Answered step by step

Verified Expert Solution

Question

1 Approved Answer

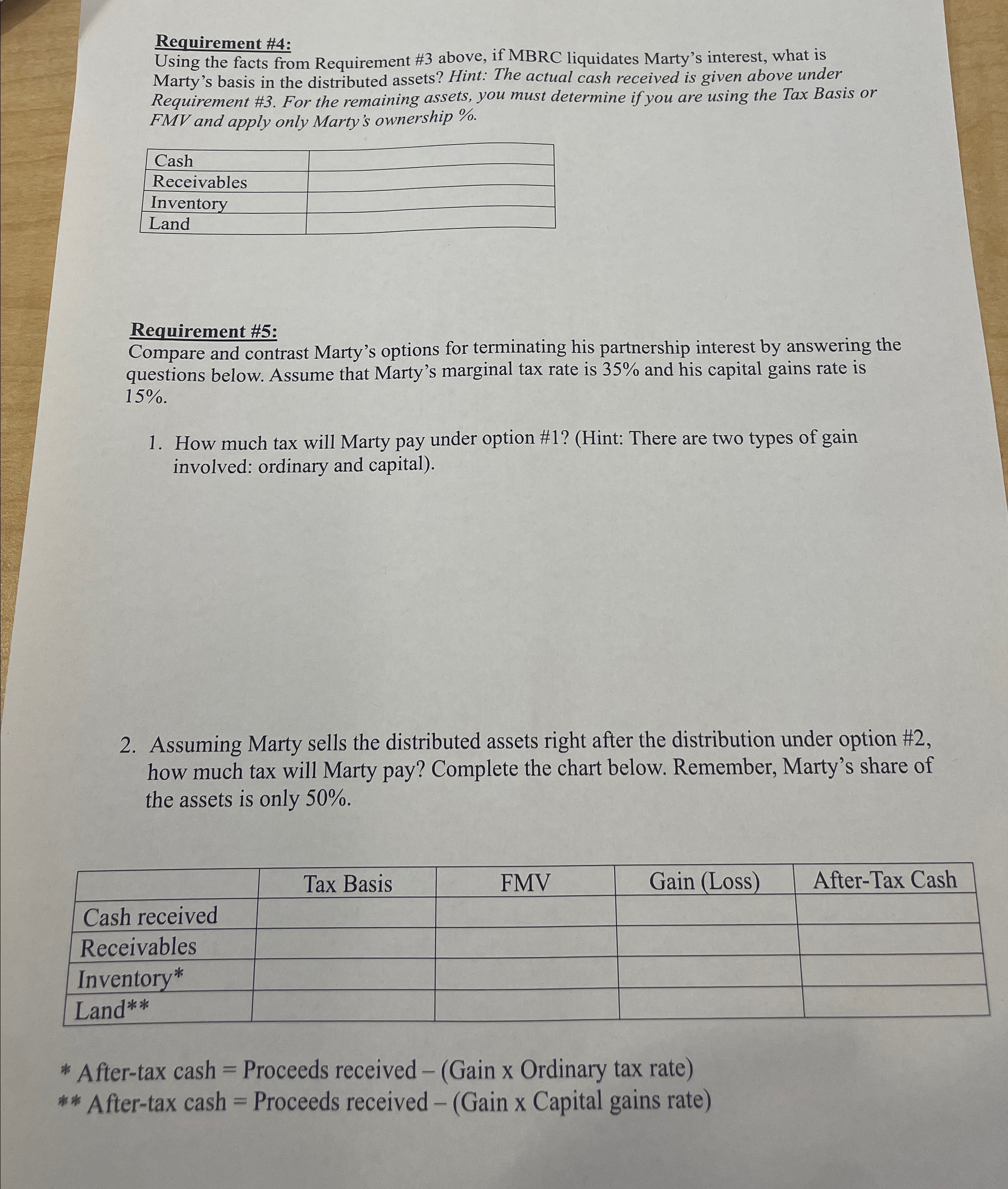

Requirement # 4 : Using the facts from Requirement # 3 above, if MBRC liquidates Marty's interest, what is Marty's basis in the distributed assets?

Requirement #:

Using the facts from Requirement # above, if MBRC liquidates Marty's interest, what is Marty's basis in the distributed assets? Hint: The actual cash received is given above under Requirement # For the remaining assets, you must determine if you are using the Tax Basis or FMV and apply only Marty's ownership

tableCashReceivablesInventoryLand

Requirement #:

Compare and contrast Marty's options for terminating his partnership interest by answering the questions below. Assume that Marty's marginal tax rate is and his capital gains rate is

How much tax will Marty pay under option #Hint: There are two types of gain involved: ordinary and capital

Assuming Marty sells the distributed assets right after the distribution under option # how much tax will Marty pay? Complete the chart below. Remember, Marty's share of the assets is only

tableTax Basis,FMVGain LossAfterTax CashCash received,,,,ReceivablesInventoryLand

Aftertax cash Proceeds received Gain Ordinary tax rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started