Question

RPORATE TAXES FINAL EXERCISE Calculate the Net Income, Annual Corportate Taxes and VAT (fiscal year 2018) of a Company located in Barcelona, Spain based on

RPORATE TAXES FINAL EXERCISE

Calculate the Net Income, Annual Corportate Taxes and VAT (fiscal year 2018) of a Company located in Barcelona, Spain based on the following information:

The Company has an Tax ID as an Intracommunity Operator.

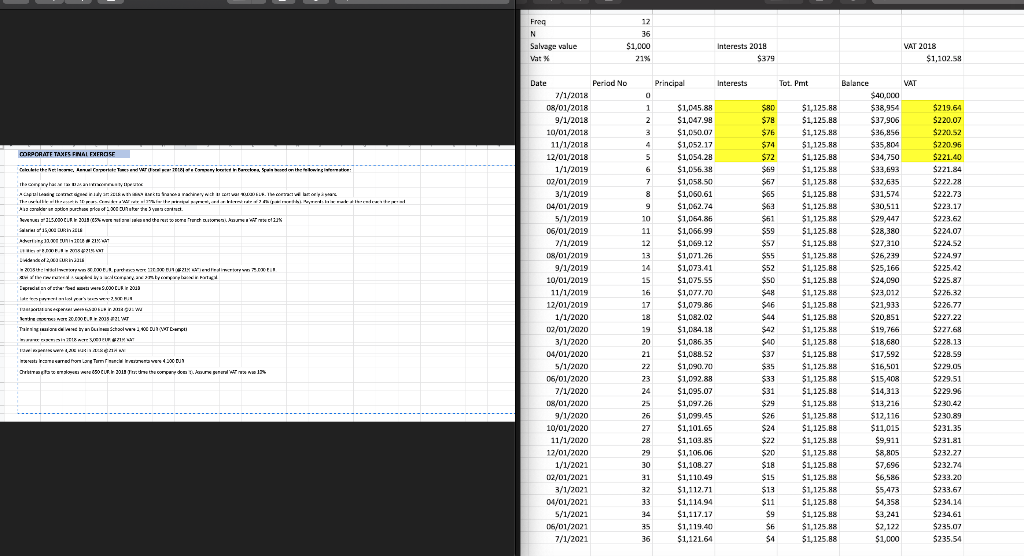

A Capital Leasing contract signed in July 1st 2018 with BBVA Bank to finance a machinery wich its cost was 40,000 EUR. The contract will last only 3 years.

The useful life of the asset is 10 years. Consider a VAT rate of 21% for the principal payment, and an Interest rate of 2.4% (paid monthly). Payments to be made at the end each the period

Also consider an option purchase price of 1,000 EUR after the 3 years contract.

Revenues of 215,000 EUR in 2018 (65% were national sales and the rest to some French customers). Assume a VAT rate of 21%

Salaries of 15,000 EUR in 2018

Advertising 10,000 EUR in 2018 @ 21% VAT

Utilities of 8,000 EUR in 2018 @21% VAT

Dividends of 2,000 EUR in 2018

In 2018 the Initial Inventory was 80,000 EUR, purchases were 120,000 EUR (@21% VAT) and final inventory was 75,000 EUR.

80% of the raw material is supplied by a local Company, and 20% by company based in Portugal.

Depreciation of other fixed assets were 9,000 EUR in 2018

Late fees payment on last years taxes were 2,500 EUR

Transportations expenses were 6,500 EUR in 2018 @21 VAT

Renting expenses were 20,000 EUR in 2018 @21 VAT

Trainning sessions delivered by an Business School were 1,400 EUR (VAT Exempt)

Insurance expenses in 2018 were 3,000 EUR @21% VAT

Travel expenses were 3,200 EUR in 2018 @21% VAT

Interests income earned from Long Term Financial Investments were 4,100 EUR

Christmas gifts to employees were 850 EUR in 2018 (first time the company does it). Assume general VAT rate was 10%

