Answered step by step

Verified Expert Solution

Question

1 Approved Answer

**SAME PROBLEM JUST 3 STEPS!! PLEASE HELP!! I WILL RATE ASAP WHEN QUESTION IS ANSWERED! At 12/31/20, the end of Cullumber Company's first year of

**SAME PROBLEM JUST 3 STEPS!! PLEASE HELP!! I WILL RATE ASAP WHEN QUESTION IS ANSWERED!

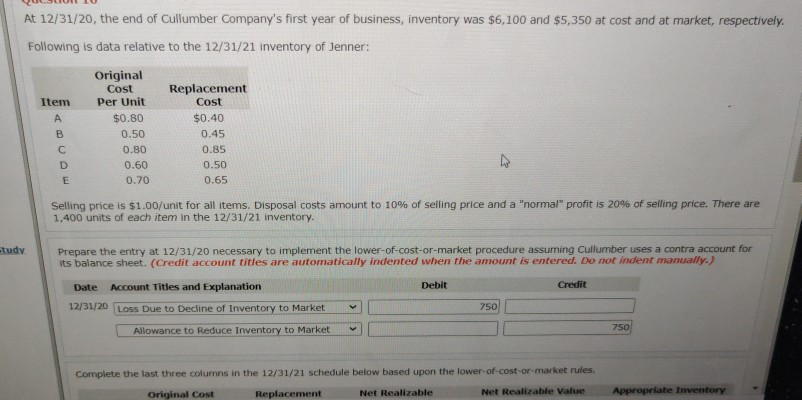

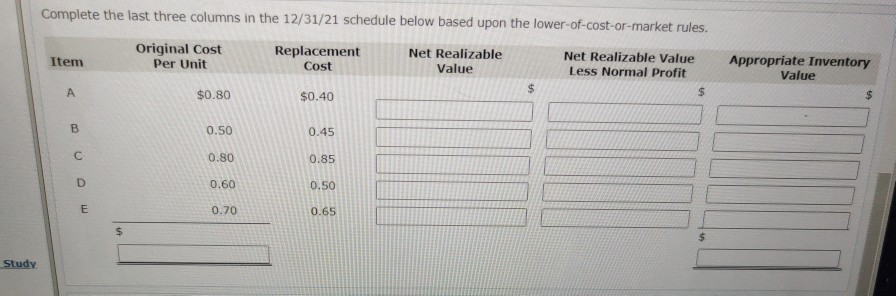

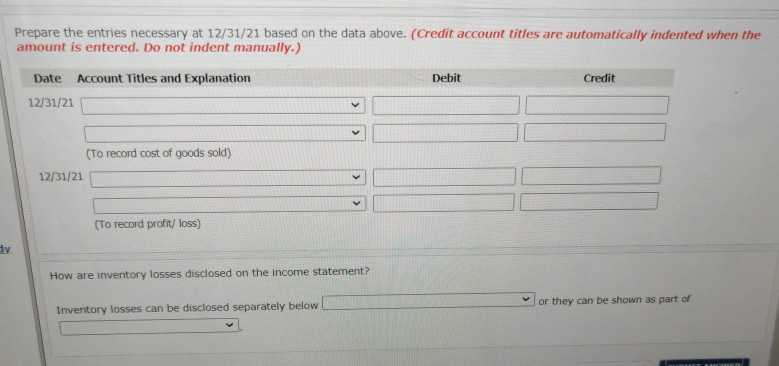

At 12/31/20, the end of Cullumber Company's first year of business, inventory was $6,100 and $5,350 at cost and at market, respectively. Following is data relative to the 12/31/21 inventory of Jenner: Item B Original Cost Per Unit $0.80 0.50 0.80 0.60 0.70 Replacement Cost $0.40 0.45 0.85 D E 0.50 0.65 Selling price is $1.00/unit for all items. Disposal costs amount to 10% of selling price and a "normal" profit is 20% of selling price. There are 1,400 units of each item in the 12/31/21 inventory. Study Prepare the entry at 12/31/20 necessary to implement the lower-of-cost-or-market procedure assuming Cullumber uses a contra account for its balance sheet. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation 12/31/20 Loss Due to Decline of Inventory to Market 750 Allowance to Reduce Inventory to Market 750 Complete the last three columns in the 12/31/21 schedule below based upon the lower-of-cost-or-market rules. Original cost Replacement Net Realizable Net Realizable Value Appropriate Inventory Complete the last three columns in the 12/31/21 schedule below based upon the lower-of-cost-or-market rules. Original Cost Per Unit Item Replacement Cost Net Realizable Value Net Realizable Value Less Normal Profit $ Appropriate Inventory Value $ $0.80 $0.40 $ B 0.50 0.45 C 0.80 0.85 D 0.60 0.50 E 0.70 0.65 $ Study Prepare the entries necessary at 12/31/21 based on the data above. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation 12/31/21 > (To record cost of goods sold) 12/31/21 (To record profit/ loss) sy How are inventory losses disclosed on the income statement? or they can be shown as part of Inventory losses can be disclosed separately belowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started