Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Return to que: Target Corporation prepares its financial statements according to U.S. GAAP. Target's financial statements and disclosure notes for the year ended February 3,

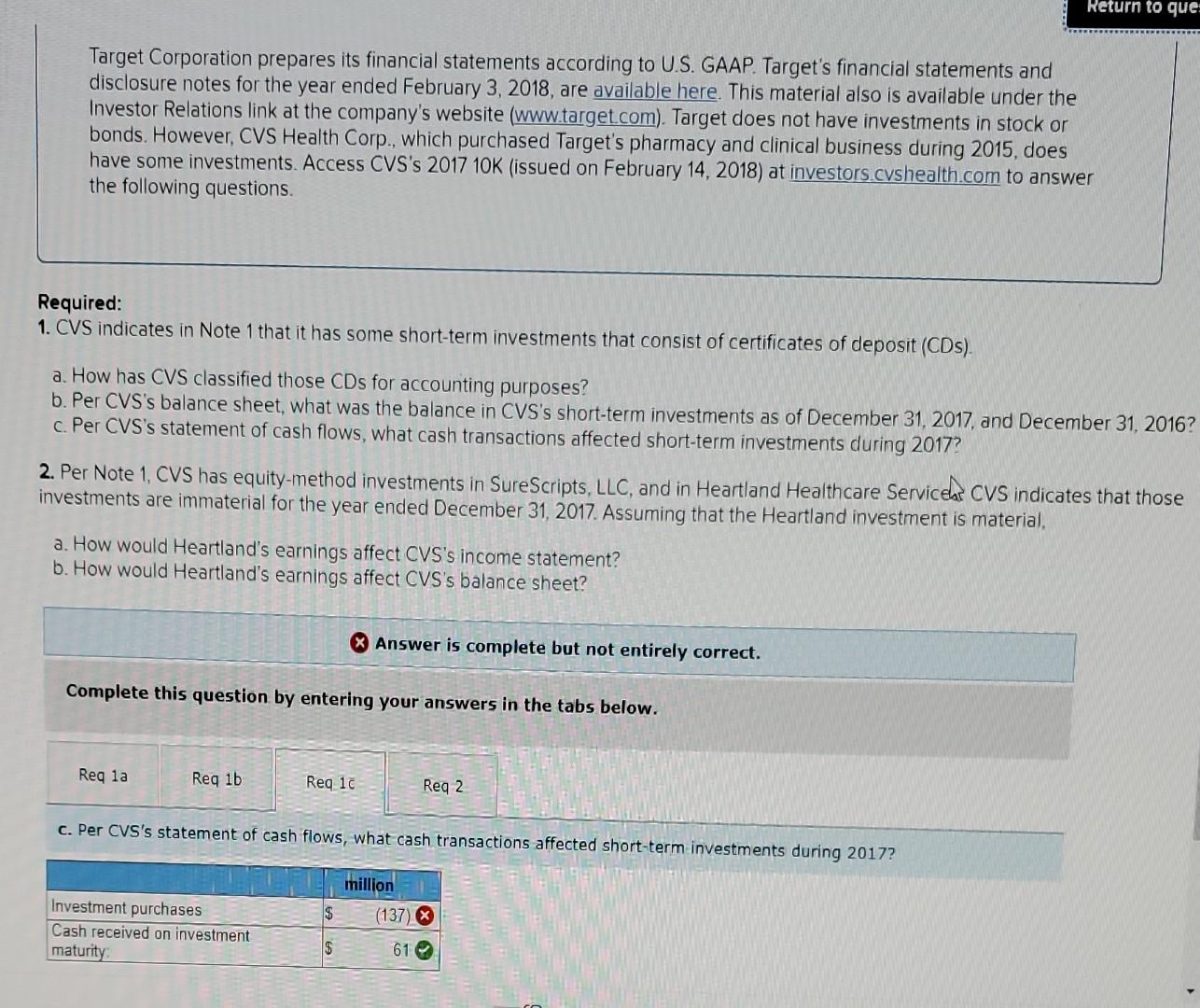

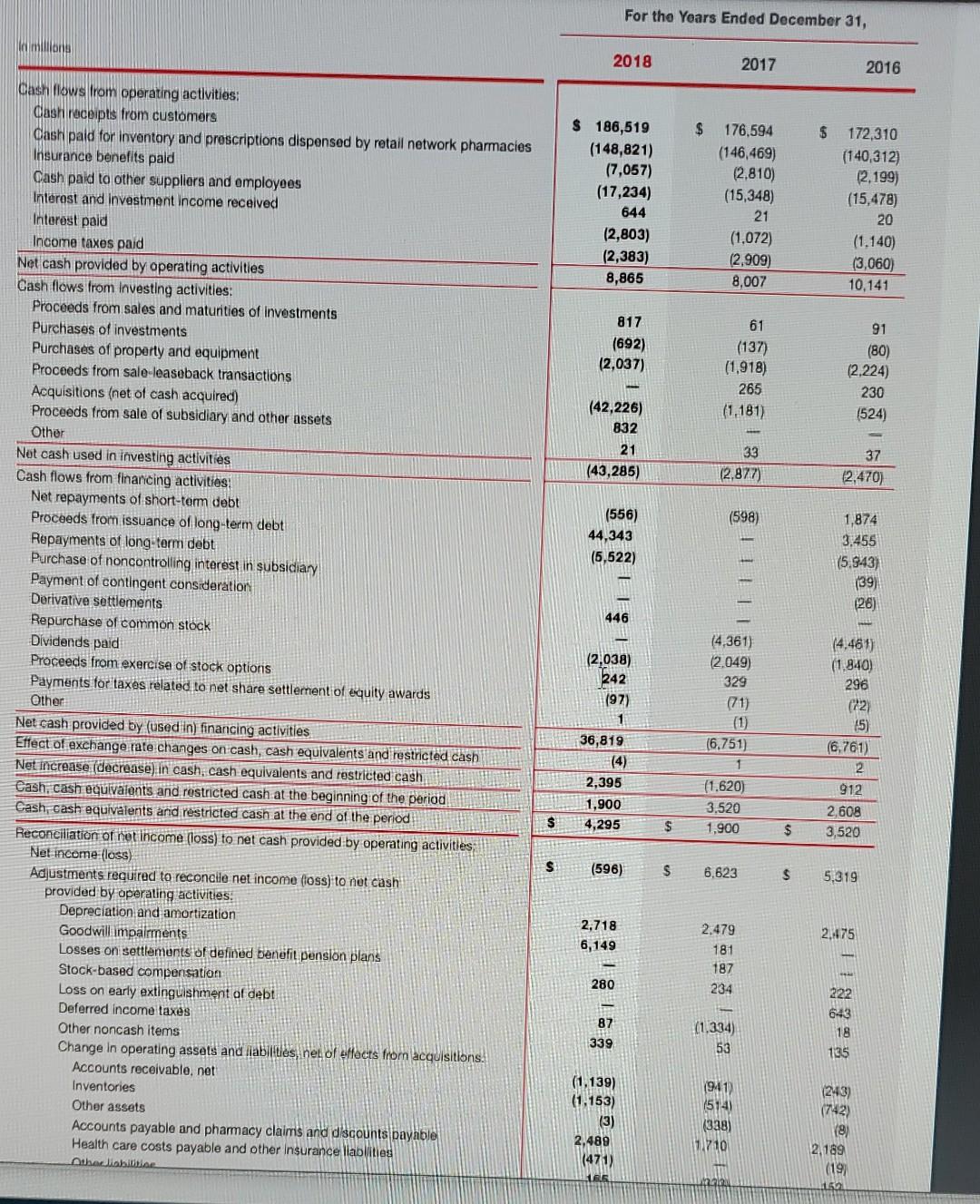

Return to que: Target Corporation prepares its financial statements according to U.S. GAAP. Target's financial statements and disclosure notes for the year ended February 3, 2018, are available here. This material also is available under the Investor Relations link at the company's website (www.target.com). Target does not have investments in stock or bonds. However, CVS Health Corp., which purchased Target's pharmacy and clinical business during 2015, does have some investments. Access CVS's 2017 10K (issued on February 14, 2018) at investors.cvshealth.com to answer the following questions. Required: 1. CVS indicates in Note 1 that it has some short-term investments that consist of certificates of deposit (CDs). a. How has CVS classified those CDs for accounting purposes? b. Per CVS's balance sheet, what was the balance in CVS's short-term investments as of December 31, 2017, and December 31, 2016? c. Per CVS's statement of cash flows, what cash transactions affected short-term investments during 2017? 2. Per Note 1, CVS has equity-method investments in SureScripts, LLC, and in Heartland Healthcare Servicead CVS indicates that those investments are immaterial for the year ended December 31, 2017. Assuming that the Heartland investment is material, a. How would Heartland's earnings