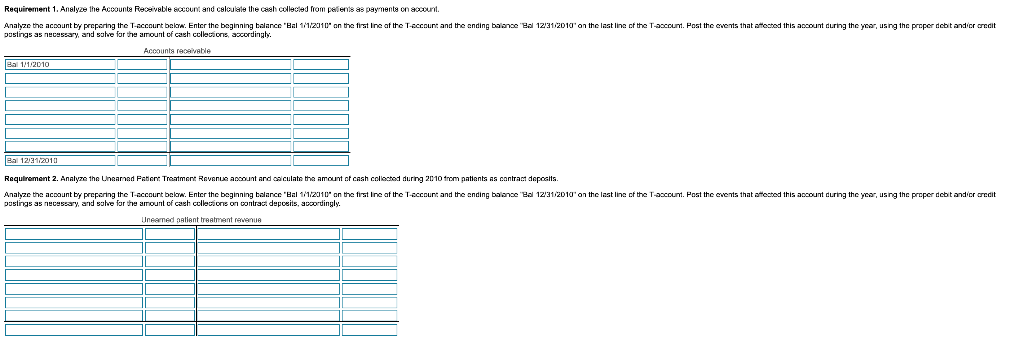

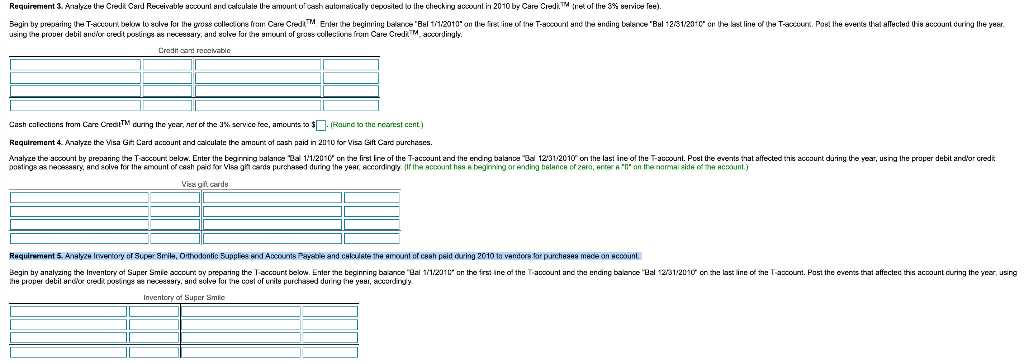

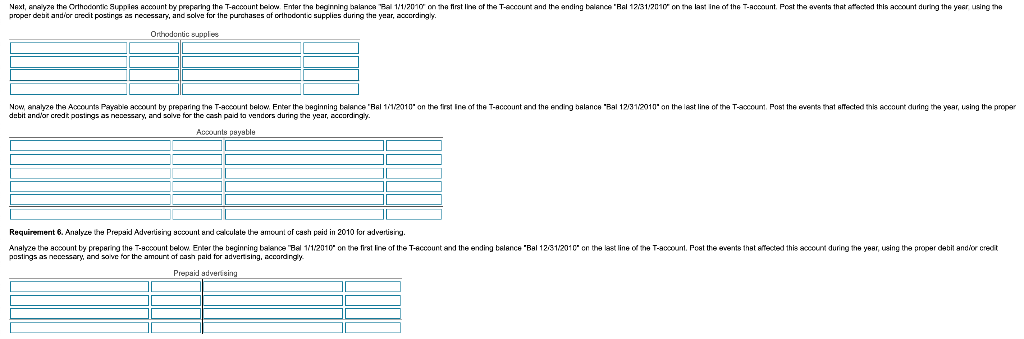

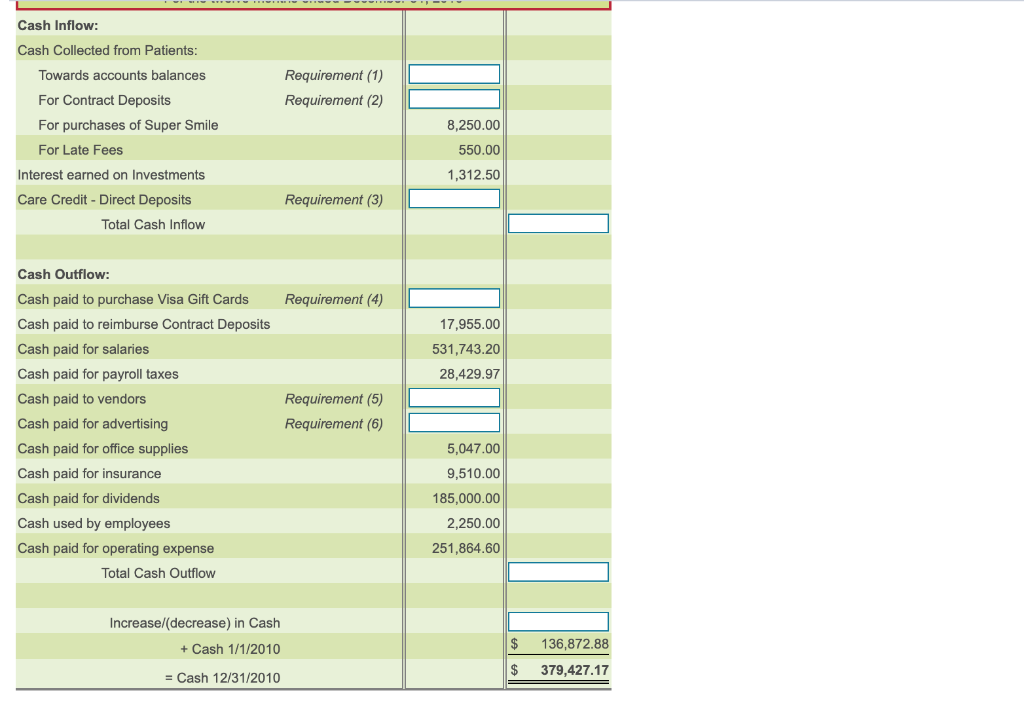

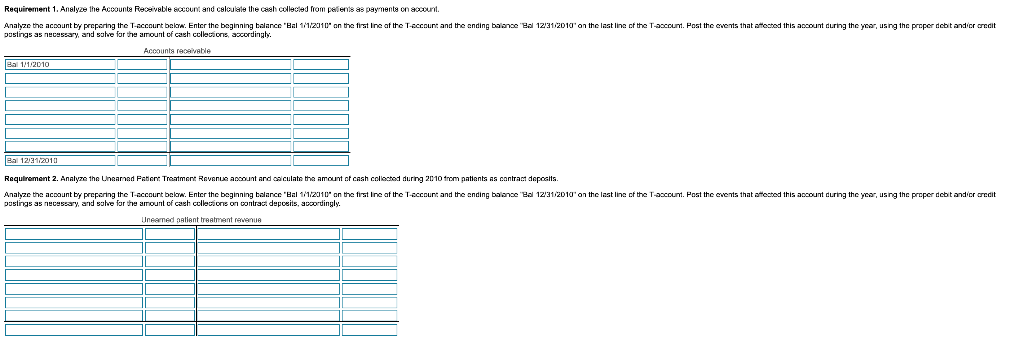

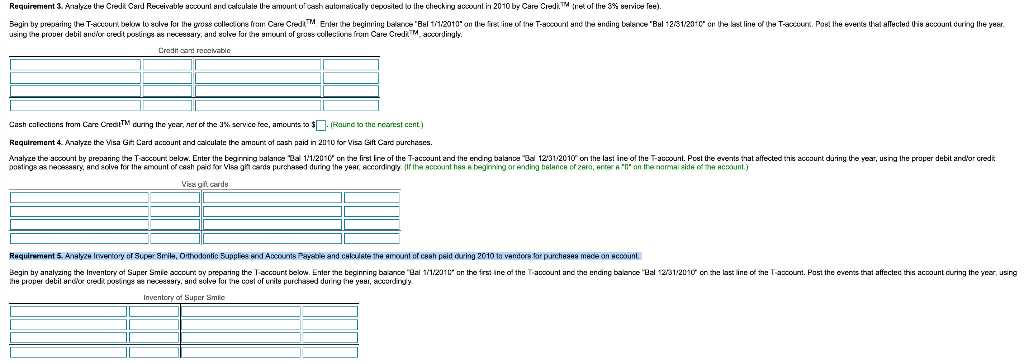

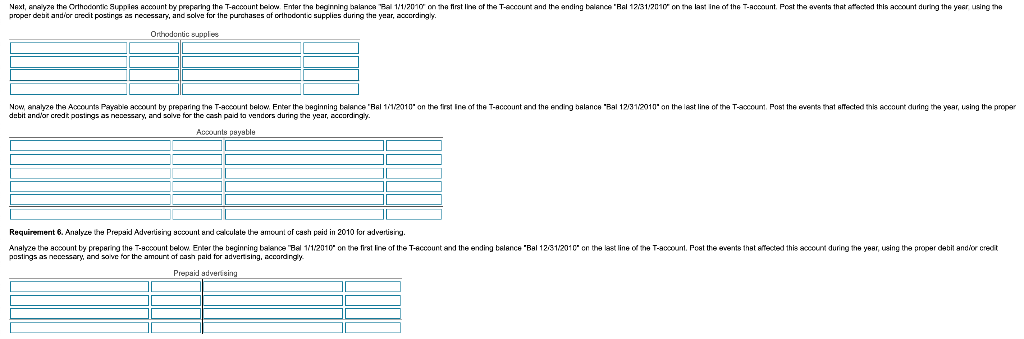

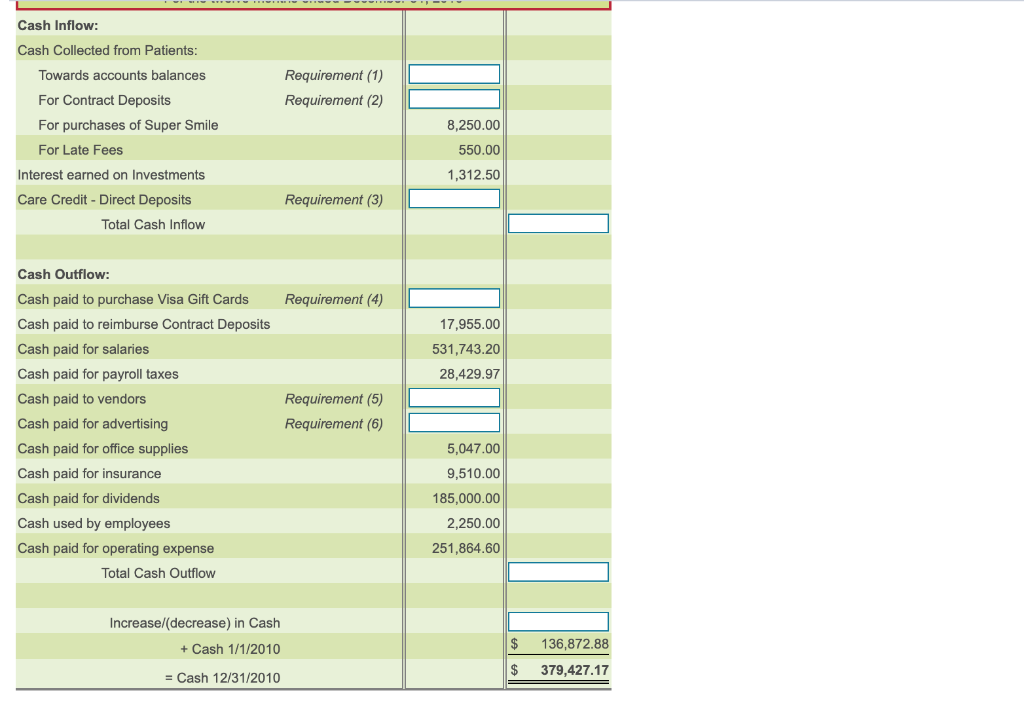

Requirement 1. Analyze the Accounts Receivable account and calculate the cash collected from patients as payments on wount. Analyze the account by preparing the T-account belon. Enter the beginning balance "Bal 111/2010" on the first line at the T-account and the ending balanse Bal 12/31/2010' on the last line of the T-ascount. Post the events that atleted this account during the year, using the proper debitandior crcdit postings as necessary, and solve for the amount of cash collections, accordingly. Accounts receivable Bal 1/1/2010 Bal 12/31/2010 Requirement 2. Analyze the Unearned Fation Treatment Revenue account and calculate the amount of cash collected during 2010 from patients as contract deposits Analyze the account by preparing the T-account below. Enter the beginning balance Hal1/1/2010" on the first ine of the Toccount and the anding balance Hal 12/31/2010' on the last line of the Taccount. Post the events that affected this account during the year, using the proper debitandior ancdit postings as necessary, and sale for the amount of cash collections on contract deposits, accordingly. Uneamed aliant treatment revenue Requirement 3. Analyze the Credit Card Receivable scount and calculate the amount of cash automatically cepusiled to the checking out in 2010 by Care Credi. T re of the 3% service Tee). Begin by preparing the T-account below to solve for the gross collections from Care Cle Enter the beginning "Bel 171/2010" on l i ne of the T-four and wending "Bal 12/31/2010 on the using the proper debilancur credit posting w e ary, and solve for the mount of gross collections from Care Crediabardingly. line of the T w Post the events alfected this count during the year Credit and receivable Cash calections from Care Credit curing the year, ner of the 2% service toe, amounts to $ (Round to the nearest cont) Requirement 