-Select-

par-because this means that the going market interest rate is less than its coupon rate.

$1,000. The price of each bond in the issue is

$1,220.00. The bond issue is callable in 5 years at a call price of

$1,086.\ What is the bond's current yield? Round your answer to two decimal places. Do not round intermediate calculations.

%\ What is the bond's nominal annual yield to maturity (YTM)? Round your artswer to two decimal places. Do not round intermediate calculations.

%\ What is the bond's nominal annual yield to call (YTC)? Round your answer to two decimal places. Do not round intermediate calculations.

%.\ Assuming interest rates remain at current levels, will the bond issue be called?\ The firm call the bond.\ Check My Work (3 remaining)

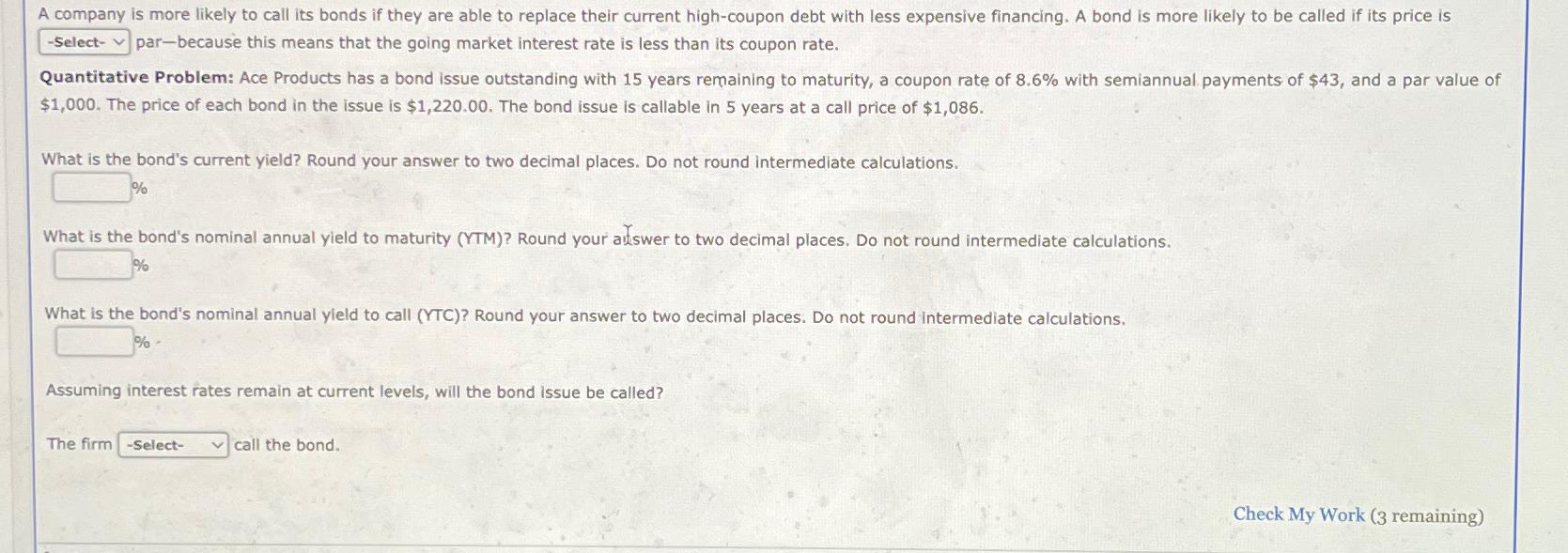

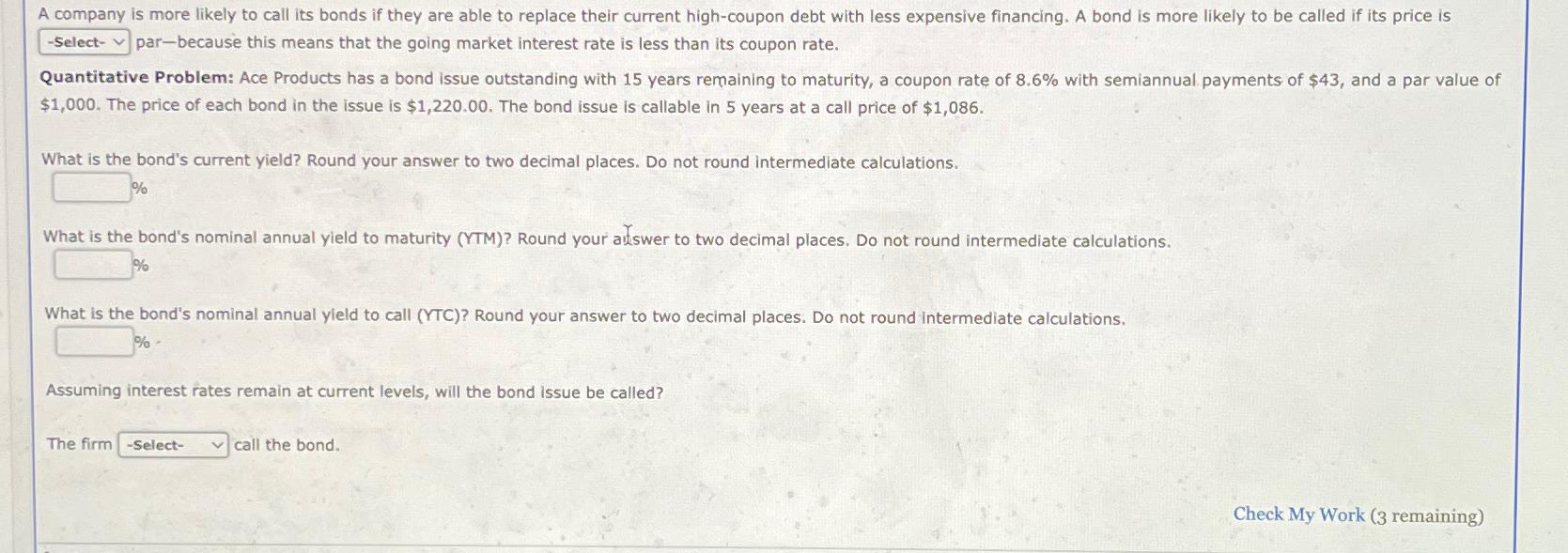

A company is more likely to call its bonds if they are able to replace their current high-coupon debt with less expensive financing. A bond is more likely to be called if its price is par-because this means that the going market interest rate is less than its coupon rate. Quantitative Problem: Ace Products has a bond issue outstanding with 15 years remaining to maturity, a coupon rate of 8.6% with semiannual payments of $43, and a par value of $1,000. The price of each bond in the issue is $1,220.00. The bond issue is callable in 5 years at a call price of $1,086. What is the bond's current yield? Round your answer to two decimal places. Do not round intermediate calculations. % What is the bond's nominal annual yield to maturity (YTM)? Round your arswer to two decimal places. Do not round intermediate calculations. % What is the bond's nominal annual yield to call (YTC)? Round your answer to two decimal places. Do not round intermediate calculations. %. Assuming interest rates remain at current levels, will the bond issue be called? The firm call the bond. A company is more likely to call its bonds if they are able to replace their current high-coupon debt with less expensive financing. A bond is more likely to be called if its price is par-because this means that the going market interest rate is less than its coupon rate. Quantitative Problem: Ace Products has a bond issue outstanding with 15 years remaining to maturity, a coupon rate of 8.6% with semiannual payments of $43, and a par value of $1,000. The price of each bond in the issue is $1,220.00. The bond issue is callable in 5 years at a call price of $1,086. What is the bond's current yield? Round your answer to two decimal places. Do not round intermediate calculations. % What is the bond's nominal annual yield to maturity (YTM)? Round your arswer to two decimal places. Do not round intermediate calculations. % What is the bond's nominal annual yield to call (YTC)? Round your answer to two decimal places. Do not round intermediate calculations. %. Assuming interest rates remain at current levels, will the bond issue be called? The firm call the bond