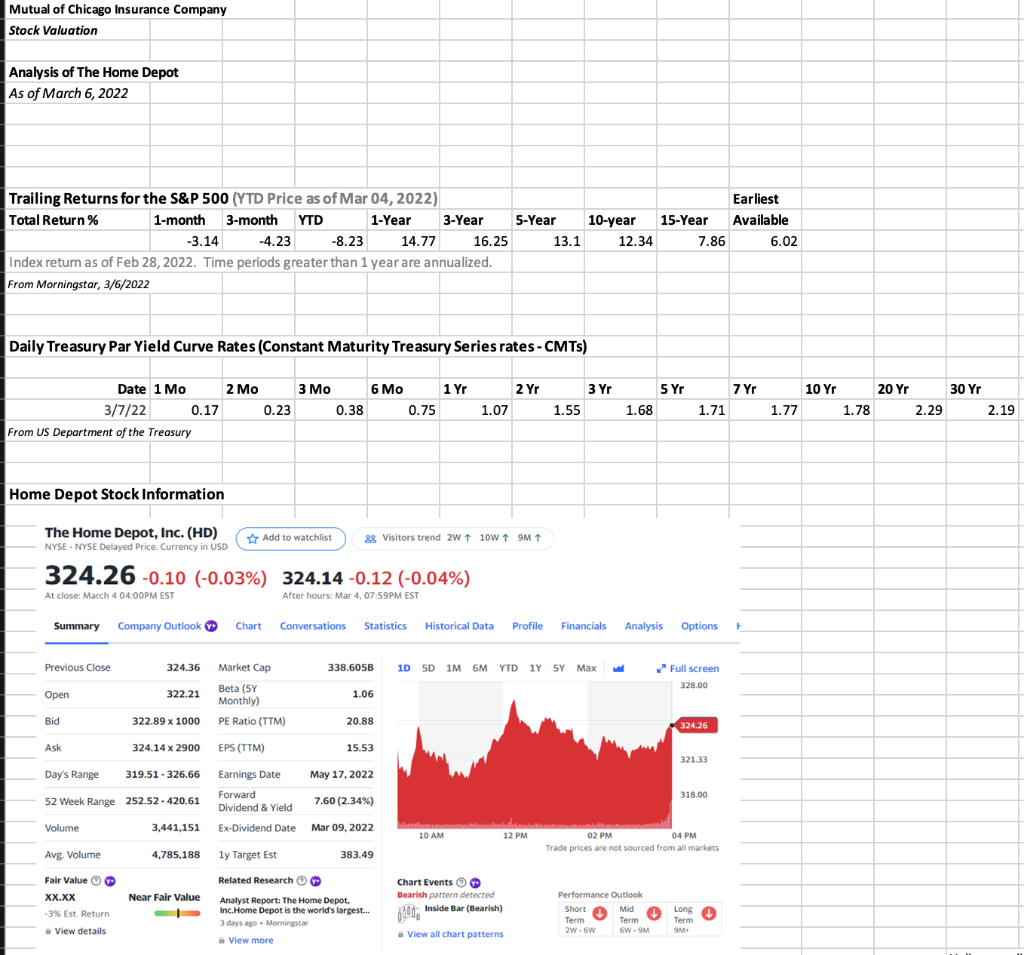

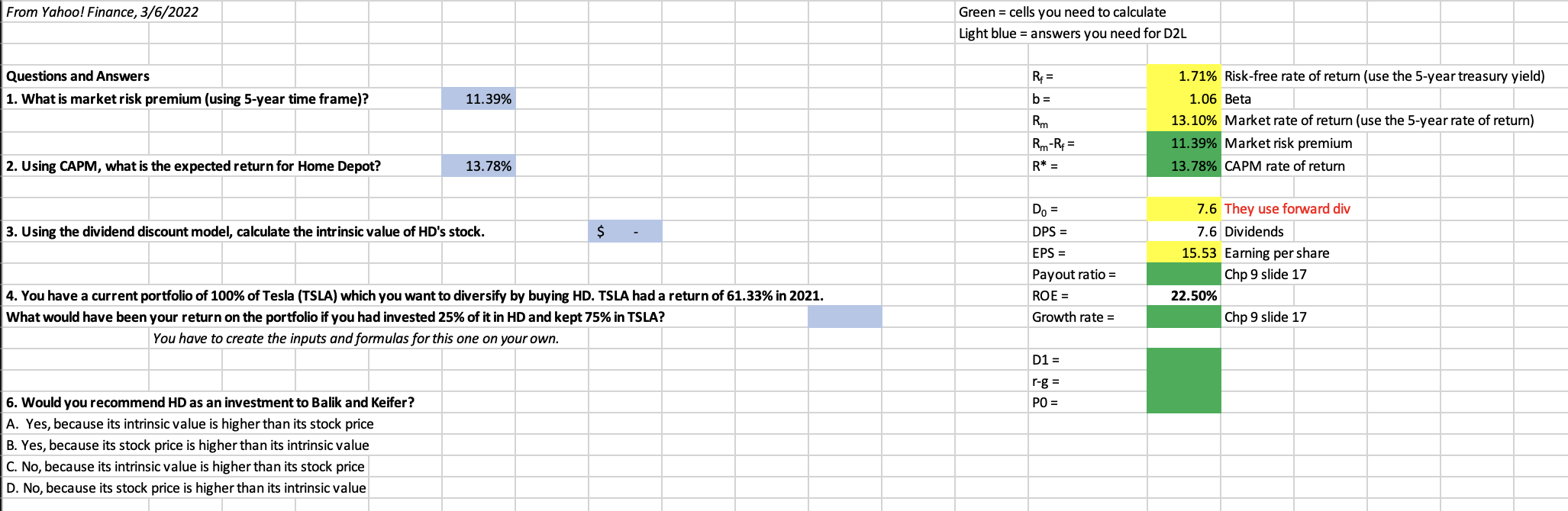

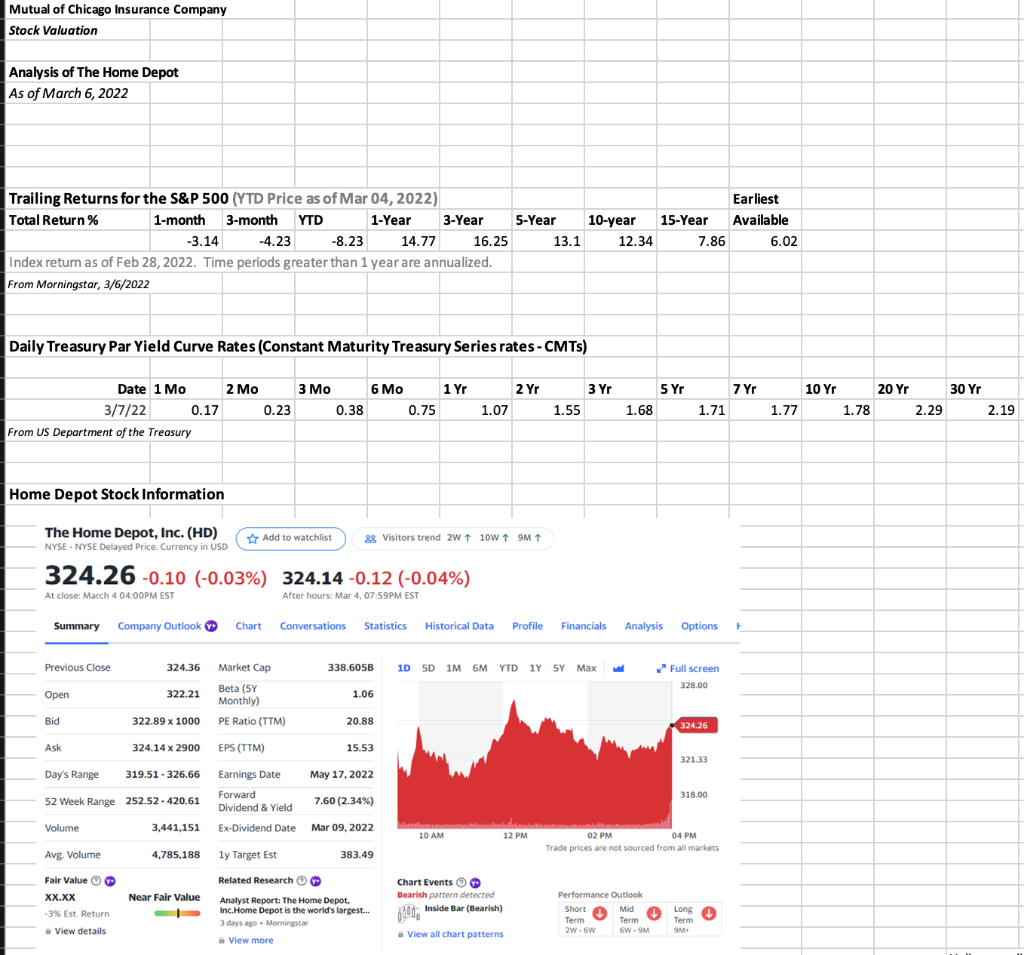

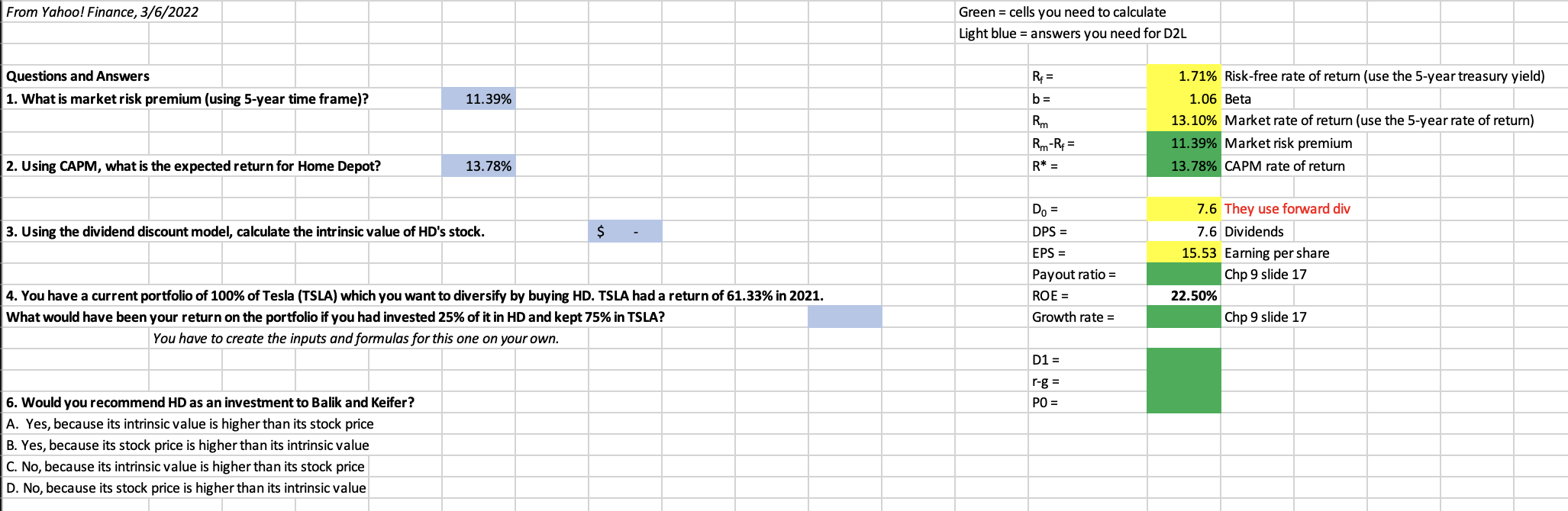

Robert Balik and Carol Kiefer are senior vice presidents of the Mutual of Chicago Insurance Company. They are codirectors of the company's pension fund management division, with Balik having responsibility for fixed-income securities (primarily bonds) and Kiefer being responsible for equity investments. A major new client, the California League of Cities, has requested that Mutual of Chicago present an investment seminar to the mayors of the represented cities; Balik and Kiefer, who will make the actual presentation, have asked vou to help them. To illustrate the common stock valuation process, Balik and Kiefer have asked you to analyze the Home Depot Company (HD). They picked this company because it is an established, mature company that the audience knows. You recently joined the firm as an equity analyst. Your job is to help Balik and Kiefer evaluate investment opportunities. Mutual of Chicago Insurance Company Stock Valuation Analysis of The Home Depot As of March 6, 2022 Trailing Returns for the S&P 500 (YTD Price as of Mar 04, 2022) Total Return% 1-month 3-month YTD 1-Year 3-Year 5-Year -3.14 -4.23 -8.23 14.77 16.25 13.1 Index return as of Feb 28, 2022. Time periods greater than 1 year are annualized. From Morningstar, 3/6/2022 10-year 12.34 15-Year 7.86 Earliest Available 6.02 Daily Treasury Par Yield Curve Rates (Constant Maturity Treasury Series rates - CMTs) 1 Yr 3 Yr 5 Yr 7 Yr 10 Yr Date 1 Mo 3/7/22 0.17 From US Department of the Treasury 2 Mo 3 Mo 6 Mo 0.23 0.38 0.75 2 Yr 1.07 