Question

Sage Meadow always knows what people need to eat. Spicy pastas to attract love, decadent chocolates to bring peaceful dreams, fruit tarts to find jobs

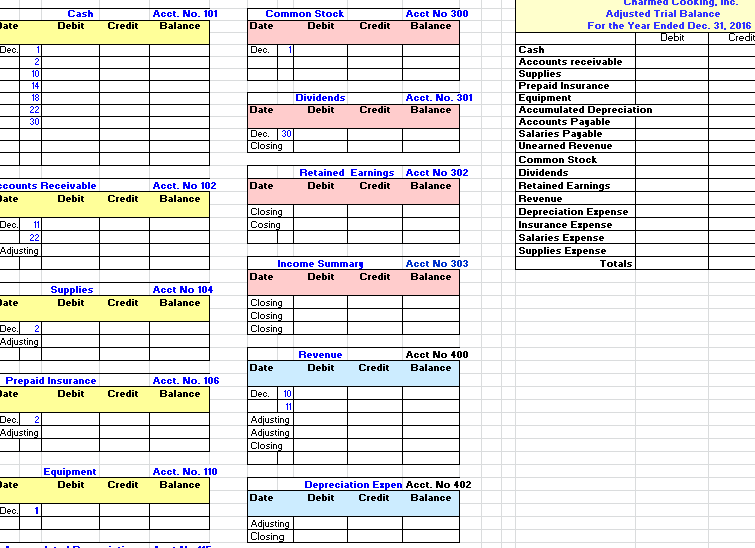

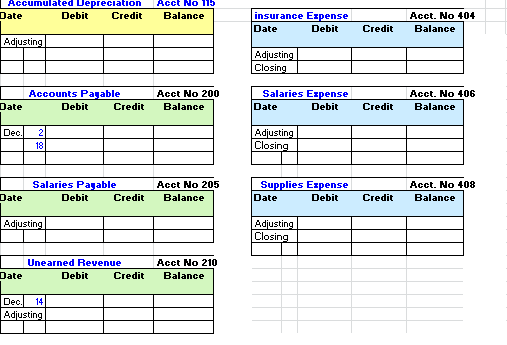

Sage Meadow always knows what people need to eat. Spicy pastas to attract love, decadent chocolates to bring peaceful dreams, fruit tarts to find jobs in exciting cities, and hearty breads for healthy babies. She is often called to cook in Garden District households to solve a variety of issues large and small salads that build self-esteem, quiches that can cause the return of absent lovers, soups that inspire a sense of direction. Therefore, in late November, she incorporated a catering business Charmed Cooking, Inc. (Please note: all her clients supply the raw food ingredients so there is no cost to Sage. Account for a service business, not a retailer. ) Part 1) Record your journal entries in the space provided below each individual event. Dec. 1. Sage invested 30,000 cash and $15,000 of equipment in the company in exchange for common stock. Debit Amount Credit Amount. Dec. 2. Sage paid $12,000 cash in advance to cover 6 months insurance for her business. Dec. 2 Sage bought $2,000 of supplies on account. Dec. 10 An accounting professor hired Sage to bake chocolate cherry smart cookies for an accounting class so all the students could make As on their Accounting Cycle Problem. Sage was paid $1000 in cash. Dec. 11. Sage catered a party for Louisiana legislators. She baked raspberry-peach cobbler to help them remember the best interest of the voters. She sent a bill for $15,000. Dec. 14 Orleans Parish pays Sage $24,000 in advance to cater a series of outdoor concerts over the next few months. Her menu of creole classics will inspire those who eat to love their neighbors, find peace and meaningful work, and never lose their keys. Dec. 18 Sage paid $1200 towards her account incurred previously for supplies Dec. 22 Louisiana legislators sent Sage a check for $10,000 in partial payment of the bill sent previously for catering services. Dec. 30 The company paid Sage a $6,000 dividend. Part 2 ) Post your Journal entries to the ledgers provided. Part 3 )Adjusting Entries Please record adjusting entries as of Dec. 31 based on the facts below. 1) Record one months depreciation on the equipment. The equipment cost $15,000 is estimated to have a $3,000 salvage value and a 5 year life. (Note: For one months depreciation take the annual amount and divide by 12) 2) During the month, Sage completed 1/4 of the work for Orleans Parish. (Orleans Parish had paid her $24,000 in advance to cater a series of concerts.) 3) Record the expiration of one months pre-paid insurance during December. (Sage paid $12,000 in advance for 6 months of insurance.) 4) An inventory at the end of the month revealed that $900 of supplies remained on hand. (She had bought $2,000 at the beginning of the month.) 5) Towards the end of the month, a wealthy patron paid Sage to cater an event for the SPCA so all the animals would find nice homes. Sage has not yet recorded the amount or sent her bill for $2,000. 6) Sages assistant earned $1500 in salaries during the last week in December. Sage intends to pay during the first week of January. Please record this amount. Part 4) Post your Adjusting Entries to your ledgers and record the ledger totals. Part 5) Prepare an Adjusted Trial Balance from your ledgers. Part 6) Using the totals from your ledgers and adjusted trial balance, please record your closing entries in the space below. 1. 2. 3. 4. Part 7) Prepare the Financial Statements in the space below: Charmed Cooking, Inc. Income Statement For the Year Ended Dec. 31, 2016 Charmed Cooking, Inc. Statement of Retained Earnings For the Year Ended Dec. 31, 2016 Charmed Cooking, Inc. Balance Sheet As of Dec. 31, 2016

CashAcct. No. 101 ebit cct No 300 Balance ommon Stock Adjusted Trial Balance ate Credit Balance ate Debit redit For the Year Ended Dec. 31, 2016 Dec Cash Accounts receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation Accounts Paable Salaries Pagable Unearned Revenue Common Stock Dividends Retained Earnings Revenue Depreciation Ezpense Insurance Ezpense Salaries Erpense Supplies Erpense vidends Debit cct. No. 301 Balance ate redit Dec. 30 Closin Retained Earnings Acct No 302 counts Receivable Acct. No 102 Date Debit Credit Balance ate Debit Credit Balance Closin Cosin Dec Adjustin Income Summar Acct No 303 Totals Date Debit Credit Balance Acct No 104 Debit Credit Balance Closin Closin Closin ate Dec. 2 Adjustin Revenue Debit Acct No 400 Date Credit Balance Prepaid Insurance Acct. No. 106 ate Debit Credit Balance Adjustin djustin Closin Adjustin Equipment Debit Acct. No. 110 ate Credit Balance Depreciation Ezpen Acct. No 402 Date Debit Credit Balance Adjustin Closin

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started