affect CVS's income statement? b. How would Heartland's earnings affect CVS's balance sheet? X Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Reg la Reg 1b Reg 1c Req 2 c. Per CVS's statement of cash flows, what cash transactions affected short-term investments during 2017? million $ (137) X Investment purchases Cash received on investment maturity 61 For the Years Ended December 31, millione 2018 2017 2016 $ $ $ 186,519 (148,821) (7,057) (17,234) 644 (2,803) (2,383) 8,865 176,594 (146,469) (2.810) (15,348) 21 (1,072) (2,909) 8,007 172,310 (140,312) (2.199) (15,478) 20 (1.140) (3,060) 10,141 817 (692) (2,037) 61 (137) (1.918) 265 (1,181) 91 (80) (2,224) 230 (524) (42,226) 832 21 (43,285) 33 12,877) 37 (2.470) (598) (556) 44,343 (5,522) 1,874 3.455 (5.943) (39) (26) 446 Cash flows from operating activities: cash receipts from customers cash paid for inventory and prescriptions dispensed by retail network pharmacies Insurance benefits pald Cash paid to other suppliers and employees Interest and Investment Income received Interest pald Income taxes paid Net cash provided by operating activities Cash flows from Investing activities: Proceeds from sales and maturities of investments Purchases of investments Purchases of property and equipment Proceeds from sale-leaseback transactions Acquisitions (net of cash acquired) Proceeds from sale of subsidiary and other assets Other Net cash used in investing activities Cash flows from financing activities Net repayments of short-term debt Proceeds from issuance of long-term debt Repayments of long-term debt Purchase of noncontrolling interest