20 Yr 2.29 30 Yr 2.19 1.55 1.68 1.71 1.77 1.78 Home Depot Stock Information The Home Depot, Inc. (HD) Add to watchlist 89 Visitors trend 2W + 10W + 9M 2w NYSE - NYSE Delayed Price. Currency in USD 324.26 -0.10 (-0.03%) 324.14 -0.12 (-0.04%) At close: March 4 04:00PM EST After hours: Mar 4, 07:59PM EST , Summary Company Outlook Chart Conversations Statistics Historical Data Profile Financials Analysis Options Previous Close 338.605B 1D 5D 1M 6M YTD 1Y5Y Max Full screen 328.00 Open 1.06 324.36 Market Cap 322.21 Beta (5Y Monthly) 322.89 x 1000 x PE Ratio (TTM) ( 324.14 x 2900 EPS (TTM) Bid 20.88 324.26 Ask 15.53 321.33 Day's Range 319.51 - 326.66 Earnings Date May 17, 2022 318.00 52 Week Range 252.52-420.61 Forward Dividend & Yield 7.60 (2.34%) Volume 3,441,151 Ex-Dividend Date Mar 09,2022 10 AM 12 PM 02 PM 04 PM Trade prices are not sourced from all markets Avg Volume 4,785,188 1y Target Est 383.49 Related Research Fair Value XX.XX -3% Est. Return Near Fair Value Chart Events Bearish pattern detected Inside Bar (Bearish) Analyst Report: The Home Depot, Inc.Home Depot is the world's largest... 3 days ago. Morningstar View more Performance Outlook Short Mid Term Term 2W-6W 6W-9M Long Term 9M View details View all chart patterns From Yahoo! Finance, 3/6/2022 Green = cells you need to calculate Light blue = answers you need for D2L Rp = Questions and Answers 1. What is market risk premium (using 5-year time frame)? 11.39% b= Rm Rm-Rp = R* = 1.71% Risk-free rate of return (use the 5-year treasury yield) 1.06 Beta 13.10% Market rate of return (use the 5-year rate of return) 11.39% Market risk premium 13.78% CAPM rate of return 2. Using CAPM, what is the expected return for Home Depot? 