Answered step by step

Verified Expert Solution

Question

1 Approved Answer

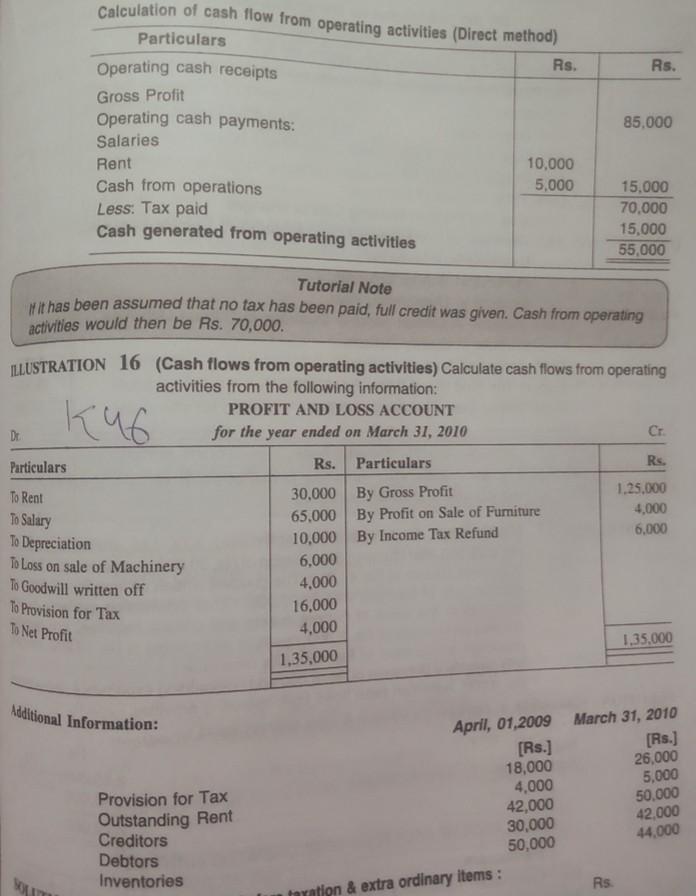

Rs. Rs. Calculation of cash flow from operating activities (Direct method) Particulars Operating cash receipts Gross Profit Operating cash payments: Salaries Rent 10,000 Cash from

Rs. Rs. Calculation of cash flow from operating activities (Direct method) Particulars Operating cash receipts Gross Profit Operating cash payments: Salaries Rent 10,000 Cash from operations 5,000 Less: Tax paid Cash generated from operating activities 85.000 15.000 70,000 15,000 55,000 Tutorial Note w it has been assumed that no tax has been paid, full credit was given. Cash from operating activities would then be Rs. 70,000. ILLUSTRATION 16 (Cash flows from operating activities) Calculate cash flows from operating activities from the following information: PROFIT AND LOSS ACCOUNT De for the year ended on March 31, 2010 Cr. Particulars Rs. Particulars Rs. To Rent 30,000 By Gross Profit 1.25.000 4,000 To Salary 65.000 By Profit on Sale of Furniture 6.000 Te Depreciation 10,000 By Income Tax Refund To Loss on sale of Machinery 6,000 To Goodwill written off 4,000 Kub To Provision for Tax To Net Profit 16,000 4,000 1,35,000 1,35.000 Additional Information: March 31, 2010 [Rs.] 26,000 5,000 50.000 42,000 44,000 Provision for Tax Outstanding Rent Creditors Debtors Inventories April, 01,2009 [Rs.] 18,000 4,000 42,000 30,000 50,000 foration & extra ordinary items: Rs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started