Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Savings, accounting for the fact that the interest rate and inflation rate will vary over time. Suppose it is now September 1st, 2019 (time

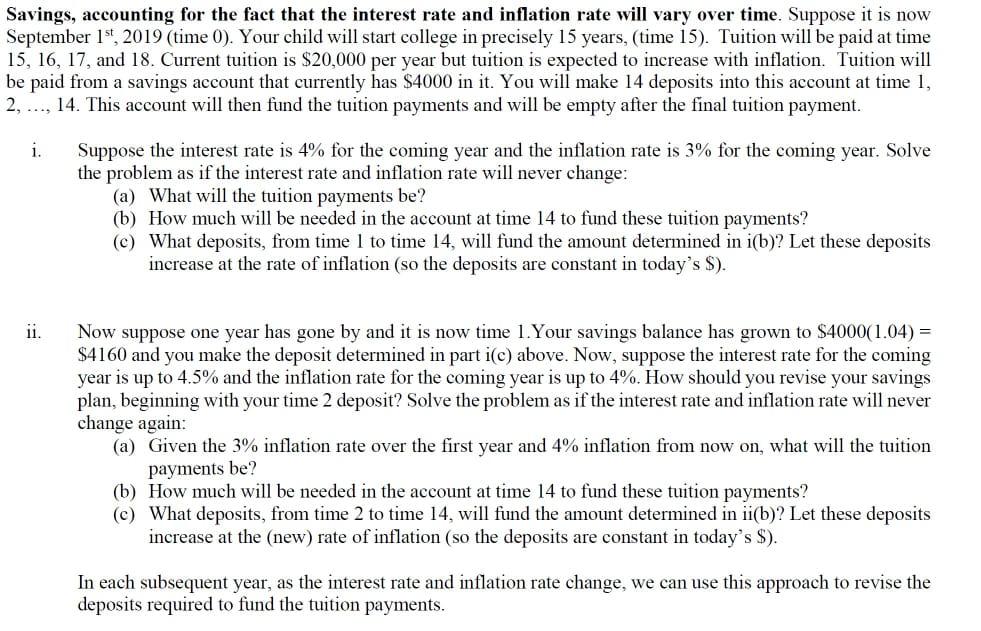

Savings, accounting for the fact that the interest rate and inflation rate will vary over time. Suppose it is now September 1st, 2019 (time 0). Your child will start college in precisely 15 years, (time 15). Tuition will be paid at time 15, 16, 17, and 18. Current tuition is $20,000 per year but tuition is expected to increase with inflation. Tuition will be paid from a savings account that currently has $4000 in it. You will make 14 deposits into this account at time 1, 2, .., 14. This account will then fund the tuition payments and will be empty after the final tuition payment. Suppose the interest rate is 4% for the coming year and the inflation rate is 3% for the coming year. Solve the problem as if the interest rate and inflation rate will never change: (a) What will the tuition payments be? (b) How much will be needed in the account at time 14 to fund these tuition payments? (c) What deposits, from time 1 to time 14, will fund the amount determined in i(b)? Let these deposits increase at the rate of inflation (so the deposits are constant in today's $). i. ii. Now suppose one year has gone by and it is now time 1.Your savings balance has grown to $4000(1.04) = $4160 and you make the deposit determined in part i(c) above. Now, suppose the interest rate for the coming is up to 4.5% and the inflation rate for the coming year is up to 4%. How should you revise your savings year plan, beginning with your time 2 deposit? Solve the problem as if the interest rate and inflation rate will never change again: (a) Given the 3% inflation rate over the first year and 4% inflation from now on, what will the tuition payments be? (b) How much will be needed in the account at time 14 to fund these tuition payments? (c) What deposits, from time 2 to time 14, will fund the amount determined in ii(b)? Let these deposits increase at the (new) rate of inflation (so the deposits are constant in today's $). In each subsequent year, as the interest rate and inflation rate change, we can use this approach to revise the deposits required to fund the tuition payments.

Step by Step Solution

★★★★★

3.38 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Answer i a Tution payments will be 20000 10315 3115935 in Year 15 20000 10316 3209413 in Year 16 200...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started