13.78% = 3. Using the dividend discount model, calculate the intrinsic value of HD's stock. $ Do = DPS = EPS = Payout ratio = ROE = Growth rate = 7.6 They use forward div 7.6 Dividends 15.53 Earning per share Chp 9 slide 17 22.50% Chp 9 slide 17 4. You have a current portfolio of 100% of Tesla (TSLA) which you want to diversify by buying HD. TSLA had a return of 61.33% in 2021. What would have been your return on the portfolio if you had invested 25% of it in HD and kept 75% in TSLA? You have to create the inputs and formulas for this one on your own. D1 = r-g = PO = 6. Would you recommend HD as an investment to Balik and Keifer? A. Yes, because its intrinsic value is higher than its stock price B. Yes, because its stock price is higher than its intrinsic value C. No, because its intrinsic value is higher than its stock price D. No, because its stock price is higher than its intrinsic value Robert Balik and Carol Kiefer are senior vice presidents of the Mutual of Chicago Insurance Company. They are codirectors of the company's pension fund management division, with Balik having responsibility for fixed-income securities (primarily bonds) and Kiefer being responsible for equity investments. A major new client, the California League of Cities, has requested that Mutual of Chicago present an investment seminar to the mayors of the represented cities; Balik and Kiefer, who will make the actual presentation, have asked vou to help them. To illustrate the common stock valuation process, Balik and Kiefer have asked you to analyze the Home Depot Company (HD). They picked this company because it is an established, mature company that the