Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rose Corporation began operations on January 2, 2022. During 2022, Rose made cash and credit sales totaling $500,000 and collected $420,000 in cash from

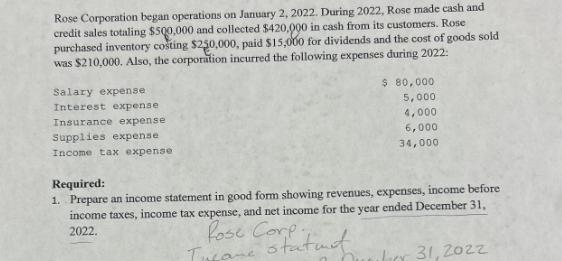

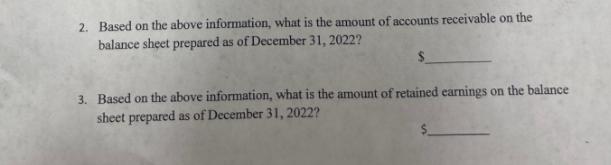

Rose Corporation began operations on January 2, 2022. During 2022, Rose made cash and credit sales totaling $500,000 and collected $420,000 in cash from its customers. Rose purchased inventory costing $250,000, paid $15,000 for dividends and the cost of goods sold was $210,000. Also, the corporation incurred the following expenses during 2022: Salary expense. Interest expense Insurance expense Supplies expense. $ 80,000 5,000 4,000 6,000 34,000 Income tax expense Required: 1. Prepare an income statement in good form showing revenues, expenses, income before income taxes, income tax expense, and net income for the year ended December 31, 2022. Rose Corfitant Tucane lor 31, 2022 2. Based on the above information, what is the amount of accounts receivable on the balance sheet prepared as of December 31, 2022? 3. Based on the above information, what is the amount of retained earnings on the balance sheet prepared as of December 31, 2022?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started