Question

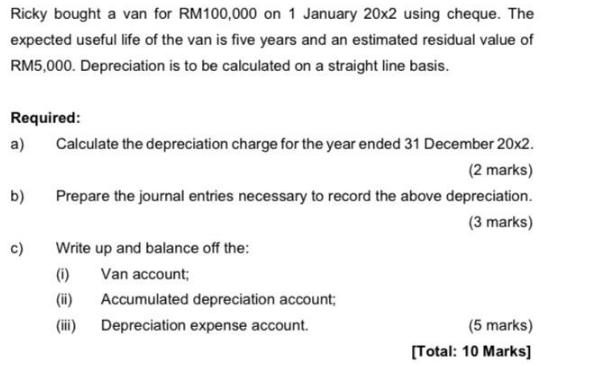

Ricky bought a van for RM100,000 on 1 January 20x2 using cheque. The expected useful life of the van is five years and an

Ricky bought a van for RM100,000 on 1 January 20x2 using cheque. The expected useful life of the van is five years and an estimated residual value of RM5,000. Depreciation is to be calculated on a straight line basis. Required: a) b) c) Calculate the depreciation charge for the year ended 31 December 20x2. (2 marks) Prepare the journal entries necessary to record the above depreciation. (3 marks) Write up and balance off the: (1) Van account; Accumulated depreciation account; Depreciation expense account. (iii) (5 marks) [Total: 10 Marks]

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Calculate the Depreciation Charge for the Year Ended 31 December 20x2 The formula for straightline ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Management Accounting

Authors: Pauline Weetman

7th edition

1292086599, 978-1292086590

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App