audience knows. You recently joined the firm as an equity analyst. Your job is to help Balik and Kiefer evaluate investment opportunities. Mutual of Chicago Insurance Company Stock Valuation Analysis of The Home Depot As of March 6, 2022 Trailing Returns for the S&P 500 (YTD Price as of Mar 04, 2022) Total Return% 1-month 3-month YTD 1-Year 3-Year 5-Year -3.14 -4.23 -8.23 14.77 16.25 13.1 Index return as of Feb 28, 2022. Time periods greater than 1 year are annualized. From Morningstar, 3/6/2022 10-year 12.34 15-Year 7.86 Earliest Available 6.02 Daily Treasury Par Yield Curve Rates (Constant Maturity Treasury Series rates - CMTs) 1 Yr 3 Yr 5 Yr 7 Yr 10 Yr Date 1 Mo 3/7/22 0.17 From US Department of the Treasury 2 Mo 3 Mo 6 Mo 0.23 0.38 0.75 2 Yr 1.07 20 Yr 2.29 30 Yr 2.19 1.55 1.68 1.71 1.77 1.78 Home Depot Stock Information The Home Depot, Inc. (HD) Add to watchlist 89 Visitors trend 2W + 10W + 9M 2w NYSE - NYSE Delayed Price. Currency in USD 324.26 -0.10 (-0.03%) 324.14 -0.12 (-0.04%) At close: March 4 04:00PM EST After hours: Mar 4, 07:59PM EST , Summary Company Outlook Chart Conversations Statistics Historical Data Profile Financials Analysis Options Previous Close 338.605B 1D 5D 1M 6M YTD 1Y5Y Max Full screen 328.00 Open 1.06 324.36 Market Cap 322.21 Beta (5Y Monthly) 322.89 x 1000 x PE Ratio (TTM) ( 324.14 x 2900 EPS (TTM) Bid 20.88 324.26 Ask 15.53 321.33 Day's Range 319.51 - 326.66 Earnings Date May 17, 2022 318.00 52 Week Range 252.52-420.61 Forward Dividend & Yield 7.60 (2.34%) Volume 3,441,151 Ex-Dividend Date Mar 09,2022 10 AM 12 PM 02 PM 04 PM Trade prices are not sourced from all markets Avg Volume 4,785,188 1y Target Est 383.49 Related Research Fair Value XX.XX -3% Est. Return Near Fair Value Chart Events Bearish pattern detected Inside Bar (Bearish) Analyst Report: The Home Depot, Inc.Home Depot is the world's largest... 