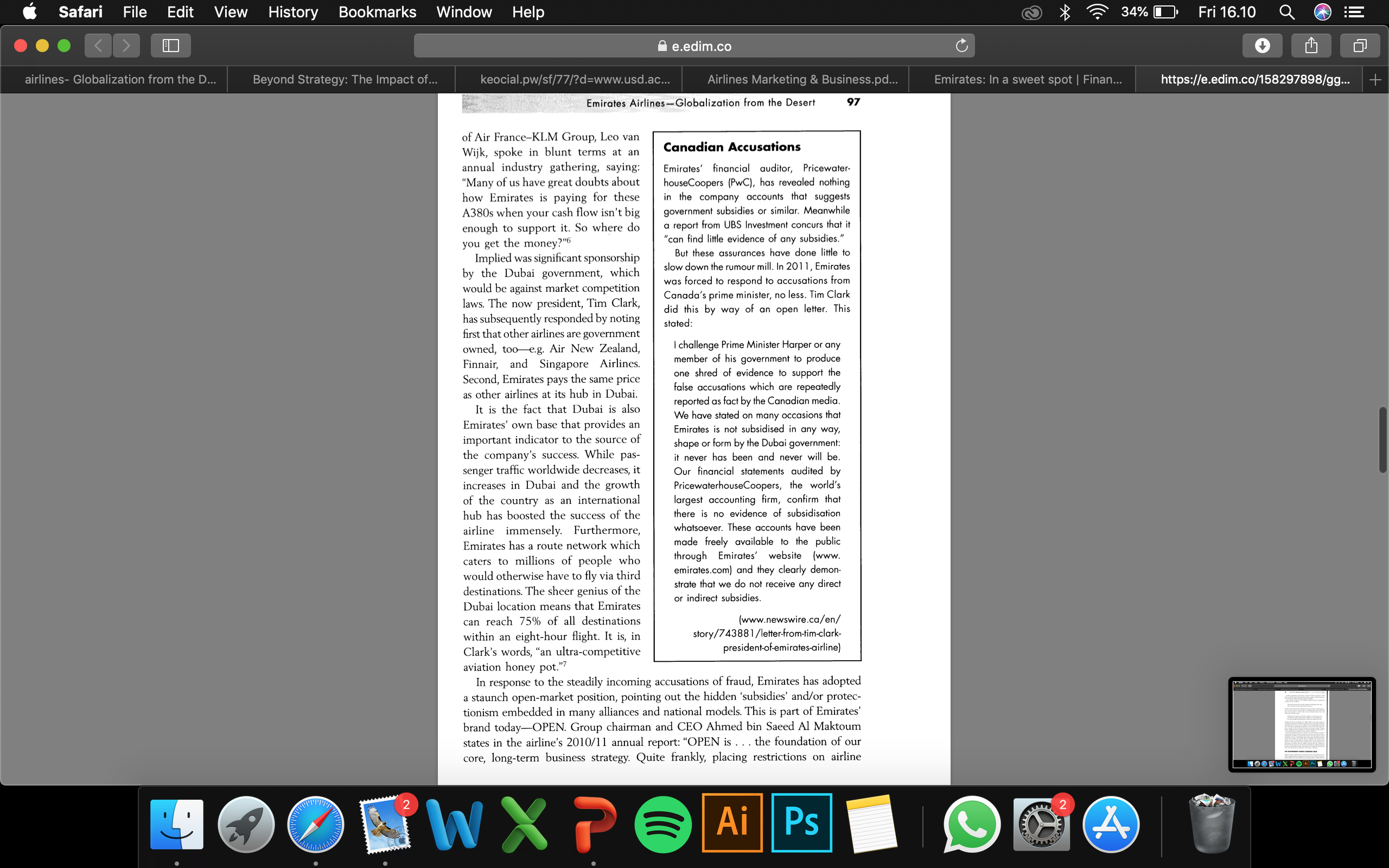

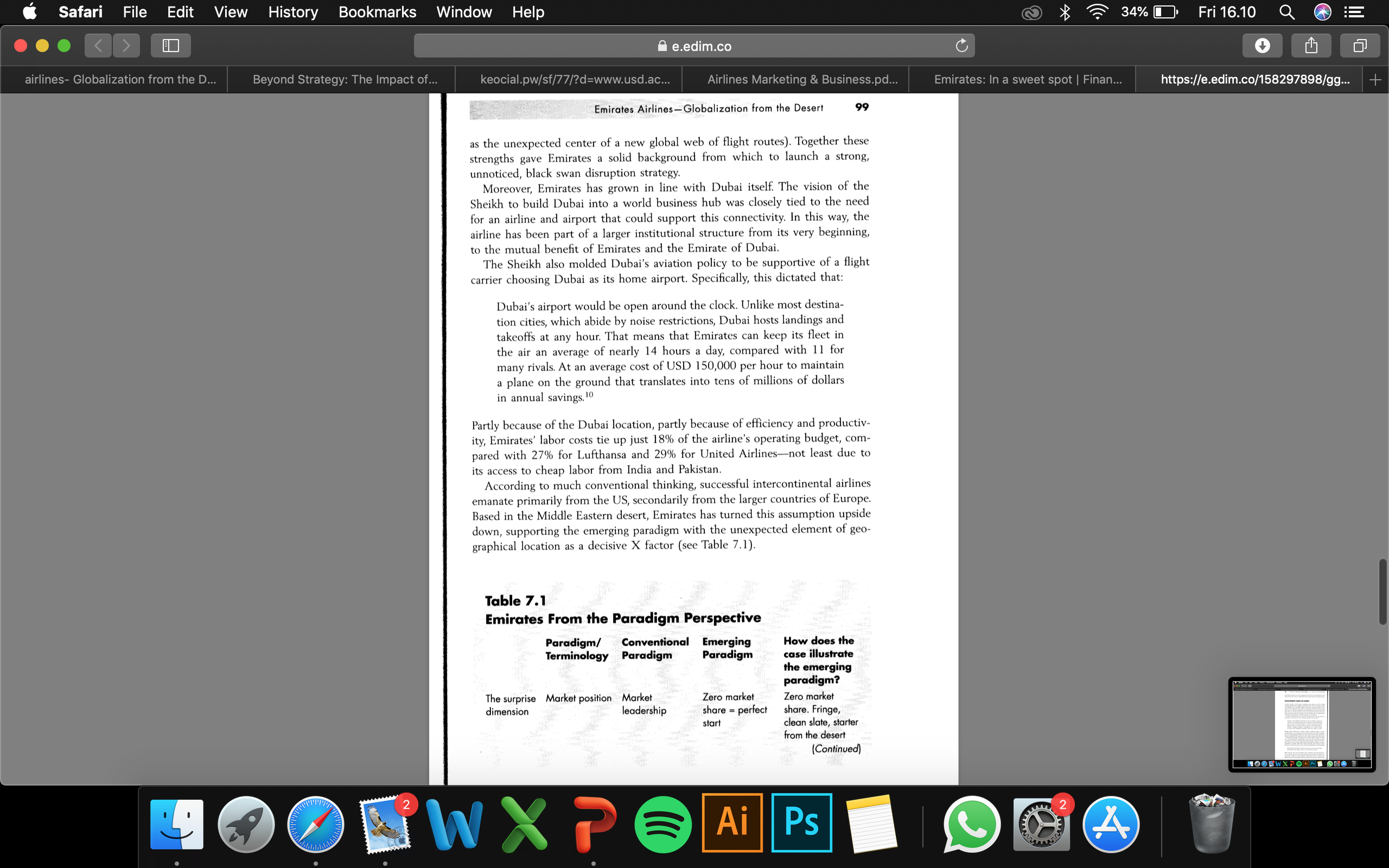

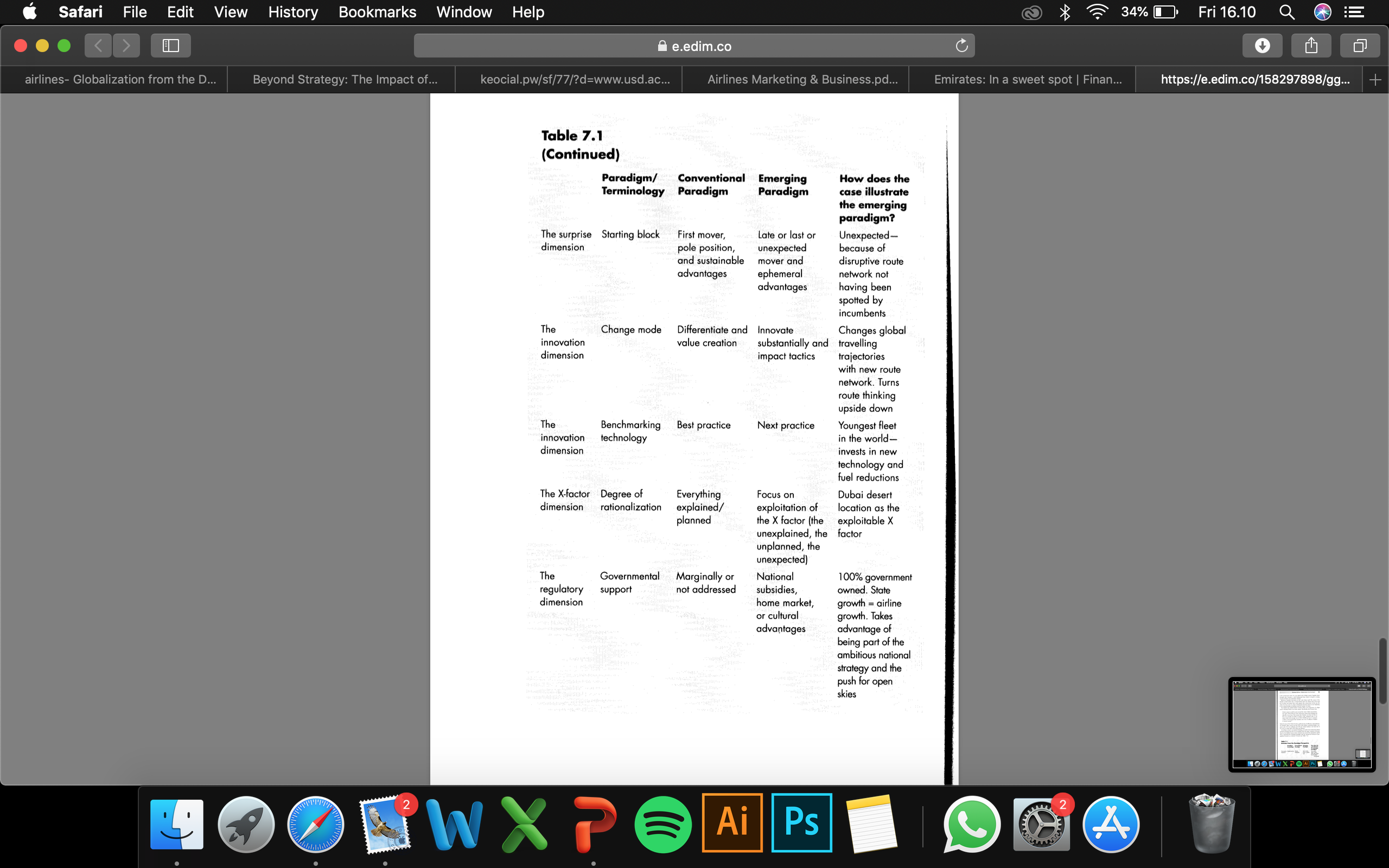

Safari File Edit View History Bookmarks Window Help 34% Fri 16.10 Q .. . A e.edim.co airlines- Globalization from the D... Beyond Strategy: The Impact of... keocial.pw/sf/77/?d=www.usd.ac... Airlines Marketing & Business.pd... Emirates: In a sweet spot | Finan... https://e.edim.co/158297898/gg... + Emirates Airlines- Globalization from the Desert Emirates is one of the fastest growing and most profitable airlines in the world. Yet the secret of its success is largely unknown outside the Arab world. It is necessary to look at the inner workings of the company to comprehend how strategically important its HQ location in Dubai is, and the extent to which the choice of a desert as the central hub of its operations deviates from conventional strategy thinking. HOW IT ALL BEGAN As has been the case for the few successful non-state airlines, Emirates was born out of a crisis. In 1985 Gulf Air refused to increase flights to and from Dubai unless the government protected the carrier's long-haul services. This was all the motivation Sheikh Mohammed bin Rashid Al-Maktoum needed. Instead of try- ing to persuade Gulf Air to change its mind, he established the Emirates Airlines knowing how dependent Dubai was on air trave To lead the venture he hired Emirates' first CEO, Maurice Flanagan from the UK, who, after a long career with British Airways, had taken up a role at Dubai travel and airport organization Dnata. Right from the start, Emirates did things differently. The Sheikh instructed Flanagan: Forget about protection against competition. That's not the way Dubai works.' Flanagan built a team together with the appointed chairman, Sheikh Ahmed bin Saeed Al Maktoum. One strategic appointment was Tim Clark, from Gulf Air, as head of airline planning. Clark had built up a reputation as a very strong route planner. The company set up with a loan of USD 10 million (since paid back many times over) and two leased planes, to fly a Dubai-Karachi route that had not existed previously. Within a year, Emirates was flying to Bombay and Delhi and quickly expanded to encompass destinations such as Colombo, Dhaka, Amman, and Cairo HOORWXPE Ai Ps 2 4Safari File Edit View History Bookmarks Window Help 34% Fri 16.10 Q .. . A e.edim.co C airlines- Globalization from the D... Beyond Strategy: The Impact of... keocial.pw/sf/77/?d=www.usd.ac... Airlines Marketing & Business.pd... Emirates: In a sweet spot | Finan... https://e.edim.co/158297898/gg... + 94 On the Inner Workings of Black Swans (1986), Frankfurt and Istanbul (1987), and Asian locations including Bangkok, The Fuel Issue Manila, and Singapore (1989) Being owned by the government of Dubai, The company quickly disrupted Emirates has been accused of getting fuel business for its nearest competitor, at