4. Analyze the Visa Git Card account and calculate the amount of cash paid in 2010 for Visa Gift Card purchases. Analyze the account by preparing the T-account below. Enter the beginning balance Bal 1:1:2010 on the first line of the T-account and the ending balance Bal 12/31/2010 on the last line of the T-account. Post the events that affected this account during the year, using the proper debitandior credit postings as necessary, and solve for the amount of cash paid for Visa git cards purchased during the year accordingly if the account has a beginning or ending balance of zero, enter a "n' on the normal side of the count) Visagil cards Requirement 5. Analyze Inventory or Super Smile, Orthodontic Supplies and A unts Payable and cause the amount of cash paid during 2010 to vendors for purchases made an account Begin by analyzing the Inventory of Super Smie Sccunt by preparing the Taccount below. Enter the beginning balance 'Bal 11/2010" on the first ine of the Taccount and the encing balance 'Bal 12/31/2010 on the last line of the Tacount. Past the events that affected this account curing the year, using the proper delil orcilor Cred. posirups esgry, and solve for the color uris purchased during the year, according Inventory of Sugar Smic Next Analyze the Orthodontic Supalas Account by preparing the T-Account balow. Enter the beginning balans Sal 1/1/20-10 on the first line of the T-account and the Anding AIANCA "RAI 12/31/2017 on the last in of the T-acount. Poat the events that attemad this amount during the year using the proper debitandior credit postings as recessary, and solve for the purchases af orthodontic supplies during the year, accordingly. Orthodontie supplies Now Analize the A A PAVANA Anunt hy preparing a T-Acun below. Fnherita beginning balance 'RAI 1/1/2010" on the traine of the T-account and the ending balance "Bal 12/31/2010" on the last line of the Taccount. Post the events that affected this account during the year, Laing the anger debitandior credit postings as necessary, and solve for the cash paid ta vendors during the year, accordingly. Accounts payable Requirement 6. Analyze the Prepaid Advertising susunand calculate the amount of