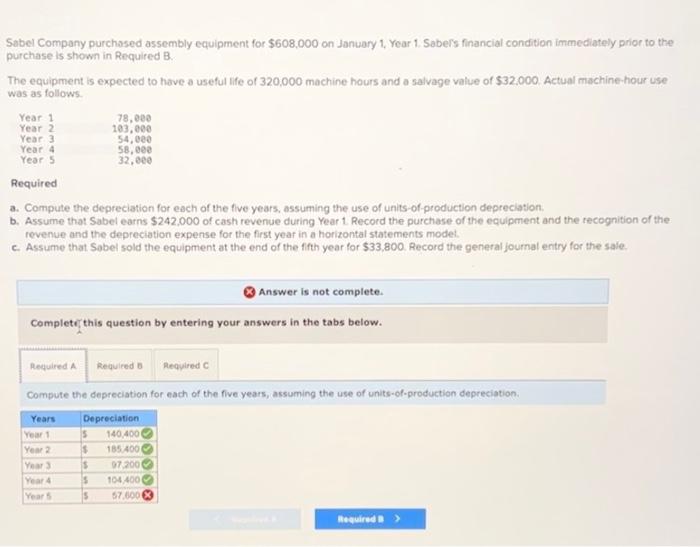

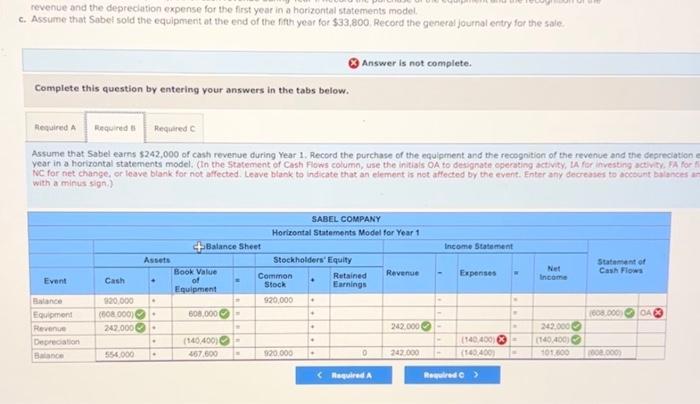

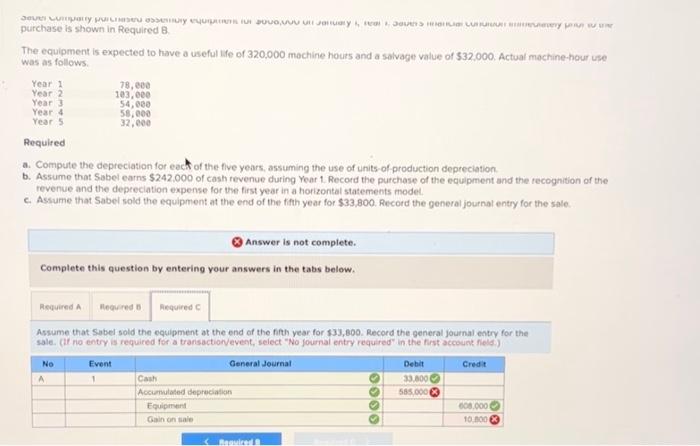

Sabel Company purchased assembly equipment for $608,000 on January 1, Year 1. Sabel's financial condition immediately prior to the purchase is shown in Required B. The equipment is expected to have a useful life of 320,000 machine hours and a salvage value of $32.000. Actual machine-hour use was as follows. Required a. Compute the depreciation for eech of the five years, assuming the use of units-of-production depreciation. b. Assume that Sabel earns $242,000 of cash revenue during Year 1 Record the purchase of the equipment and the tecognition of the revenue and the depreciation expense for the first year in a horizontal statements model. c. Assume that Sabel sold the equipment at the end of the fifth year for $33,800. Record the general joumal entry for the sale. Answer is not complete. Completc this question by entering your answers in the tabs below. Compute the depreciation for each of the five years, assuming the use of units-of-production depreciation. revenue and the depreclation expense for the first year in a horizontal statements model. 3ssume that Sabet sold the equipment at the end of the fifth year for $33,800. Record the general journal entry for the sale. ) Answer is not complete. Complete this question by entering your answers in the tabs below. Assume that Sabel earns $2.42,000 of cash revenue during Year 1 . Record the purchase of the equigment and the recognition of the revenue and the cepreciation year in a horizontal statements model. (In the Statement of Cash flows column, use the initials OA to desgnate operating activity, th for itvesting act.vity. FA for NC for net change, or leave blank for not affected. Leave blank to indicate that an element is not affected by the event. Enter any decreases to acceunt balances with a minus sign.) purchase is shown in Required B. The equipment is expected to have a useful ife of 320.000 mochine hours and a salvaget value of 532.000. Actual mochine-hour use Was as follows. Requited a. Compute the depreciation for each of the five years, assuming the use of units of production depreciation. b. Assume that Sabel eatns 5242.000 of cash revenue during Year 1 . Record the purchase of the eculpment and the tecognition of the revenue and the depreciation expense for twe first year in a horizontal statements modet. c. Assume that Sabel sold the equipment at the end of the tifth year for $33,800. Record the general journal entry for the sale. Q Answer is not complete. Complete this question by entering your answers in the tabs below. Assume that Sabel sold the equipment at the end of the fith year for 133, 800. Record the general journal entry for the sale. (If rio entry is required for a trarisactionvevent, select "No fournal entry required" in the first account fiels.)