reduced prices, sponsored directly by the Gulf Air, which in the first year of Dubai sheikhs. President Tim Clark has Emirates' existence suffered a 30% loss. refuted this allegation numerous times. In his Emirates did not receive any speech to the European Aviation Club in direct subsidies, nor did it rely on 2009, he lashed out: government handouts, according to prevailing reports. Dubai's 'open The other claim we hear ad nauseum, usually fired from a grassy knoll in the skies' policy granted foreign airlines Frankfurt area, is our secret supply of free the same access and privileges as uel. I imagine this comes from the some Emirates. Operating under this pol- what simplistic view that all Gulf States icy has been a cornerstone in the are oil rich and therefore must have fuel competitive game, according to pumps dispensing giveaway Avgas. The Flanagan, who has commented that: Truth is that we, like almost all other airlines, buy fuel on the open market from This has helped us to become a multiple global suppliers. The jet fuel price carrier which can compete with paid by Emirates at Dubai Airport is the best of the world's airlines.2 based on the Arab Gulf jet fuel traded in Singapore . . . And the price we pay Emirates has thrived since its foun in Paris, Frankfurt or Heathrow is courtesy of these well-known European charities, dation, enjoying an annual growth Royal Dutch Shell and British Petroleum. rate in the order of 25%, making it the world's largest carrier. The busi- In the financial year 2007/2008, fuel ness is divided into a number of accounted for more than 30% of Emirates companies-first and foremost the total expenditure, comparable with other Emirates airline itself, with subsidiar international long-haul carriers such as ies in resorts, congresses, and holiday British Airways, Lufthansa, Qantas, or tours, as well as divisions such as Singapore Airlines (http://en. wikipedia. org/wiki/Emirates_business_model). Emirates SkyCargo (with its own At the time of writing, Emirates' fuel costs soaring success), Emirates Aviation had in the most recent accounts added up College, and Emirates Engineering. to 34.4% of its total operating costs, rising By 2011, Emirates was the largest to 45% for the current period, with prospects airline company in the world in terms of further increases to come (www.bloomberg. of scheduled international passenger comews/2012-03-21/emirates-says- kilometers flown. By 2012 it was whole-load-of-airlines-will-fail-in-fuel-squeeze. operating on six continents and flying html) . to 111 destinations, carrying more To address the fuel price challenge, which than 31 million passengers a year. In is one of the key factors contributing to the May 2012, Emirates announced its steady flow of bankruptcies being witnessed Ai Ps C 2 4Safari File Edit View History Bookmarks Window Help 34% Fri 16.10 Q .. . A