cash paid in 2010 for advertising. Analyze the countly preparing the T-scount below. Envier the beginning balance "Bal 1/1/2010 on the first line of the T-scoount and the ending balance "Bal 1231/2010 on the last line of pastings as necessaryand save for the amount of cash paid for advarsing, accordingly. T- uniPoal the event that affected this count during the year wing the rear debitandior credit Prepaid suverting Requirement (1) Requirement (2) Cash Inflow: Cash Collected from Patients: Towards accounts balances For Contract Deposits For purchases of Super Smile For Late Fees Interest earned on Investments Care Credit - Direct Deposits Total Cash Inflow 8,250.00 550.00 1,312.50 Requirement (3) Requirement (4) 17,955.00 531,743.20 28,429.97 Cash Outflow: Cash paid to purchase Visa Gift Cards Cash paid to reimburse Contract Deposits Cash paid for salaries Cash paid for payroll taxes Cash paid to vendors Cash paid for advertising Cash paid for office supplies Cash paid for insurance Cash paid for dividends Cash used by employees Cash paid for operating expense Total Cash Outflow Requirement (5) Requirement (6) 5,047.00 9,510.00 185,000.00 2,250.00 251,864.60 Increase/(decrease) in Cash + Cash 1/1/2010 = Cash 12/31/2010 $ $ 136,872.88 379,427.17 Requirement 1. Analyze the Accounts Receivable account and calculate the cash collected from patients as payments on wount. Analyze the account by preparing the T-account belon. Enter the beginning balance "Bal 111/2010" on the first line at the T-account and the ending balanse Bal 12/31/2010' on the last line of the T-ascount. Post the events that atleted this account during the year, using the proper debitandior crcdit postings as necessary, and solve for the amount of cash collections, accordingly. Accounts receivable Bal 1/1/2010 Bal 12/31/2010 Requirement 2. Analyze the Unearned Fation Treatment Revenue account and calculate the amount of cash collected during 2010 from patients as contract deposits Analyze the account by preparing the T-account below. Enter the beginning balance Hal1/1/2010" on the first ine of the Toccount and the anding balance Hal 12/31/2010' on the last line of the Taccount. Post the events