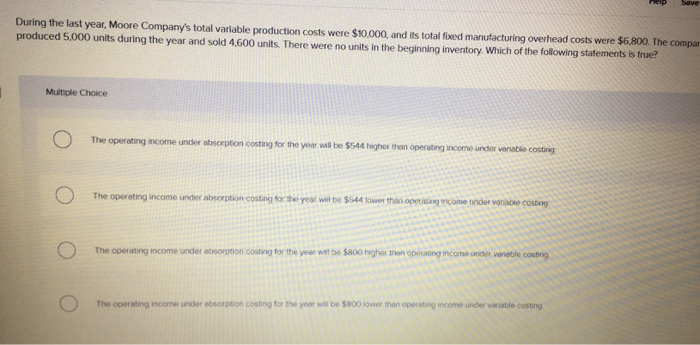

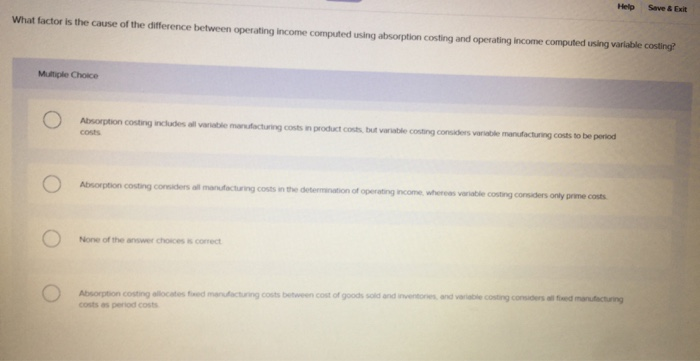

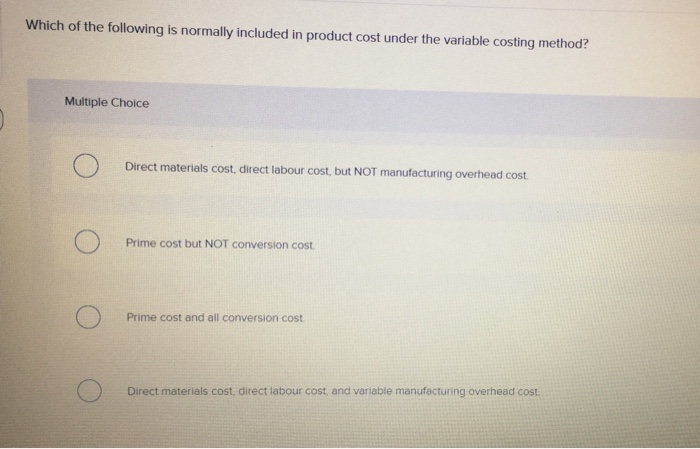

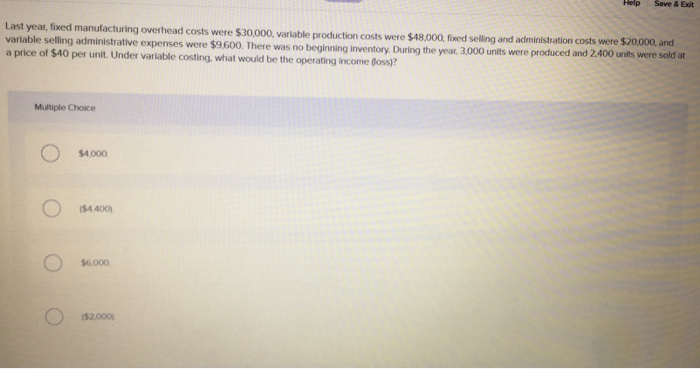

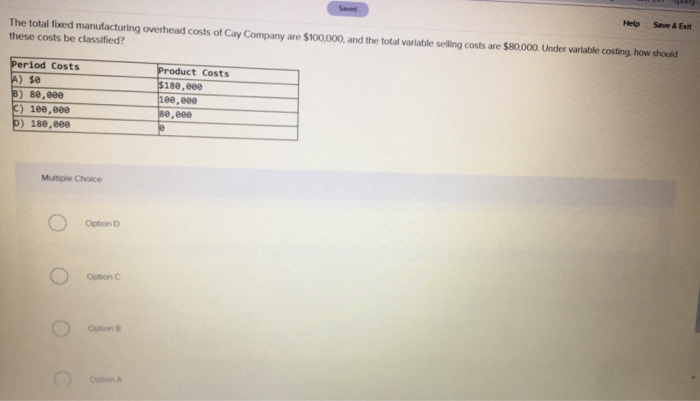

Save During the last year, Moore Company's total variable production costs were $10,000, and its total feed manufacturing overhead costs were $6,800. The compar produced 5,000 units during the year and sold 4.600 units. There were no units in the beginning inventory. Which of the following statements is true? Multiple Choice The operating income under absorption costing for the year will be $544 higher than operating income under variable costing The operating income under absorption costing for the you wit be $544 lower than operating income under variable costung The operating income under absorption costing for the year wil be $800 higher than operating income under variable costing The operating income under absorption costing for the year wil be $800 lower than operating income under variable costing Help Save & Exit What factor is the cause of the difference between operating income computed using absorption costing and operating income computed using variable costing? Multiple Choice Absorption costing includes all variable manufacturing costs in productos, but variable conting considers variable manufacturing costs to be period costs Absorption costing considers al manufacturing costs in the determnation of operating income, whereas variable costing considers only prime costs None of the answer choices is correct Absorption costing locates federacturing costs between cost of goods sold and inventones and variable costing considers of manufacturing costs as perod costs Which of the following is normally included in product cost under the variable costing method? Multiple Choice Direct materials cost, direct labour cost, but NOT manufacturing overhead cost. Prime cost but NOT conversion cost. Prime cost and all conversion cost Direct materials cost, direct labour cost, and variable manufacturing overhead cost Help Save & Exit Last year, fixed manufacturing overhead costs were $30,000, variable production costs were $18,000, fixed selling and administration costs were $20,000, and variable selling administrative expenses were $9.600. There was no beginning inventory. During the year, 3,000 units were produced and 2400 units were sold at a price of $40 per unit. Under variable costing, what would be the operating income foss)? Multiple Choice $4.000 (54.400) $6.000 152.000 Help The total fred manufacturing overhead costs of Cay Company are $100,000, and the total variable selling costs are $80,000. Under variable costing. how should these costs be classified? Save & Exit Period Costs A) Se B) se, eee C) 100,000 P) 180,eee Product Costs $180,eee 1ee, eee se, eee Multiple Choice Option Option Option