e.edim.co C + airlines- Globalization from the D... Beyond Strategy: The Impact of... keocial.pw/sf/77/?d=www.usd.ac... Airlines Marketing & Business.pd... Emirates: In a sweet spot | Finan... https://e.edim.co/158297898/gg... + Emirates Airlines-Globalization from the Desert 95 24th consecutive year of profit, up by almost 18% from the previous year- in the airline industry, Emirates has invested highly impressive in a sector in crisis. In the latest and lightest energy-conserving aircraft. Its fuel efficiency rates are currently The core story behind Emirates' 30% below the global fleet average, and success is the visionary route plan- continued improvements are being made on ning and its understanding of chang- the numerous new planes on order with ing markets and geographies. From Boeing and Airbus initially being considered a geo- graphical outlier in the desert, Emirates has reversed this perspective to position Dubai as a deliberate global hub. The competitors regularly accuse Emirates of being protected by the Dubai government ownership through competition- distorting subsidies and free or very cheap oil supplies. However, Emirates consistently presents accounts which refute these claims. REINVENTING DUBAI Much of Emirates' success is due to Sheikh Ahmed bin Saeed Al Maktoum's ambitious strategy of reinventing Dubai as a modern hub of business and tour- ism in the Middle East. This is reflected in one of the company's slogans: Fly Emirates, meet Dubai. Tim Clark, now president of the airline, attributes Emirates' achievements to a deep understanding of how the world is connected-not only today but also in the future, and the benefit of locating its central hub at its home airport in Dubai. The support of ambitious home-rulers cannot be underestimated either: they have built Dubai from a dusty desert post in the 1970s to one of the world's most bustling centers of growth, finance, and business connections. In 2010, the number of visitors was approximately 15 million with another 20 million trav- elers passing through Dubai in transit. This further fuels the expansion of Emirates which will contribute to and benefit from the growth. REJECTING CONVENTIONAL WISDOM Emirates' recipe for success cannot be found in any conventional management book. The company's creative approach to seizing opportunities and solving problems can be attributed to a distinct mindset, according to former CEO Maurice Flanagan, who famously noted: We don't have to do what other airlines do.3 HOOFWXPONG ON BOORWXPE Ai Ps 46 Safari File Edit View History Bookmarks Window Help a? \"a? 34%EI Fri16.10 Q ED 9 e.edim.co o hiips://e.edim.co/158297898/99... 