3 days ago. Morningstar View more Performance Outlook Short Mid Term Term 2W-6W 6W-9M Long Term 9M View details View all chart patterns From Yahoo! Finance, 3/6/2022 Green = cells you need to calculate Light blue = answers you need for D2L Rp = Questions and Answers 1. What is market risk premium (using 5-year time frame)? 11.39% b= Rm Rm-Rp = R* = 1.71% Risk-free rate of return (use the 5-year treasury yield) 1.06 Beta 13.10% Market rate of return (use the 5-year rate of return) 11.39% Market risk premium 13.78% CAPM rate of return 2. Using CAPM, what is the expected return for Home Depot? 13.78% = 3. Using the dividend discount model, calculate the intrinsic value of HD's stock. $ Do = DPS = EPS = Payout ratio = ROE = Growth rate = 7.6 They use forward div 7.6 Dividends 15.53 Earning per share Chp 9 slide 17 22.50% Chp 9 slide 17 4. You have a current portfolio of 100% of Tesla (TSLA) which you want to diversify by buying HD. TSLA had a return of 61.33% in 2021. What would have been your return on the portfolio if you had invested 25% of it in HD and kept 75% in TSLA? You have to create the inputs and formulas for this one on your own. D1 = r-g = PO = 6. Would you recommend HD as an investment to Balik and Keifer? A. Yes, because its intrinsic value is higher than its stock price B. Yes, because its stock price is higher than its intrinsic value C. No, because its intrinsic value is higher than its stock price D. No, because its stock price is higher than its intrinsic value