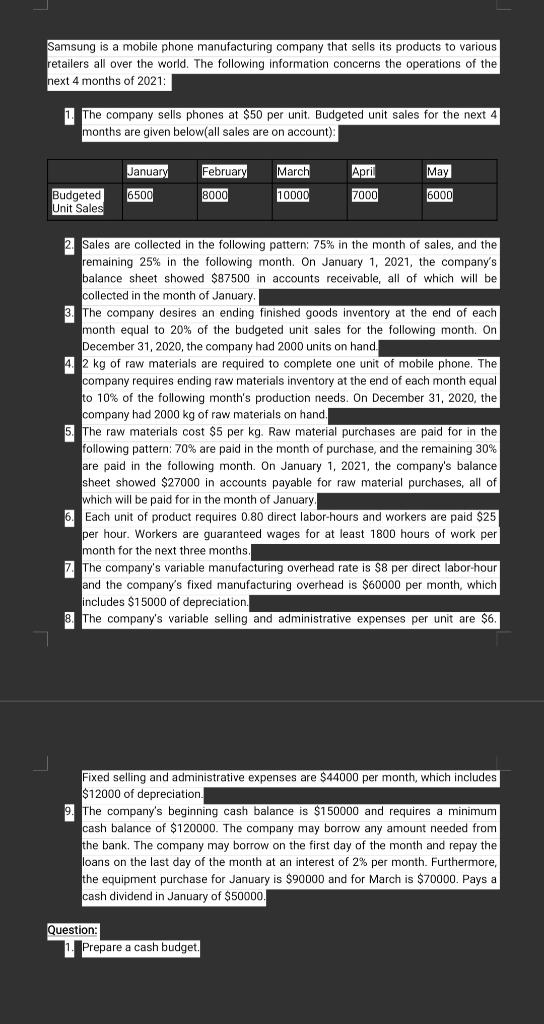

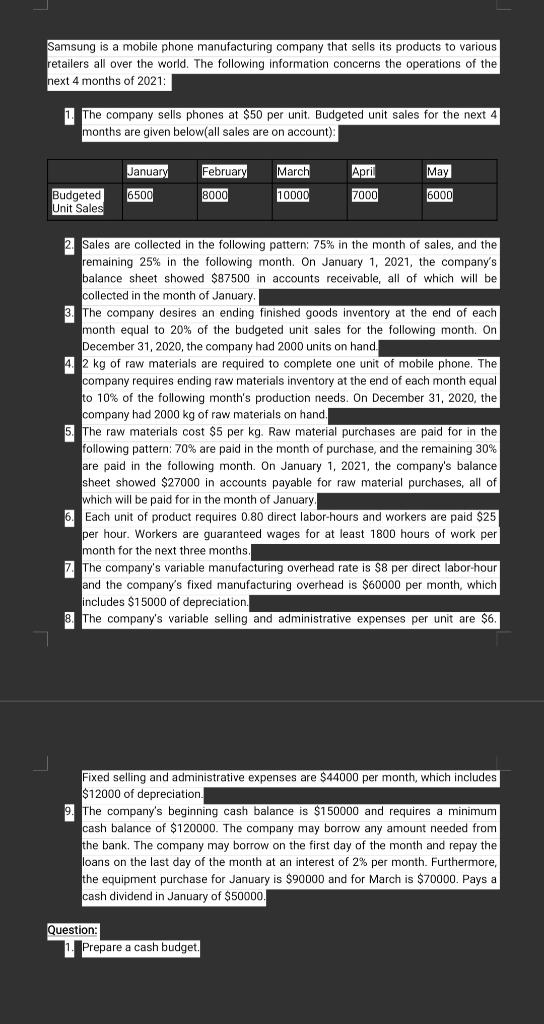

Samsung is a mobile phone manufacturing company that sells its products to various retailers all over the world. The following information concerns the operations of the next 4 months of 2021: 1. The company sells phones at $50 per unit. Budgeted unit sales for the next 4 months are given below(all sales are on account): 2. Sales are collected in the following pattern: 75% in the month of sales, and the remaining 25% in the following month. On January 1, 2021, the company's balance sheet showed $87500 in accounts receivable, all of which will be collected in the month of January. 3. The company desires an ending finished goods inventory at the end of each month equal to 20% of the budgeted unit sales for the following month. On December 31,2020 , the company had 2000 units on hand. 4. 2kg of raw materials are required to complete one unit of mobile phone. The company requires ending raw materials inventory at the end of each month equal to 10% of the following month's production needs. On December 31, 2020, the company had 2000kg of raw materials on hand. 5. The raw materials cost $5 per kg. Raw material purchases are paid for in the following pattern: 70% are paid in the month of purchase, and the remaining 30% are paid in the following month. On January 1, 2021, the company's balance sheet showed $27000 in accounts payable for raw material purchases, all of which will be paid for in the month of January. 6. Each unit of product requires 0.80 direct labor-hours and workers are paid $25 per hour. Workers are guaranteed wages for at least 1800 hours of work per month for the next three months. 7. The company's variable manufacturing overhead rate is $8 per direct labor-hour and the company's fixed manufacturing overhead is $60000 per month, which includes $15000 of depreciation. 8. The company's variable selling and administrative expenses per unit are $6. Fixed selling and administrative expenses are $44000 per month, which includes $12000 of depreciation. 9. The company's beginning cash balance is $150000 and requires a minimum cash balance of $120000. The company may borrow any amount needed from the bank. The company may borrow on the first day of the month and repay the loans on the last day of the month at an interest of 2% per month. Furthermore, the equipment purchase for January is $90000 and for March is $70000. Pays a Samsung is a mobile phone manufacturing company that sells its products to various retailers all over the world. The following information concerns the operations of the next 4 months of 2021: 1. The company sells phones at $50 per unit. Budgeted unit sales for the next 4 months are given below(all sales are on account): 2. Sales are collected in the following pattern: 75% in the month of sales, and the remaining 25% in the following month. On January 1, 2021, the company's balance sheet showed $87500 in accounts receivable, all of which will be collected in the month of January. 3. The company desires an ending finished goods inventory at the end of each month equal to 20% of the budgeted unit sales for the following month. On December 31,2020 , the company had 2000 units on hand. 4. 2kg of raw materials are required to complete one unit of mobile phone. The company requires ending raw materials inventory at the end of each month equal to 10% of the following month's production needs. On December 31, 2020, the company had 2000kg of raw materials on hand. 5. The raw materials cost $5 per kg. Raw material purchases are paid for in the following pattern: 70% are paid in the month of purchase, and the remaining 30% are paid in the following month. On January 1, 2021, the company's balance sheet showed $27000 in accounts payable for raw material purchases, all of which will be paid for in the month of January. 6. Each unit of product requires 0.80 direct labor-hours and workers are paid $25 per hour. Workers are guaranteed wages for at least 1800 hours of work per month for the next three months. 7. The company's variable manufacturing overhead rate is $8 per direct labor-hour and the company's fixed manufacturing overhead is $60000 per month, which includes $15000 of depreciation. 8. The company's variable selling and administrative expenses per unit are $6. Fixed selling and administrative expenses are $44000 per month, which includes $12000 of depreciation. 9. The company's beginning cash balance is $150000 and requires a minimum cash balance of $120000. The company may borrow any amount needed from the bank. The company may borrow on the first day of the month and repay the loans on the last day of the month at an interest of 2% per month. Furthermore, the equipment purchase for January is $90000 and for March is $70000. Pays a