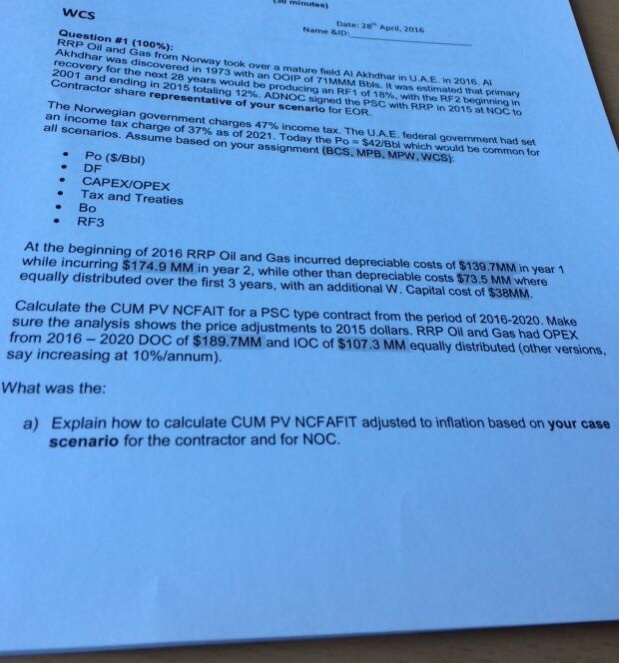

RRP oil and Gas from Norway took over a mature field A1 Akhdhar in U.A.E, in 2016, A1 Akhdhar was discovered in 1973 with OOIP of 71MMM Bbis. It was estimated that primary recovery for the next 28 years would be producing an RF1 of 18%, with the RF2 beginning in 2001 and ending in 2015 totaling 12%. ADNOC signed the PSC with RRP in 2015 at NOC to Contractor share representative of your scenario for EOR. The Norweglan government charges 47% income tax. The U.A.E, federal government had set an income tax charge of 37% as of 2021. Today the Po = $42/Bbl which would be common for all scenarios. Assume based on your assignment (BCS, MPB, MPW, WCS): Po($/Bbl) DF CAPEX/OPEX Tax and Treaties Bo RF3 At the beginning of 2016 RRP Oil and Gas incurred depreciable costs of $139.7MM m in year 1 while incurring $174.9 MM in year 2, while other than depreciable costs $73.5 MM where equally distributed over the first 3 years, with an additional W. Capital cost of $38MM. Calculate the CUM PV NCFAIT for a PSC type contract from the period ot 2016-2020. Make sure the analysis shows the price adjustments to 2015 dollars. RRP Oil and Gas had OPEX from 2016 - 2020 DOC of $189.7MM and IOC of $107.3 MM equally distributed (other versions, say increasing at 10%/annum). What was the: Explain how to calculate CUM PV NCFAFIT adjusted to inflation based on your case scenario for the contractor and for NOC. RRP oil and Gas from Norway took over a mature field A1 Akhdhar in U.A.E, in 2016, A1 Akhdhar was discovered in 1973 with OOIP of 71MMM Bbis. It was estimated that primary recovery for the next 28 years would be producing an RF1 of 18%, with the RF2 beginning in 2001 and ending in 2015 totaling 12%. ADNOC signed the PSC with RRP in 2015 at NOC to Contractor share representative of your scenario for EOR. The Norweglan government charges 47% income tax. The U.A.E, federal government had set an income tax charge of 37% as of 2021. Today the Po = $42/Bbl which would be common for all scenarios. Assume based on your assignment (BCS, MPB, MPW, WCS): Po($/Bbl) DF CAPEX/OPEX Tax and Treaties Bo RF3 At the beginning of 2016 RRP Oil and Gas incurred depreciable costs of $139.7MM m in year 1 while incurring $174.9 MM in year 2, while other than depreciable costs $73.5 MM where equally distributed over the first 3 years, with an additional W. Capital cost of $38MM. Calculate the CUM PV NCFAIT for a PSC type contract from the period ot 2016-2020. Make sure the analysis shows the price adjustments to 2015 dollars. RRP Oil and Gas had OPEX from 2016 - 2020 DOC of $189.7MM and IOC of $107.3 MM equally distributed (other versions, say increasing at 10%/annum). What was the: Explain how to calculate CUM PV NCFAFIT adjusted to inflation based on your case scenario for the contractor and for NOC