96 on in. Inner Working: at Black sworn Another contributing characteristic is Emirates' exible organization which favors an informal and entrepreneurial spirit. The company's family-based struc- ture provides the airline with great structural exibility. Gary Chapman, president of the afliated company Dnata, has summarized Emirates' success as follows: Emirates [is] organized around the strengths of individuals rather than [the constraints oi] rigid organizational structure.' Emirates' strategy and decision-making process seems to follow a fluid approach one more akin to that of a start-up than to a traditional airline carrier with rigid layers and procedures. A simple 'Okay' from the Sheikh suffices. This is the Dubai style, Flanagan argues: Obviously, you must have created the condence to get into that situa- Lion. We have weekly meetings, and the ability to go to the Sheikh or to the senior management group and get a decision very quickly is the key.5 Emirates has become something of an enfant terrible in the airline industry it consistently argues against restrictions on market access, airport usage, and airline ownership, not least in the form of alliances and national/regional protection laws. Star Alliance. OneWorld, and SkyTeam are the world's three largest alli- ances, covering 4766% of North American and European markets. Emirates briey considered joining StarAlliance in 2000, but decided (strongly) against it on the grounds that its strategic freedom would be hindered. Since then, Emirates has risen as a harsh critic of protectionism by alliances and nations Dubai airport, Emirates' home base, remains an 'open skies' territory meaning that no airlines are prevented from using it. But other airports are hard to negotiate access toir took Emirates three years to gain a foothold in Australian airports such as Sydney, for example, Also, i-:u regulations and German protec- tionism have led to tough battles for Emirates. Driven by the interests of the alliances to which their largest home operators belong, national authorities have put pressure on Emiratestake, for example, Germany where the company was forced to increase its prices so as to not he too competitive for Lufthansa! Emirates pursues its anti-regulation mission with lawsuits, very transparent reporting, and provocative discussions and statements to the aviation community. THE GOVERNMENT-SHEIKH SUBSIDIES ISSUE Emirates' business model has been repeatedly queried, with allegations that the airline's aggressive eet investments over the yearseven in times of adversity cannot possibly have been supported by its earnings alone. In 2005, the CEO Safari File Edit View History Bookmarks Window Help 34% Fri 16.10 Q .. . A e.edim.co C airlines- Globalization from the D... Beyond Strategy: The Impact of... keocial.pw/sf/77/?d=www.usd.ac... Airlines Marketing & Business.pd... Emirates: In a sweet spot | Finan... https://e.edim.co/158297898/gg... + Emirates Airlines - Globalization from the Desert 97 of Air France-KLM Group, Leo van Wijk, spoke in blunt terms at an Canadian Accusations annual industry gathering, saying: 