Answered step by step

Verified Expert Solution

Question

1 Approved Answer

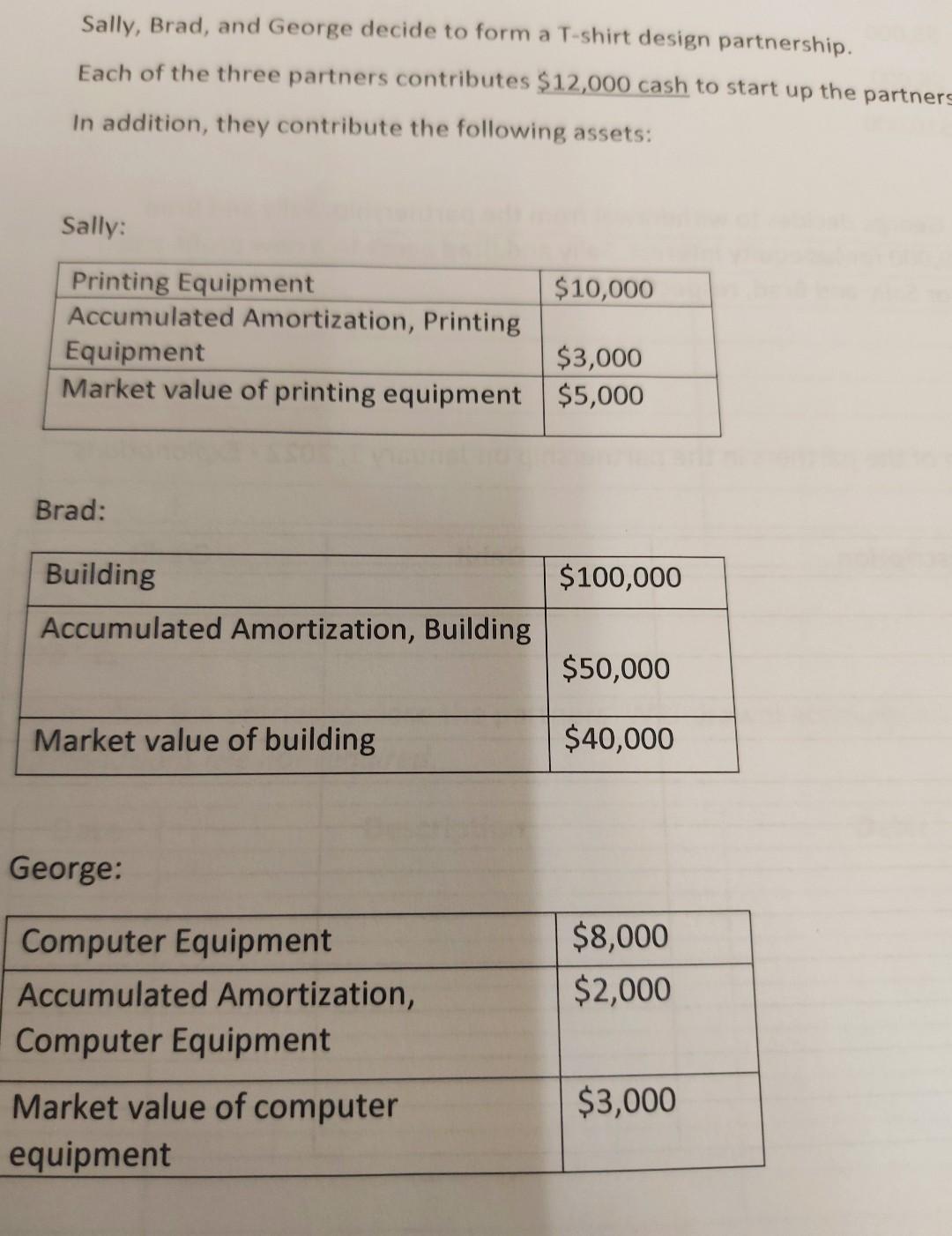

Sally, Brad, and George decide to form a T-shirt design partnership. Each of the three partners contributes $12,000 cash to start up the partners In

