Answered step by step

Verified Expert Solution

Question

1 Approved Answer

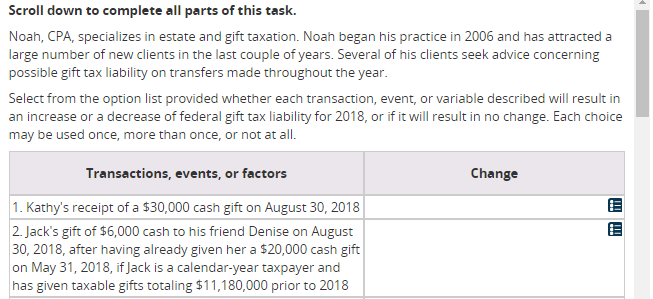

Scroll down to complete all parts of this task. Noah, CPA, specializes in estate and gift taxation. Noah began his practice in 2006 and has

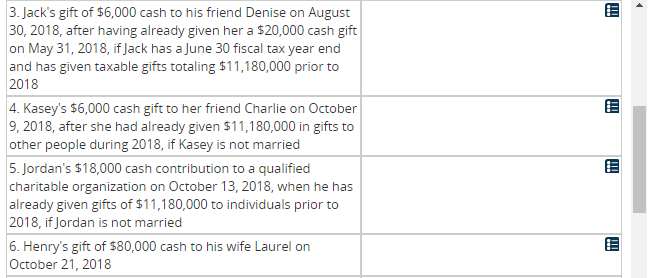

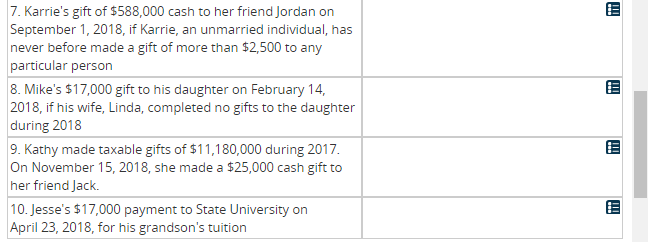

Scroll down to complete all parts of this task. Noah, CPA, specializes in estate and gift taxation. Noah began his practice in 2006 and has attracteda large number of new clients in the last couple of years. Several of his clients seek advice concerning possible gift tax liability on transfers made throughout the year Select from the option list provided whether each transaction, event, or variable described will result in an increase or a decrease of federal gift tax liability for 2018, or if it will result in no change. Each choice may be used once, more than once, or not at all. Transactions, events, or factors Change 1. Kathy's receipt of a $30,000 cash gift on August 30, 2018 2. Jack's gift of $6,000 cash to his friend Denise on August 30, 2018, after having already given her a $20,000 cash gift on May 31, 2018, if Jack is a calendar-year taxpayer and has given taxable gifts totaling $11,180,000 prior to 2018 3. Jack's gift of $6,000 cash to his friend Denise on August 30, 2018, after having already given her a $20,000 cash gift on May 31, 2018, if Jack has a June 30 fiscal tax year end and has given taxable gifts totaling $11,180,000 prior to 2018 4. Kasey's $6,000 cash gift to her friend Charlie on October 9, 2018, after she had already given $11,180,000 in gifts to other people during 2018, if Kasey is not married 5. Jordan's $18,000 cash contribution to a qualified charitable organization on October 13, 2018, when he has already given gifts of $11,180,000 to individuals prior to 2018, if Jordan is not married 6. Henry's gift of $80,000 cash to his wife Laurel orn October 21, 2018 7. Karrie's gift of $588,000 cash to her friend Jordan on September 1, 2018, if Karrie, an unmarried individual, has never before made a gift of more than $2,500 to any particular person 8.Mike's $17,000 gift to his daughter on February 14, 2018, if his wife, Linda, completed no gifts to the daughter during 2018 9. Kathy made taxable gifts of $11,180,000 during 2017 On November 15, 2018, she made a $25,000 cash gift to her friend Jack. 10. Jesse's $17,000 payment to State University on April 23, 2018, for his grandson's tuition

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started