Answered step by step

Verified Expert Solution

Question

1 Approved Answer

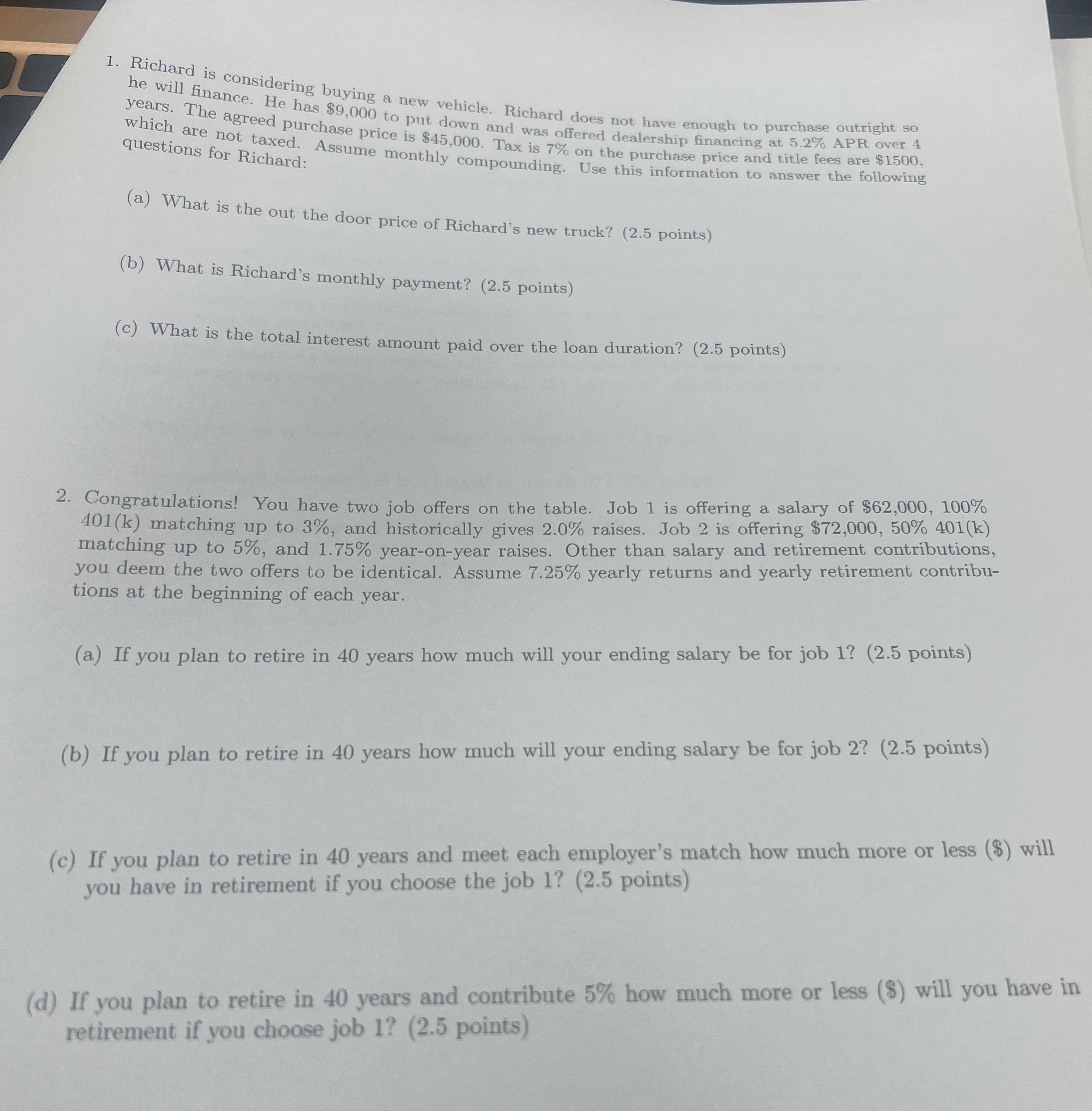

Richard is considering buying a new vehicle. Richard does not have enough to purchase outright so he will finance. He has $ 9 , 0

Richard is considering buying a new vehicle. Richard does not have enough to purchase outright so he will finance. He has $ to put down and was offered dealership financing at APR over years. The agreed purchase price is $ Tax is on the purchase price and title fees are $ which are not taxed. Assume monthly compounding. Use this information to answer the following questions for Richard:

a What is the out the door price of Richard's new truck? points

b What is Richard's monthly payment? points

c What is the total interest amount paid over the loan duration? points

Congratulations! You have two job offers on the table. Job is offering a salary of $ matching up to and historically gives raises. Job is offering $ matching up to and yearonyear raises. Other than salary and retirement contributions, you deem the two offers to be identical. Assume yearly returns and yearly retirement contributions at the beginning of each year.

a If you plan to retire in years how much will your ending salary be for job points

b If you plan to retire in years how much will your ending salary be for job points

c If you plan to retire in years and meet each employer's match how much more or less $ will you have in retirement if you choose the job points

d If you plan to retire in years and contribute how much more or less $ will you have in retirement if you choose job points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started