in subsidiary Payment of contingent consideration Derivative settlements Repurchase of common stock Dividends paid Proceeds from exercise of stock options Payments for taxes related to net share settlement of equity awards Other Net cash provided by (used in) financing activities Effect of exchange rate changes on cash, cash equivalents and restricted cash Net increase (decrease) in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash at the beginning of the period Cash, cash equivalents and restricted cash at the end of the period Reconciliation of net income (loss) to net cash provided by operating activities Nel income (loss) Adjustments required to reconcile net income foss) to net cash provided by operating activities: Depreciation and amortization Goodwill impairments Losses on settlements of defined benefit pension plans Stock-based compensation Loss on early extinguishment of debt Deferred Income taxes Other noncash items Change in operating assets and abilities, net of effects from acquisitions. Accounts receivable, net Inventories Other assets Accounts payable and pharmacy claims and discounts payable Health care costs payable and other Insurance liabilities theiabilito (2,038) 242 (97) 1 36,819 (4) 2,395 1,900 4,295 (4,361) 2,049) 329 (71) (1) (6.751) 1 (1.620) 3.520 1,900 (4.461) (1 940) 296 (72) (5) (6,761) 2 912 2,608 3,520 $ $ $ $ (596) s 6.623 $ 5,319 2,718 6,149 2,475 2.479 181 187 234 280 87 339 (1.334) 53 222 643 18 135 (1,139) (1.153) (3) 2,489 (471) 1941) (514) (328) 1.710 (243) (742) 19) 2.189 (19) 152

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started