'Many of us have great doubts about Emirates' financial auditor, Pricewater- houseCoopers (PWC), has revealed nothing how Emirates is paying for these in the company accounts that suggests A380s when your cash flow isn't big government subsidies or similar. Meanwhile enough to support it. So where do a report from UBS Investment concurs that it you get the money?"6 can find little evidence of any subsidies." Implied was significant sponsorship But these assurances have done little to by the Dubai government, which slow down the rumour mill. In 2011, Emirates would be against market competition was forced to respond to accusations from laws. The now president, Tim Clark, Canada's prime minister, no less. Tim Clark has subsequently responded by noting did this by way of an open letter. This first that other airlines are government stated: owned, too e.g. Air New Zealand, challenge Prime Minister Harper or any Finnair, and Singapore Airlines. member of his government to produce Second, Emirates pays the same price one shred of evidence to support the as other airlines at its hub in Dubai. false accusations which are repeatedly It is the fact that Dubai is also eported as fact by the Canadian media. Emirates' own base that provides an We have stated on many occasions that important indicator to the source of Emirates is not subsidised in any way, the company's success. While pas- shape or form by the Dubai government: senger traffic worldwide decreases, it I never has been and never will be. increases in Dubai and the growth Our financial statements audited by PricewaterhouseCoopers, the world's of the country as an international argest accounting firm, confirm that hub has boosted the success of the there is no evidence of subsidisation airline immensely. Furthermore, whatsoever. These accounts have been Emirates has a route network which made freely available to the public caters to millions of people who through Emirates' website (www. would otherwise have to fly via third emirates.com) and they clearly demon- destinations. The sheer genius of the strate that we do not receive any direct Dubai location means that Emirates or indirect subsidies. can reach 75% of all destinations (www.newswire.ca/en/ within an eight-hour flight. It is, in story/743881/letter-from-tim-clark- Clark's words, "an ultra-competitive president-of-emirates-airline) aviation honey pot."7 In response to the steadily incoming accusations of fraud, Emirates has adopted a staunch open-market position, pointing out the hidden 'subsidies' and/or protec tionism embedded in many alliances and national models. This is part of Emirates' brand today-OPEN. Group chairman and CEO Ahmed bin Saeed Al Maktoum states in the airline's 2010/11 annual report: "OPEN is . . . the foundation of our core, long-term business strategy. Quite frankly, placing restrictions on airline HOWXPONG ONG HOORWXPE Ai Ps 46 Safari File Edit View History Bookmarks Window Help )[3 \"a? 34%EI Fri16.10 Q ED 9 e.edim.co o hilps://e.edim.co/158297898/99... in On ih. Inner Working: at Black Swan ownership and market access is incongruent to how the rest of the business world works in the 2151 Century.