Question

S Musik uses sales, purchases, commission, cash receipts, cash payments and a general journal along with subsidiary ledgers for accounts receivable and accounts payable. The

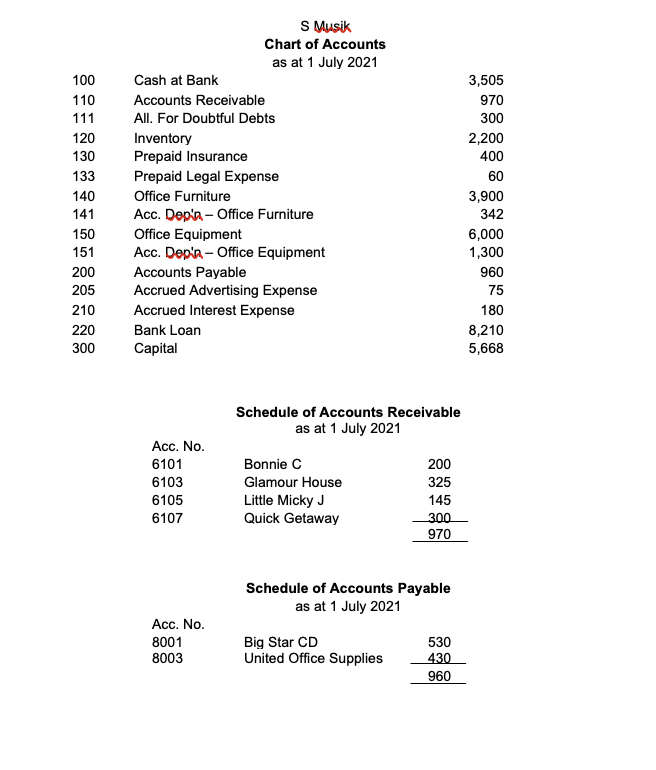

S Musik uses sales, purchases, commission, cash receipts, cash payments and a general journal along with subsidiary ledgers for accounts receivable and accounts payable. The chart of accounts and schedules of balances of the subsidiary ledgers as at 1st July 2021 are presented below:

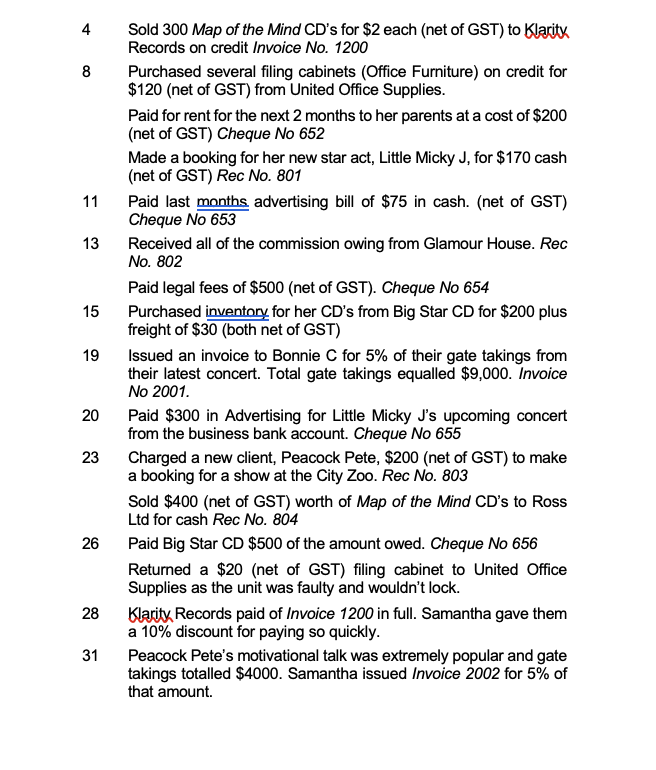

You are provided with the following transactions occurred in July 2021. Samantha, the owner, reminds you that once she has made a booking for an act she also receives a 5% cut of the gate takings. Samantha is informed of the total amount of gate takings on the day of the performance but does not receive her commission until a few weeks after the performance. Commissions are not subject to GST.

Task 1:

Using the information from the chart of accounts and schedules of accounts balances, enter the opening balances and reversing entries (where applicable) into the General Ledger Accounts provided in the excel file.

Task 2:

Prepare schedules of accounts receivable and accounts payable as at 31 July 2021 to show that their totals reconcile with the balances of the control accounts.

100 110 111 120 130 133 140 141 150 151 200 205 210 220 300 S Musik Chart of Accounts as at 1 July 2021 Cash at Bank Accounts Receivable All. For Doubtful Debts Inventory Prepaid Insurance Prepaid Legal Expense Office Furniture Acc. Depin - Office Furniture Office Equipment Acc. Depin - Office Equipment Accounts Payable Accrued Advertising Expense Accrued Interest Expense Bank Loan Capital 3,505 970 300 2,200 400 60 3,900 342 6,000 1,300 960 75 180 8,210 5,668 Schedule of Accounts Receivable as at 1 July 2021 Acc. No. 6101 6103 6105 6107 Bonnie Glamour House Little Micky J Quick Getaway 200 325 145 300 970 Schedule of Accounts Payable as at 1 July 2021 Acc. No. 8001 8003 Big Star CD United Office Supplies 530 430 960 4 8 11 13 15 19 Sold 300 Map of the Mind CD's for $2 each (net of GST) to Klarity Records on credit Invoice No. 1200 Purchased several filing cabinets (Office Furniture) on credit for $120 (net of GST) from United Office Supplies. Paid for rent for the next 2 months to her parents at a cost of $200 (net of GST) Cheque No 652 Made a booking for her new star act, Little Micky J, for $170 cash (net of GST) Rec No. 801 Paid last months advertising bill of $75 in cash. (net of GST) Cheque No 653 Received all of the commission owing from Glamour House. Rec No. 802 Paid legal fees of $500 (net of GST). Cheque No 654 Purchased inventory for her CD's from Big Star CD for $200 plus freight of $30 (both net of GST) Issued an invoice to Bonnie C for 5% of their gate takings from their latest concert. Total gate takings equalled $9,000. Invoice No 2001. Paid $300 in Advertising for Little Micky J's upcoming concert from the business bank account. Cheque No 655 Charged a new client, Peacock Pete, $200 (net of GST) to make a booking for a show at the City Zoo. Rec No. 803 Sold $400 (net of GST) worth of Map of the Mind CD's to Ross Ltd for cash Rec No. 804 Paid Big Star CD $500 of the amount owed. Cheque No 656 Returned a $20 (net of GST) filing cabinet to United Office Supplies as the unit was faulty and wouldn't lock. Klarity Records paid of Invoice 1200 in full. Samantha gave them a 10% discount for paying so quickly. Peacock Pete's motivational talk was extremely popular and gate takings totalled $4000. Samantha issued Invoice 2002 for 5% of that amount 20 23 26 28 31Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started