that affected this account during the year, using the proper debitandior ancdit postings as necessary, and sale for the amount of cash collections on contract deposits, accordingly. Uneamed aliant treatment revenue Requirement 3. Analyze the Credit Card Receivable scount and calculate the amount of cash automatically cepusiled to the checking out in 2010 by Care Credi. T re of the 3% service Tee). Begin by preparing the T-account below to solve for the gross collections from Care Cle Enter the beginning "Bel 171/2010" on l i ne of the T-four and wending "Bal 12/31/2010 on the using the proper debilancur credit posting w e ary, and solve for the mount of gross collections from Care Crediabardingly. line of the T w Post the events alfected this count during the year Credit and receivable Cash calections from Care Credit curing the year, ner of the 2% service toe, amounts to $ (Round to the nearest cont) Requirement 4. Analyze the Visa Git Card account and calculate the amount of cash paid in 2010 for Visa Gift Card purchases. Analyze the account by preparing the T-account below. Enter the beginning balance Bal 1:1:2010 on the first line of the T-account and the ending balance Bal 12/31/2010 on the last line of the T-account. Post the events that affected this account during the year, using the proper debitandior credit postings as necessary, and solve for the amount of cash paid for Visa git cards purchased during the year accordingly if the account has a beginning or ending balance of zero, enter a "n' on the normal side of the count) Visagil cards Requirement 5. Analyze Inventory or Super Smile, Orthodontic Supplies and A unts Payable and cause the amount of cash paid during 2010 to vendors for purchases made an account Begin by analyzing the Inventory of Super Smie Sccunt by preparing the Taccount below. Enter the beginning balance 'Bal 11/2010" on the first ine of the Taccount and the encing balance 'Bal 12/31/2010 on the last line of the Tacount. Past the events that affected this account curing the year, using the proper delil orcilor Cred. posirups esgry, and solve for the color uris purchased during the year, according Inventory of Sugar Smic Next