\" OPEN goes hand in hand wnh the open-skies policy. DEVELOPMENT FROM THE DESERT As many reports in the business consultancy press discuss (cg. EIU's Global Dismptars, 2008; BCG's Companies on the Mm, 201 l ; BCG's Unlocking Growth in the Middle, 2012; and IBM's beal CEO study], emerging markets are the place to be for tomorrow's (and today's] corporation. Asia St the Gulf have been called 'the new Silk Road' (McKinsey Quarterly, 2006), the argument being that those able to create the products, services, and travels for that road will win the future. Emirates do this by catering not to the old West, but to holidaymakers and business personnel from localities neglected by incumbents. Emirates understood this new connectivity pattern from an early stage. As Clark put it in his speech to the European Aviation Club in 200'): Aviation is the globalised world and air services helped to make the earth at. Our model works because we don't have a one-dimensional route network of traditional Atlantic or Pacific crossings, or just the Kangaroo route or focusing inside one region. Connecting Moscow to Durban, or Beijing to Luanda, or Hyderabad in LA, or Perth tlz Dubai, are some of the thousands of examples of the new world's city pairs. Residing wirhin 4.000 miles of Dubairoughly an eight-hour flight on today's modern jetlinersare 3.5 billion people (more than half ofthc world's population) and 75% of all destinations. Before any other airline discovered the opportunity, Emirates capitalized on its location and created a hub to connect all of these people. Emirates took advantage of staning out as a nobody Neither Emirates nor Dubai were considered important regional players, and it was easy for Emirates to negoti- ate airport access both in and beyond its regional domain. During its rst three years, the three top executives (Clark, Ahmed, and Flanagan) travelled to numerous destinations to negotiate trafc rights with governments, speak with key opinion leaders and construct the future route network, As described by a CNN joumalist: Believing that the airline would never amount to much, most foreign governments were happy to give it access to their runways." Right from the start, the top Emirates team combined a full understanding of the incumbent carriers and the dual opportunity presented by the desert loca- tion of the company (Le. that Emirates' master plan could be developed and fullled away from international attention, and that this location would emerge Safari File Edit View History Bookmarks Window Help 34% Fri 16.10 Q .. . A e.edim.co C + airlines- Globalization