Price$40,000

AnnualNIR % 2.40% $1,125.88

Depreciation exp $13,000

Years 3

Freq 12N36

Salvage value $1,000

Interests 2018 $379

VAT 2018 Vat %21= $1,102.58

Fren Salvage value Vat 36 $1,000 21% Interests 2018 $379 VAI 2013 $1,102.58 Principal Interests Tot. Pmt B VAT $80 $78 $74 CORPORATE TAXES FINAL EXEROSE $72 $69 $67 $65 M ini Carrier In $63 arkiert rosaled. Xtra vasca k315. AN T IS $59 1 01 2170 FESTANT $52 $55 $52 $50 $48 Date Period No 7/1/2018 08/01/2018 9/1/2018 10/01/2018 11/1/2018 12/01/2018 1/1/2019 02/01/2019 3/1/2019 04/01/2019 5/1/2019 06/01/2019 7/1/2019 08/01/2019 9/1/2019 10/01/2019 11/1/2019 12/01/2019 1/1/2020 02/01/2020 3/1/2020 04/01/2020 5/1/2020 06/01/2020 7/1/2020 08/01/2020 9/1/2020 10/01/2020 11/1/2020 12/01/2020 1/1/2021 02/01/2021 3/1/2021 01/01/2021 5/1/2021 06/01/2021 7/1/2021 $1,045.88 $1,047.98 $1,050.07 $1,052.17 $1,054.28 $1,056.38 $1,058.50 $1,050.61 $1,062.74 $1,054.86 $1.056.99 $1,069.12 $1,071.26 $1,073.41 $1,075.55 $1,077.70 $1,079.86 $1,082.02 $1,084.18 $1,086.35 $1,088.52 $1,090.70 $1,092.88 $1,095,07 $1,0997.26 $1,099.45 $1,101.65 $1,103.85 $1,105.06 $1.108.27 $1,110.49 $1,112.71 $1,114.94 $1,117.17 $1,119.40 $1,121.64 $46 $44 $42 $1,125.88 $1,125.88 $1,125.98 $1,125.88 $1.125.88 $1,125.98 $1,125.88 $1,125.88 $1125.88 $1,125.88 $1,125.88 $1,125.88 $1,125.88 $1,125.88 $1,125.88 $1.125.88 $1.125.88 $1,125.88 $1,125.98 $1.125.88 $1,125.88 $1,125.98 $1,125 88 $1,125.88 $1,125.88 $1,125.88 $1,125.88 $1,125.98 $1,125.88 $1.125.88 $1,125.88 $1,125.98 $1,125.88 $1,125.98 $1,125.88 $1,125.88 alance $40,000 $38,954 $37,905 $36,856 $35,804 $34,750 $33,693 $32,635 $31.574 $30.511 $29,447 $28.380 $27.310 $26,239 $25,166 $24,090 $23,012 $21.933 $20.851 $19,766 $18,680 $17.592 $16.501 $15 408 $14,313 $13,216 $12,116 $11,015 $9.911 $8,805 $7,696 $6,586 $5,473 $4,358 $3,241 $2,122 $1,000 $219.64 $220.07 $220.52 $220.95 $221.40 $221.84 $222.28 $222.73 $223.17 $223.62 $22407 $224.52 $224.97 $225.42 $225.87 $225.32 $226.77 $227.22 $227.68 $228.13 $228.59 $229.05 $229.51 $229.96 $230.42 $230.89 $231.35 $231.81 $232.27 $232.74 $233,20 $233.67 $234.14 $234.61 $235.07 $235.54 FYRST VETPLF #21 $40 at Tasardong Turnul 4200 US $37 $35 $33 $31 $26 $22 $20 $18 $15 $13 $11 $9 $6 Fren Salvage value Vat 36 $1,000 21% Interests 2018 $379 VAI 2013 $1,102.58 Principal Interests Tot. Pmt B VAT $80 $78 $74 CORPORATE TAXES FINAL EXEROSE $72 $69 $67 $65 M ini Carrier In $63 arkiert rosaled. Xtra vasca k315. AN T IS $59 1 01 2170 FESTANT $52 $55 $52 $50 $48 Date Period No 7/1/2018 08/01/2018 9/1/2018 10/01/2018 11/1/2018 12/01/2018 1/1/2019 02/01/2019 3/1/2019 04/01/2019 5/1/2019 06/01/2019 7/1/2019 08/01/2019 9/1/2019 10/01/2019 11/1/2019 12/01/2019 1/1/2020 02/01/2020 3/1/2020 04/01/2020 5/1/2020 06/01/2020 7/1/2020 08/01/2020 9/1/2020 10/01/2020 11/1/2020 12/01/2020 1/1/2021 02/01/2021 3/1/2021 01/01/2021 5/1/2021 06/01/2021 7/1/2021 $1,045.88 $1,047.98 $1,050.07 $1,052.17 $1,054.28 $1,056.38 $1,058.50 $1,050.61 $1,062.74 $1,054.86 $1.056.99 $1,069.12 $1,071.26 $1,073.41 $1,075.55 $1,077.70 $1,079.86 $1,082.02 $1,084.18 $1,086.35 $1,088.52 $1,090.70 $1,092.88 $1,095,07 $1,0997.26 $1,099.45 $1,101.65 $1,103.85 $1,105.06 $1.108.27 $1,110.49 $1,112.71 $1,114.94 $1,117.17 $1,119.40 $1,121.64 $46 $44 $42 $1,125.88 $1,125.88 $1,125.98 $1,125.88 $1.125.88 $1,125.98 $1,125.88 $1,125.88 $1125.88 $1,125.88 $1,125.88 $1,125.88 $1,125.88 $1,125.88 $1,125.88 $1.125.88 $1.125.88 $1,125.88 $1,125.98 $1.125.88 $1,125.88 $1,125.98 $1,125 88 $1,125.88 $1,125.88 $1,125.88 $1,125.88 $1,125.98 $1,125.88 $1.125.88 $1,125.88 $1,125.98 $1,125.88 $1,125.98 $1,125.88 $1,125.88 alance $40,000 $38,954 $37,905 $36,856 $35,804 $34,750 $33,693 $32,635 $31.574 $30.511 $29,447 $28.380 $27.310 $26,239 $25,166 $24,090 $23,012 $21.933 $20.851 $19,766 $18,680 $17.592 $16.501 $15 408 $14,313 $13,216 $12,116 $11,015 $9.911 $8,805 $7,696 $6,586 $5,473 $4,358 $3,241 $2,122 $1,000 $219.64 $220.07 $220.52 $220.95 $221.40 $221.84 $222.28 $222.73 $223.17 $223.62 $22407 $224.52 $224.97 $225.42 $225.87 $225.32 $226.77 $227.22 $227.68 $228.13 $228.59 $229.05 $229.51 $229.96 $230.42 $230.89 $231.35 $231.81 $232.27 $232.74 $233,20 $233.67 $234.14 $234.61 $235.07 $235.54 FYRST VETPLF #21 $40 at Tasardong Turnul 4200 US $37 $35 $33 $31 $26 $22 $20 $18 $15 $13 $11 $9 $6Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started