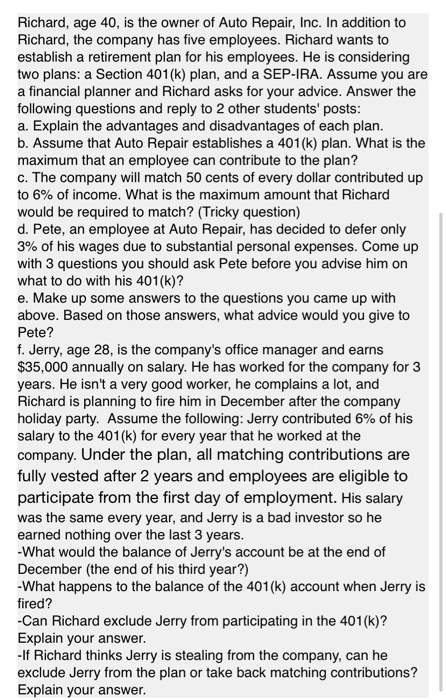

Richard, age 40, is the owner of Auto Repair, Inc. In addition to Richard, the company has five employees. Richard wants to establish a retirement plan for his employees. He is considering two plans: a Section 401(k) plan, and a SEP-IRA. Assume you are a financial planner and Richard asks for your advice. Answer the following questions and reply to 2 other students' posts: a. Explain the advantages and disadvantages of each plan. b. Assume that Auto Repair establishes a 401(k) plan. What is the maximum that an employee can contribute to the plan? c. The company will match 50 cents of every dollar contributed up to 6% of income. What is the maximum amount that Richard would be required to match? (Tricky question) d. Pete, an employee at Auto Repair, has decided to defer only 3% of his wages due to substantial personal expenses. Come up with 3 questions you should ask Pete before you advise him on what to do with his 401(k)? e. Make up some answers to the questions you came up with above. Based on those answers, what advice would you give to Pete? f. Jerry, age 28, is the company's office manager and earns $35,000 annually on salary. He has worked for the company for 3 years. He isn't a very good worker, he complains a lot, and Richard is planning to fire him in December after the company holiday party. Assume the following: Jerry contributed 6% of his salary to the 401(k) for every year that he worked at the company. Under the plan, all matching contributions are fully vested after 2 years and employees are eligible to participate from the first day of employment. His salary was the same every year, and Jerry is a bad investor so he earned nothing over the last 3 years. -What would the balance of Jerry's account be at the end of December (the end of his third year?) - What happens to the balance of the 401(k) account when Jerry is fired? -Can Richard exclude Jerry from participating in the 401(k)? Explain your answer. - If Richard thinks Jerry is stealing from the company, can he exclude Jerry from the plan or take back matching contributions? Explain your