from the D... Beyond Strategy: The Impact of... keocial.pw/sf/77/?d=www.usd.ac... Airlines Marketing & Business.pd... Emirates: In a sweet spot | Finan... https://e.edim.co/158297898/gg... + Emirates Airlines-Globalization from the Desert 99 as the unexpected center of a new global web of flight routes). Together these strengths gave Emirates a solid background from which to launch a strong, unnoticed, black swan disruption strategy. Moreover, Emirates has grown in line with Dubai itself. The vision of the Sheikh to build Dubai into a world business hub was closely tied to the need for an airline and airport that could support this connectivity. In this way, the airline has been part of a larger institutional structure from its very beginning, to the mutual benefit of Emirates and the Emirate of Dubai. The Sheikh also molded Dubai's aviation policy to be supportive of a flight carrier choosing Dubai as its home airport. Specifically, this dictated that: Dubai's airport would be open around the clock. Unlike most destina- tion cities, which abide by noise restrictions, Dubai hosts landings and takeoffs at any hour. That means that Emirates can keep its fleet in the air an average of nearly 14 hours a day, compared with 11 for many rivals. At an average cost of USD 150,000 per hour to maintain a plane on the ground that translates into tens of millions of dollars in annual savings. 10 Partly because of the Dubai location, partly because of efficiency and productive ity, Emirates' labor costs tie up just 18% of the airline's operating budget, com- pared with 27% for Lufthansa and 29% for United Airlines-not least due to its access to cheap labor from India and Pakistan. According to much conventional thinking, successful intercontinental airlines emanate primarily from the US, secondarily from the larger countries of Europe. Based in the Middle Eastern desert, Emirates has turned this assumption upside down, supporting the emerging paradigm with the unexpected element of geo- graphical location as a decisive X factor (see Table 7.1). Table 7.1 Emirates From the Paradigm Perspective Paradigm/ Conventional Emerging How does the Terminology Paradigm Paradigm case illustrate the emerging paradigm? The surprise Market position Market Zero market Zero marke dimension leadership share = perfect share. Fringe, start clean slate, starter from the deser (Continued) HOORWXPE Ai Ps 4Safari File Edit View History Bookmarks Window Help 34% Fri 16.10 Q .. . A e.edim.co C + airlines- Globalization from the D... Beyond Strategy: The Impact of... keocial.pw/sf/77/?d=www.usd.ac... Airlines Marketing & Business.pd... Emirates: In a sweet spot | Finan... https://e.edim.co/158297898/gg... + Table 7.1 (Continued) Paradigm/ Conventional Emerging How does the Terminology Paradigm Paradigm case illustrate the emerging paradigm? The surprise Starting block First