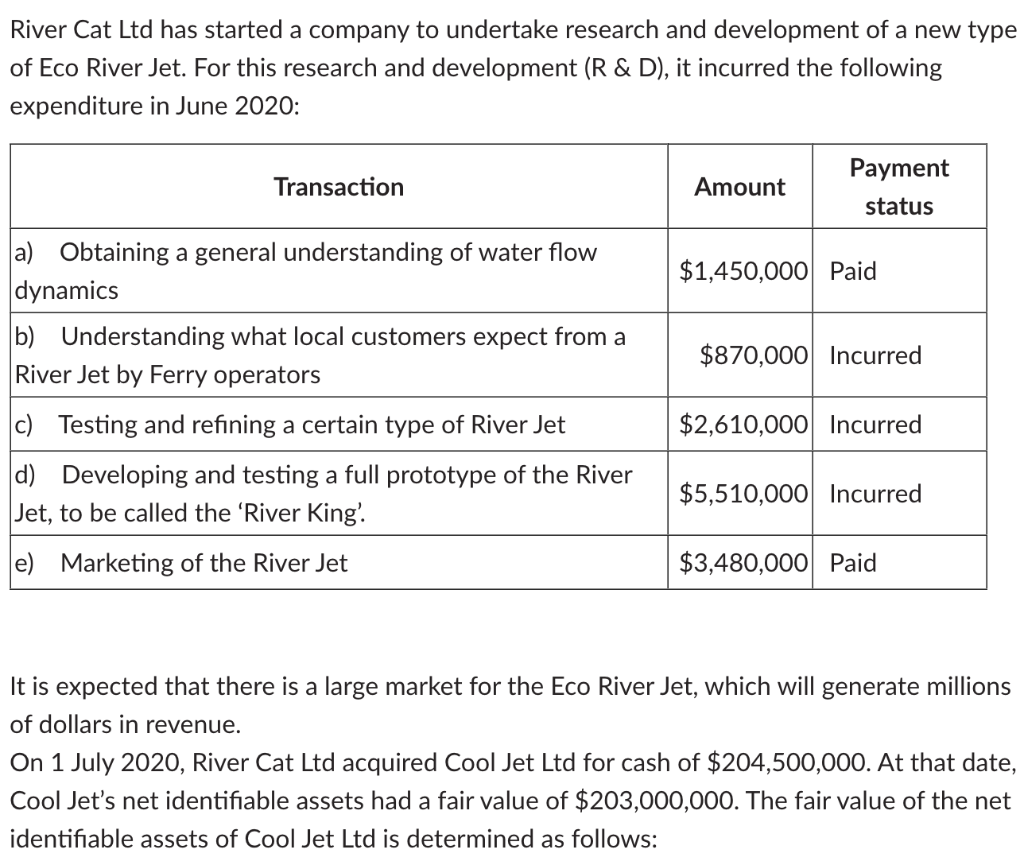

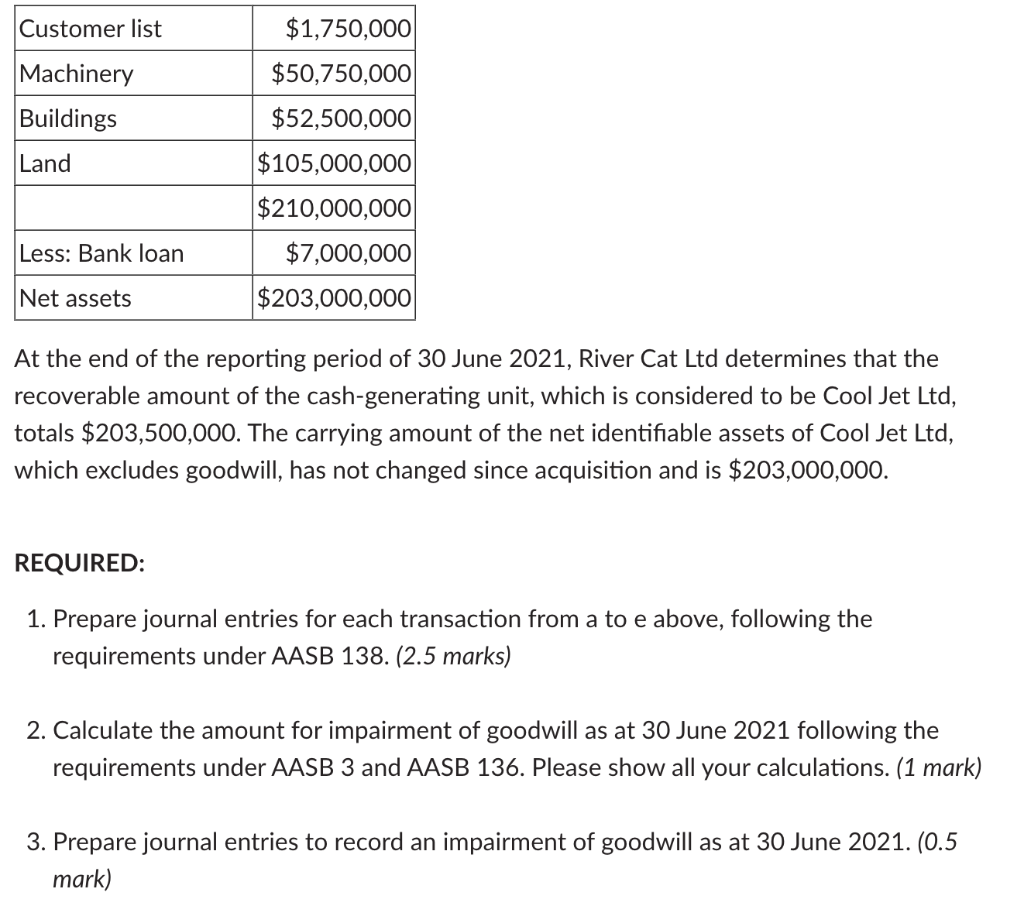

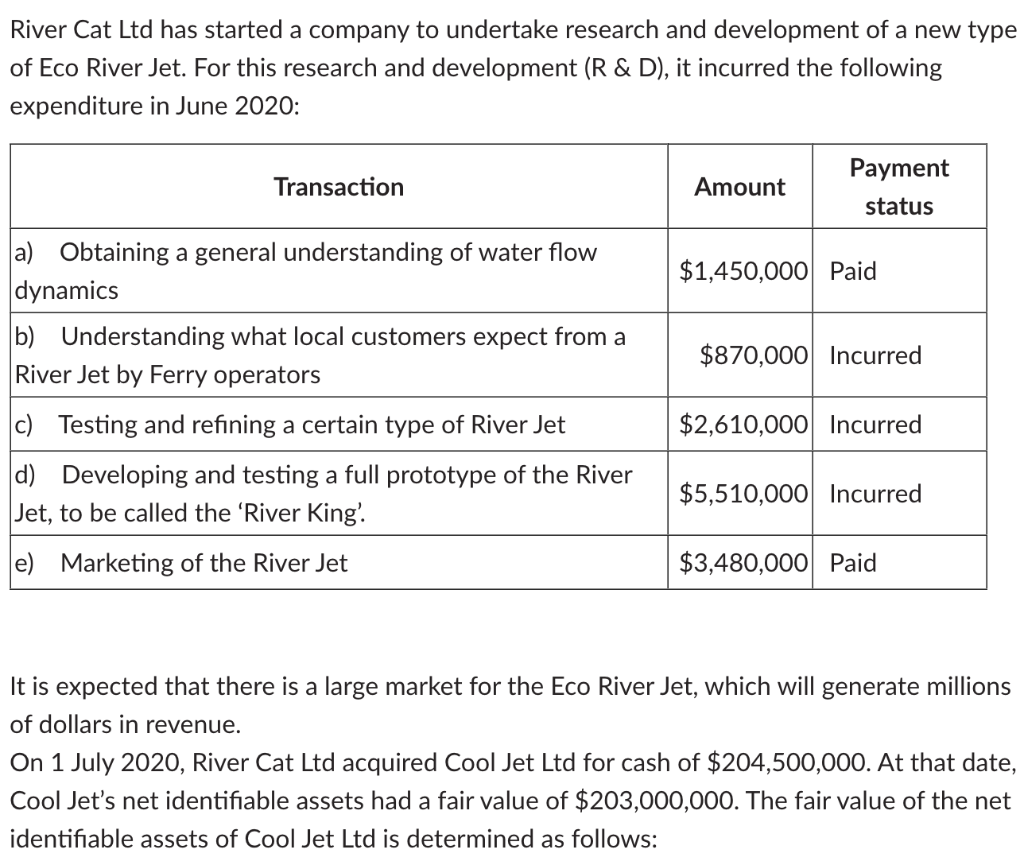

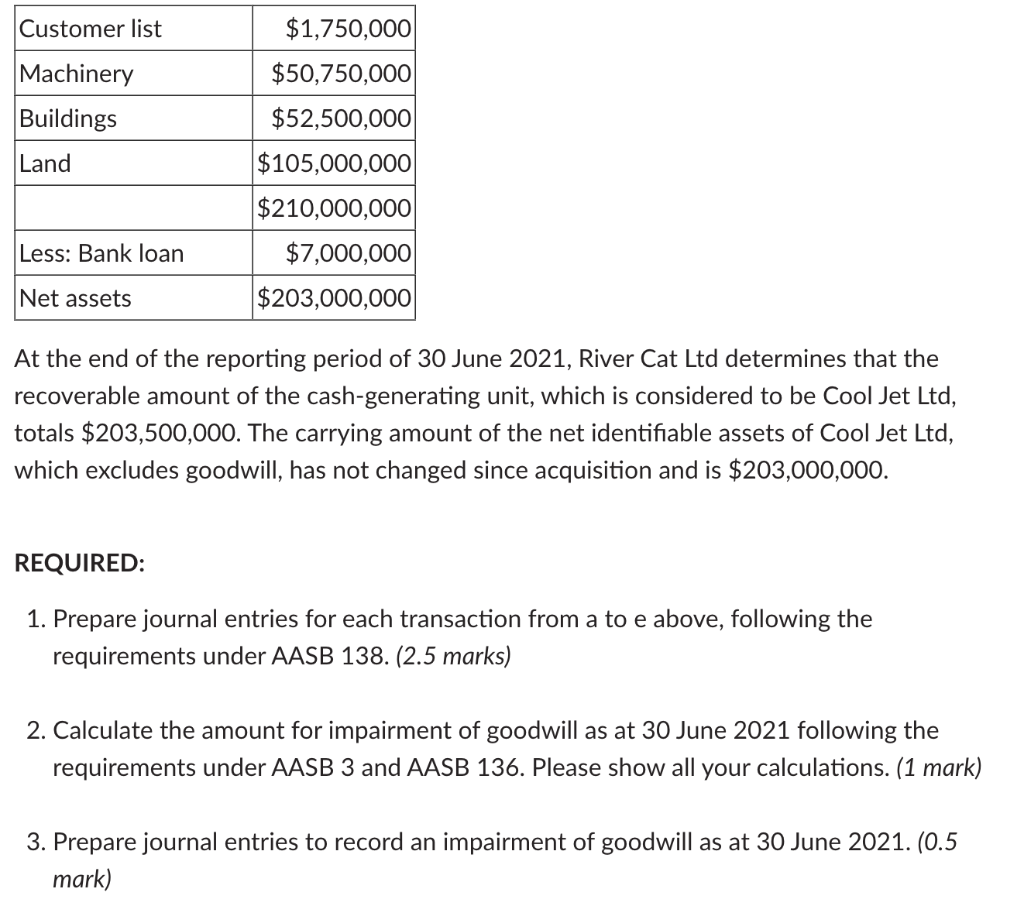

River Cat Ltd has started a company to undertake research and development of a new type of Eco River Jet. For this research and development (R \& D), it incurred the following expenditure in June 2020: It is expected that there is a large market for the Eco River Jet, which will generate millions of dollars in revenue. On 1 July 2020, River Cat Ltd acquired Cool Jet Ltd for cash of $204,500,000. At that date, Cool Jet's net identifiable assets had a fair value of $203,000,000. The fair value of the net identifiable assets of Cool Jet Ltd is determined as follows: At the end of the reporting period of 30 June 2021 , River Cat Ltd determines that the recoverable amount of the cash-generating unit, which is considered to be Cool Jet Ltd, totals $203,500,000. The carrying amount of the net identifiable assets of Cool Jet Ltd, which excludes goodwill, has not changed since acquisition and is $203,000,000. REQUIRED: 1. Prepare journal entries for each transaction from a to e above, following the requirements under AASB 138. (2.5 marks) 2. Calculate the amount for impairment of goodwill as at 30 June 2021 following the requirements under AASB 3 and AASB 136. Please show all your calculations. (1 mark) 3. Prepare journal entries to record an impairment of goodwill as at 30 June 2021. 0.5 mark) River Cat Ltd has started a company to undertake research and development of a new type of Eco River Jet. For this research and development (R \& D), it incurred the following expenditure in June 2020: It is expected that there is a large market for the Eco River Jet, which will generate millions of dollars in revenue. On 1 July 2020, River Cat Ltd acquired Cool Jet Ltd for cash of $204,500,000. At that date, Cool Jet's net identifiable assets had a fair value of $203,000,000. The fair value of the net identifiable assets of Cool Jet Ltd is determined as follows: At the end of the reporting period of 30 June 2021 , River Cat Ltd determines that the recoverable amount of the cash-generating unit, which is considered to be Cool Jet Ltd, totals $203,500,000. The carrying amount of the net identifiable assets of Cool Jet Ltd, which excludes goodwill, has not changed since acquisition and is $203,000,000. REQUIRED: 1. Prepare journal entries for each transaction from a to e above, following the requirements under AASB 138. (2.5 marks) 2. Calculate the amount for impairment of goodwill as at 30 June 2021 following the requirements under AASB 3 and AASB 136. Please show all your calculations. (1 mark) 3. Prepare journal entries to record an impairment of goodwill as at 30 June 2021. 0.5 mark)