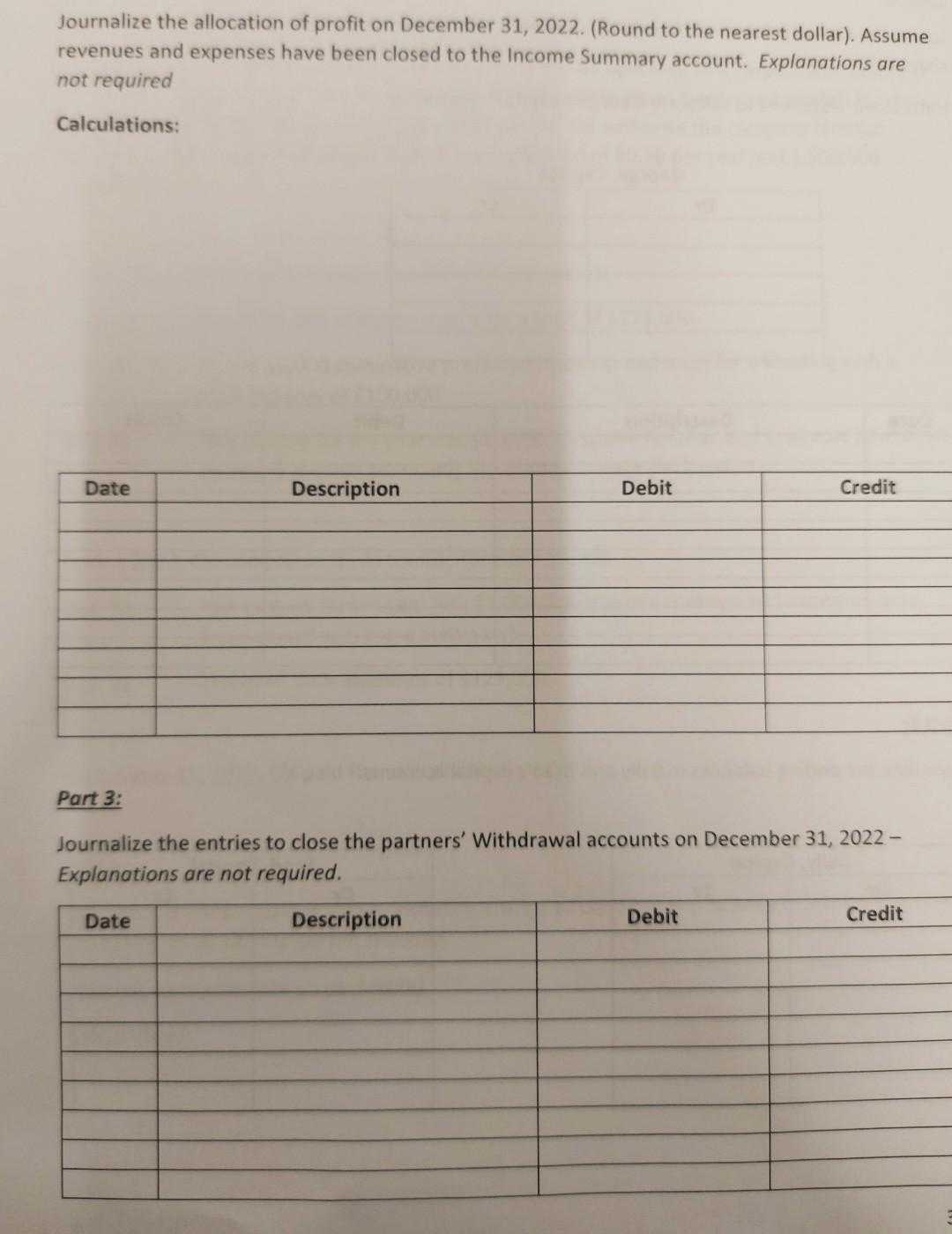

Sally, Brad, and George decide to form a T-shirt design partnership. Each of the three partners contributes $12,000 cash to start up the partners In addition, they contribute the following assets: Sally: Printing Equipment $10,000 Accumulated Amortization, Printing Equipment $3,000 Market value of printing equipment $5,000 Brad: Building $100,000 Accumulated Amortization, Building $50,000 Market value of building $40,000 George: Computer Equipment Accumulated Amortization, Computer Equipment $8,000 $2,000 $3,000 Market value of computer equipment Journalize the allocation of profit on December 31, 2022. (Round to the nearest dollar). Assume revenues and expenses have been closed to the Income Summary account. Explanations are not required Calculations: Date Description Debit Credit Part 3: Journalize the entries to close the partners' Withdrawal accounts on December 31, 2022 - Explanations are not required. Date Description Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started