mover, Late or last or Unexpected- dimension pole position, unexpected because of and sustainable mover and disruptive route advantages ephemera network not advantages having been spotted by incumbents The Change mode Differentiate and Innovate Changes global innovation value creation substantially and travelling dimension mpact tactics trajectories with new route network. Turns route thinking upside down The Benchmarking Best practice Next practice Youngest fleet innovation technology in the world- dimension invests in new technology and fuel reductions The X-factor Degree of Everything Focus on Dubai desert dimension rationalization explained/ exploitation of location as the planned the X factor (the exploitable X unexplained, the factor unplanned, the unexpected) The Governmental Marginally or National 100% government regulatory support not addressed subsidies, owned. State dimension home market, growth = airline or cultural growth. Takes advantages advantage of being part of the ambitious national strategy and the push for open skies HOORWXPE Ai Ps 2 4Safari File Edit View History Bookmarks Window Help 34% Fri 16.10 Q .. . A e.edim.co + airlines- Globalization from the D... Beyond Strategy: The Impact of... keocial.pw/sf/77/?d=www.usd.ac... Airlines Marketing & Business.pd... Emirates: In a sweet spot | Finan... https://e.edim.co/158297898/gg... + Emirates Airlines-Globalization from the Desert 101 KEY REFLECTIONS A. A driving force in the development of the Emirates has been the goal not only to develop a global airline but also to create a new focus on Dubai as the hub of the world. In this way Emirates and Dubai's governors have aligned ambitions and mutual benefits. Is this typical for a city and an airline? Can you think of other potential win-wins between companies and their geographical locations? B. Emirates, like Ryanair, has demonstrated that going against the wind and subscribing to non-conventional wisdom pays off. This can be characterized as an X-factor mindset and a stand-out ability to reverse the conventional modus operandi. C. From a management perspective, the case of Emirates also indicates a kind of reverse globalization, showing how an airline originating in a desert in the Middle East can, from nothing, almost conquer the world. Is there a danger that Western companies are underestimating peers from emerging economies? Will we see more Emirates in the future? NOTES 1 Quoted from Sull, Donald N., Ghoshal, Sumantra, and Monteiro, Felipe (2005), The hub of the world, Business Strategy Review, Spring. 2 Ibid. 3 Ibid 4 Ibid. 5 Ibid. 6 See Maier, Matthew (2005), Rise of the Emirates' empire, CNN Money, October 1. 7 Clark, Tim (2005), speech to the European Aviation Club, 12 November 8 See Emirates Annual Report (2010/2011). 9 See Maier, Matthew (2005), Rise of the Emirates empire, CNN Money, October 1. 0 Ibid. BOORWXPE Ai Ps 4