Company, that had previously been written off in part a. Prepare the entres to reinstate the account and record the cash recelved. (Note from Dr. Beck. Do this with two separate journal entries) Journal entry worksheet On February 1, the company determined that $9,800 in customer accounts was uncollectible; specifically, $2,400 for Oakley Co, and $7,400 for Brookes Co. Prepare the journal entry to write off those two accounts. Note Enter debits before credits. Journal entry worksheet Record the reinstatement of Oakley's account, if necessary. Note: Enter debits before credits. Record the receipt of the amount due from Oakley. Note: Enter debits before credits