Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Salma Yeo created the Yeo Family Trust, an inter vivos trust to hold family. investments. The trust deed specifies that trust net income is

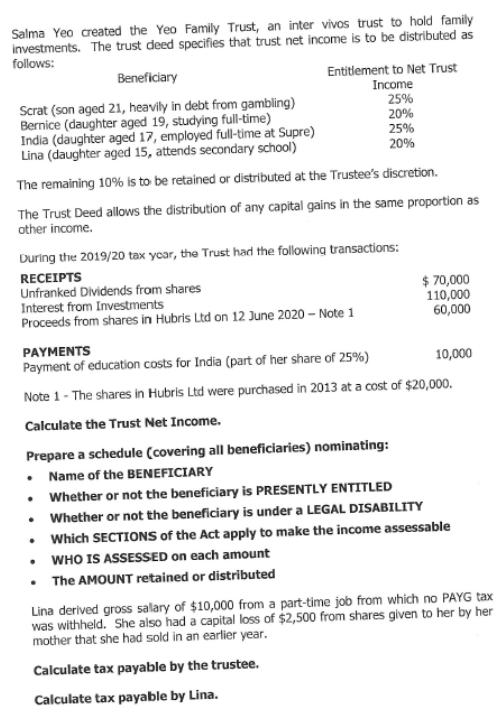

Salma Yeo created the Yeo Family Trust, an inter vivos trust to hold family. investments. The trust deed specifies that trust net income is to be distributed as follows: Entitlement to Net Trust Income 25% 20% 25% 20% Beneficiary Scrat (son aged 21, heavily in debt from gambling) Bernice (daughter aged 19, studying full-time) India (daughter aged 17, employed full-time at Supre) Lina (daughter aged 15, attends secondary school) The remaining 10% is to be retained or distributed at the Trustee's discretion. The Trust Deed allows the distribution of any capital gains in the same proportion as other income. During the 2019/20 tax year, the Trust had the following transactions: RECEIPTS Unfranked Dividends from shares Interest from Investments Proceeds from shares in Hubris Ltd on 12 June 2020 - Note 1 $70,000 110,000 60,000 PAYMENTS Payment of education costs for India (part of her share of 25%) Note 1 - The shares in Hubris Ltd were purchased in 2013 at a cost of $20,000. Calculate the Trust Net Income. . 10,000 Prepare a schedule (covering all beneficiaries) nominating: Name of the BENEFICIARY Whether or not the beneficiary is PRESENTLY ENTITLED . Whether or not the beneficiary is under a LEGAL DISABILITY Which SECTIONS of the Act apply to make the income assessable WHO IS ASSESSED on each amount The AMOUNT retained or distributed Lina derived gross salary of $10,000 from a part-time job from which no PAYG tax was withheld. She also had a capital loss of $2,500 from shares given to her by her mother that she had sold in an earlier year. Calculate tax payable by the trustee. Calculate tax payable by Lina.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started