Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Requirement 1: Determine the amount of current assets for Tiger Company. Show the amounts included (e.g., 22 + 15 + 41). Requirement 2: Determine the

Requirement 1: Determine the amount of current assets for Tiger Company. Show the amounts included (e.g., 22 + 15 + 41).

Requirement 2: Determine the amount of current liabilities for Tiger Company. Show the amounts included (e.g., 22 + 15 + 41).

Requirement 3: Determine the debt/equity ratio (total liabilities/total SE) for Tiger Company. Show the amounts included in the numerator and denominator (e.g., 22 + 15 + 41). Round your answer to 4 decimal places.

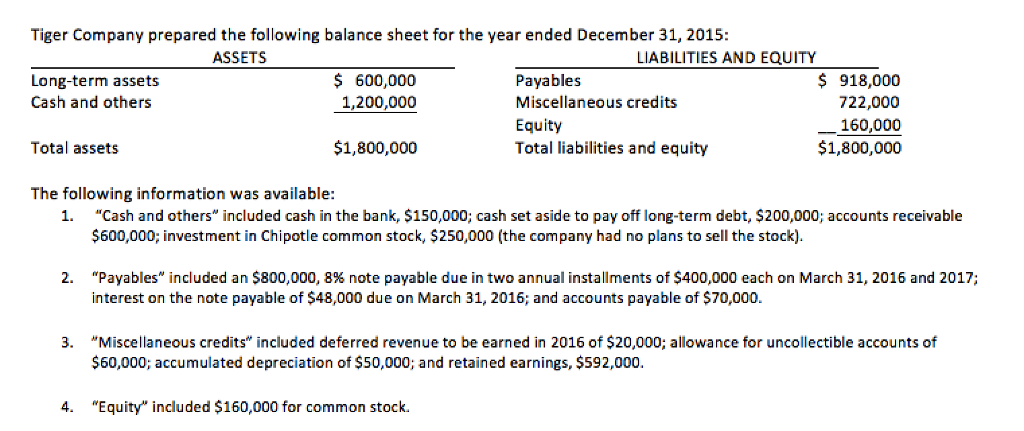

Tiger Company prepared the following balance sheet for the year ended December 31, 2015: ASSETS LIABILITIES AND EQUITY 600,000 918,000 Long-term assets Payables Cash and others 1,200,000 Miscellaneous credits 722,000 160,000 Equity $1,800,000 $1,800,000 Total assets Total liabilities and equity The following information was available: 1. Cash and others included cash in the bank, $150,000; cash set aside to pay off long-term debt, $200,000; accounts receivable $600,000 investment in Chipotle common stock, $250,000 (the company had no plans to sell the stock). 2. "Payables included an $800,000, 8% note payable due in two annual installments of $400,000 each on March 31, 2016 and 2017; interest on the note payable of $48,000 due on March 31, 2016; and accounts payable of $70,000. 3. "Miscellaneous credits included deferred revenue to be earned in 2016 of $20,000; allowance for uncollectible accounts of $60,000; accumulated depreciation of$50,000; and retained earnings, $592,000. 4. Equity" included $160,000 for common stockStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started