Analyze the Orthodontic Supalas Account by preparing the T-Account balow. Enter the beginning balans Sal 1/1/20-10 on the first line of the T-account and the Anding AIANCA "RAI 12/31/2017 on the last in of the T-acount. Poat the events that attemad this amount during the year using the proper debitandior credit postings as recessary, and solve for the purchases af orthodontic supplies during the year, accordingly. Orthodontie supplies Now Analize the A A PAVANA Anunt hy preparing a T-Acun below. Fnherita beginning balance 'RAI 1/1/2010" on the traine of the T-account and the ending balance "Bal 12/31/2010" on the last line of the Taccount. Post the events that affected this account during the year, Laing the anger debitandior credit postings as necessary, and solve for the cash paid ta vendors during the year, accordingly. Accounts payable Requirement 6. Analyze the Prepaid Advertising susunand calculate the amount of cash paid in 2010 for advertising. Analyze the countly preparing the T-scount below. Envier the beginning balance "Bal 1/1/2010 on the first line of the T-scoount and the ending balance "Bal 1231/2010 on the last line of pastings as necessaryand save for the amount of cash paid for advarsing, accordingly. T- uniPoal the event that affected this count during the year wing the rear debitandior credit Prepaid suverting Requirement (1) Requirement (2) Cash Inflow: Cash Collected from Patients: Towards accounts balances For Contract Deposits For purchases of Super Smile For Late Fees Interest earned on Investments Care Credit - Direct Deposits Total Cash Inflow 8,250.00 550.00 1,312.50 Requirement (3) Requirement (4) 17,955.00 531,743.20 28,429.97 Cash Outflow: Cash paid to purchase Visa Gift Cards Cash paid to reimburse Contract Deposits Cash paid for salaries Cash paid for payroll taxes Cash paid to vendors Cash paid for advertising Cash paid for office supplies Cash paid for insurance Cash paid for dividends Cash used by employees Cash paid for operating expense Total Cash Outflow Requirement (5) Requirement (6) 5,047.00 9,510.00 185,000.00 2,250.00 251,864.60 Increase/(decrease) in Cash + Cash 1/1/2010 = Cash 12/31/2010 $ $ 136,872.88 379,427.17