Question

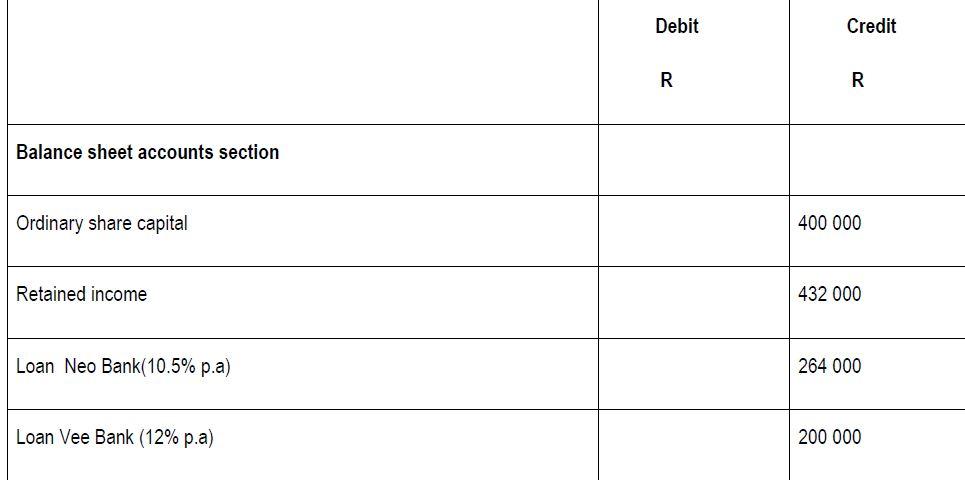

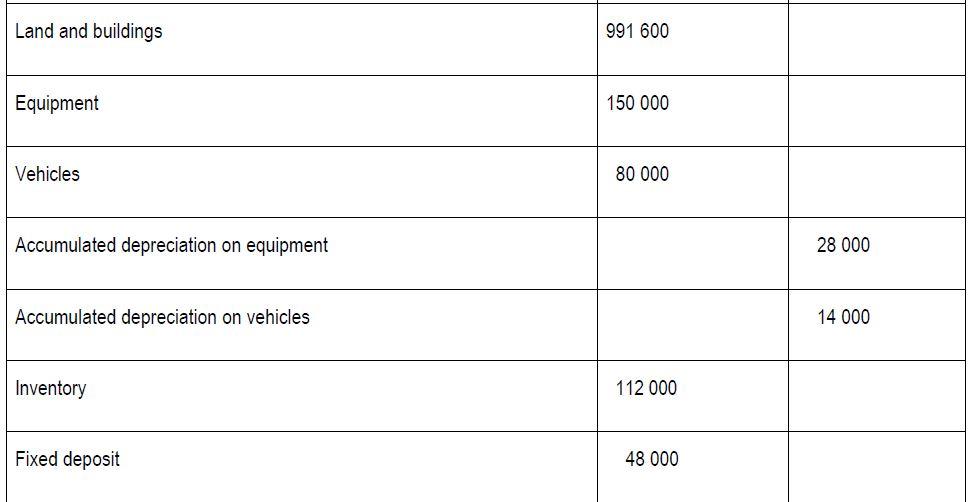

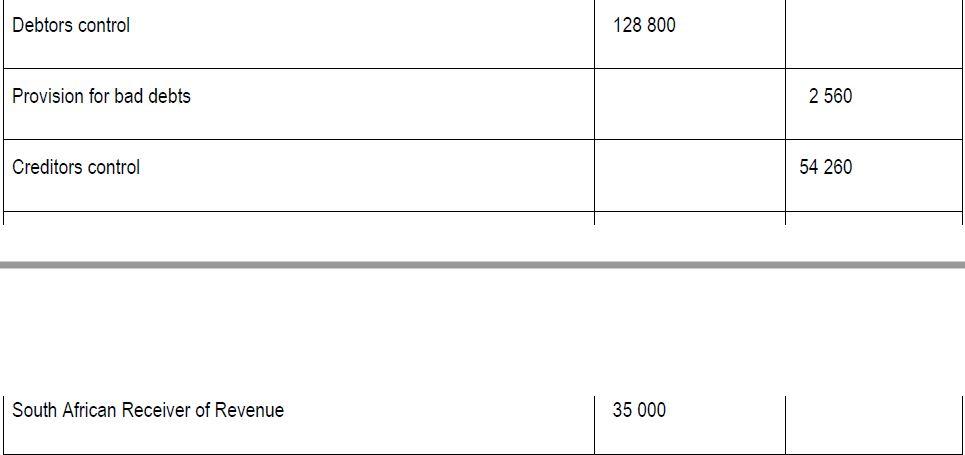

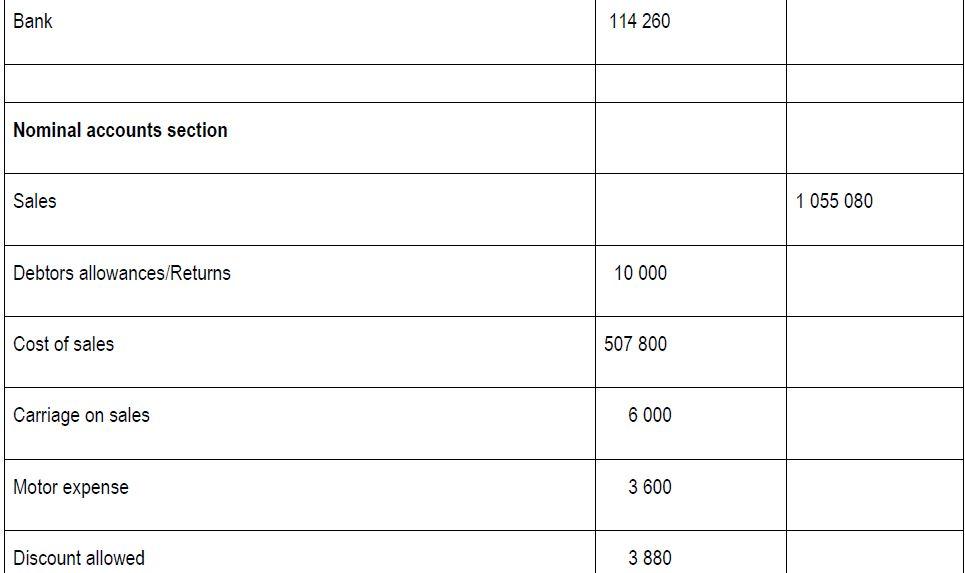

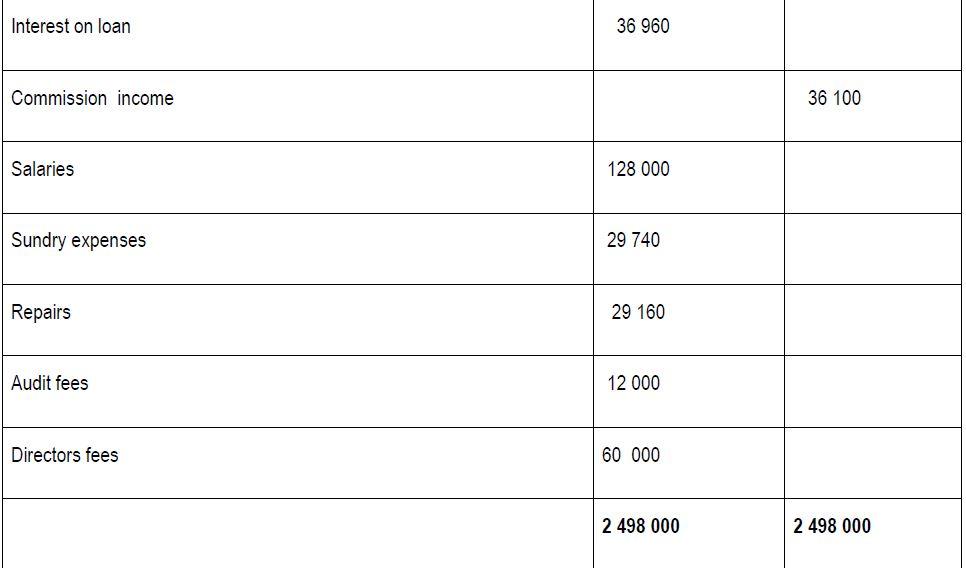

Required: Statement of Financial Position as at: 30 June 2021. N.B. Show your workings in brackets. Stellenbosch Ltd Pre-Adjustment Trial Balance at: 30 June 2021.

Required: Statement of Financial Position as at: 30 June 2021. N.B. Show your workings in brackets. Stellenbosch Ltd Pre-Adjustment Trial Balance at: 30 June 2021.

Adjustments and additional information 1. Provision for bad debts must be increased by R1 840.

2. Trading inventory according to stocktaking on 30 June 2021 amounted to R96 000. 3. Depreciation must be provided for as follows: - Vehicles at 20% on cost. Equipment at 28% on cost. 4. A portion of unsecured loan from Neo Bank R24 000 is payable in the next financial year. Provide for outstanding interest on loan. 5. Outstanding interest on loan from Neo Bank amounts to R26 000 6. a dividend of R9 600 is receivable on the listed shares in DSL Ltd. 7. A cash amount of R16 000 that went missing in our account miraculously appeared in our June bank statement. Make the necessary entry. 8. The authorised share capital consists of 500 000 ordinary shares. Note than on 01 January 2021 the company issued 100 000 shares at R1 each. 9. The income tax for the year amounted to R62 400. 10. Companys directors declared a total of R48 000 for dividends. 11. Profit after tax amounted to R125 400.

2. Trading inventory according to stocktaking on 30 June 2021 amounted to R96 000. 3. Depreciation must be provided for as follows: - Vehicles at 20% on cost. Equipment at 28% on cost. 4. A portion of unsecured loan from Neo Bank R24 000 is payable in the next financial year. Provide for outstanding interest on loan. 5. Outstanding interest on loan from Neo Bank amounts to R26 000 6. a dividend of R9 600 is receivable on the listed shares in DSL Ltd. 7. A cash amount of R16 000 that went missing in our account miraculously appeared in our June bank statement. Make the necessary entry. 8. The authorised share capital consists of 500 000 ordinary shares. Note than on 01 January 2021 the company issued 100 000 shares at R1 each. 9. The income tax for the year amounted to R62 400. 10. Companys directors declared a total of R48 000 for dividends. 11. Profit after tax amounted to R125 400.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started