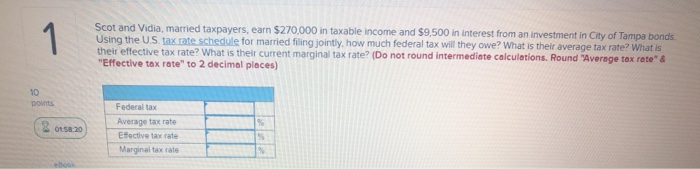

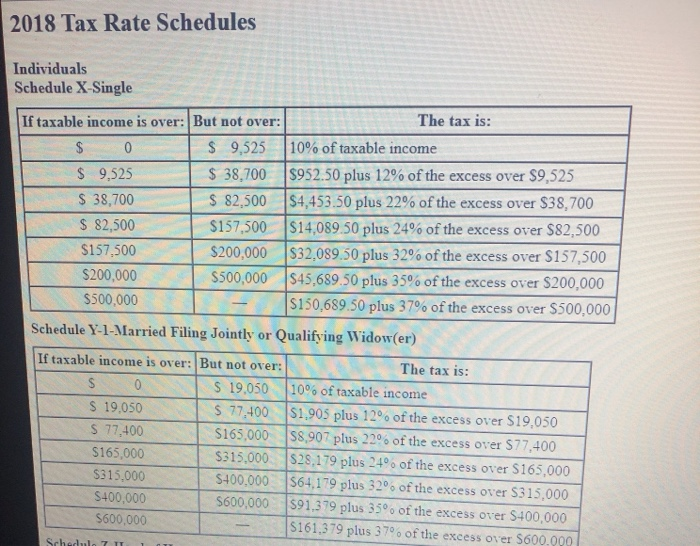

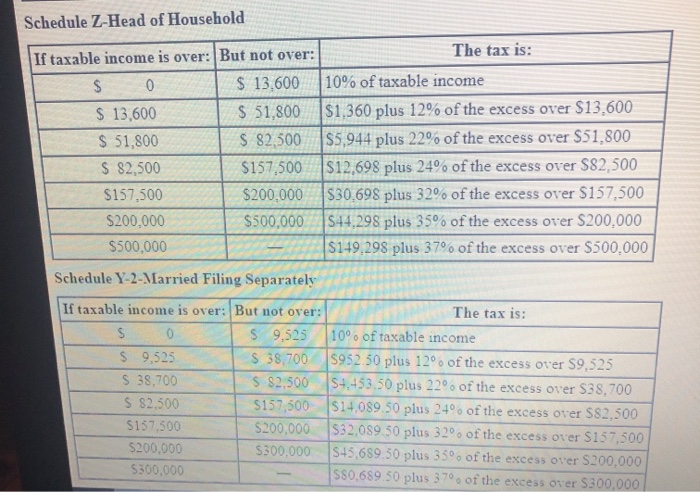

Scot and Vidia, married taxpayers, earn $270,000 in taxable income and $9,500 in interest from an investment in City of Tampa bonds Using the US, tax rate schedule for married filling jointly, how much federal tax will they owe? What is their average tax rate? What is their effective tax rate? What is their current marginal tax rate? (Do not round intermediate calculations. Round "Average tax rate" & "Effective tax rate" to 2 decimal places) points Federal tax Average tax rate 2015 20 Efective tax rate Marginal tax rate 2018 Tax Rate Schedules Individuals Schedule X-Single The tax is: If taxable income is over: But not over: $ 0 $ 9,525 (10% of taxable income $ 9,525 $ 38,7008952.50 plus 12% of the excess over $9,525 $ 38,700 $ 82,500 $4,453.50 plus 22% of the excess over $38,700 $ 82,500 $157,500 $14,089 50 plus 24% of the excess over $82,500 $157,500 $200,000 $32,089.50 plus 32% of the excess over $157,500 $200,000 $500,000 $45,689.50 plus 35% of the excess over $200,000 | $500,000 - $150.689.50 plus 37% of the excess over $500,000 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: S 0 S 19.050 10% of taxable income $ 19,050 $ 77.400 51.905 plus 12% of the excess over $19,050 S 77.400 $165,000 $8,907 plus 22of the excess over $77,400 $165,000 $315,000 $28,179 plus 24 of the excess over $165,000 $315,000 $400,000 $64,179 plus 32% of the excess over S315.000 S400,000 $600,000 $91,379 plus 35 of the excess over $400,000 $600,000 - $161.379 plus 37 of the excess over $600.000 Schedule 7 ITE Schedule Z-Head of Household The tax is: If taxable income is over: But not over: $ 0 $ 13,600 10% of taxable income $ 13,600 13.600 $ 51,800 $1,360 plus 12% of the excess over $13.600 $ 51,800 $ 82,500 $5,944 plus 22% of the excess over $51,800 $ 82,500 $157,500 $12,698 plus 24% of the excess over $82,500 $157,500 $200,000 $30,698 plus 32% of the excess over $157,500 I S 200,000 $500,000 $44.298 plus 35% of the excess over $200,000 $500,000 - 149,298 plus 37% of the excess over $500,000 Schedule Y-2- Married Filing Separately If taxable income is over: But not over: The tax is: S 0 5 9,525 10 of taxable income S 9,525 $ 38,700 $952.50 plus 12 of the excess over $9,525 $ 38,700 S $2.500 54,453.50 plus 22o of the excess over $38,700 S 82.500 $157,500 $14,089.50 plus 24 of the excess over $82,500 $157,500 $200,000 $32,089 50 plus 32 o of the excess over $157,500 $200,000 $300,000 $45.689 50 plus 350 of the excess over $200,000 $300,000 550.689 50 plus 37 of the excess over $300 000