Answered step by step

Verified Expert Solution

Question

1 Approved Answer

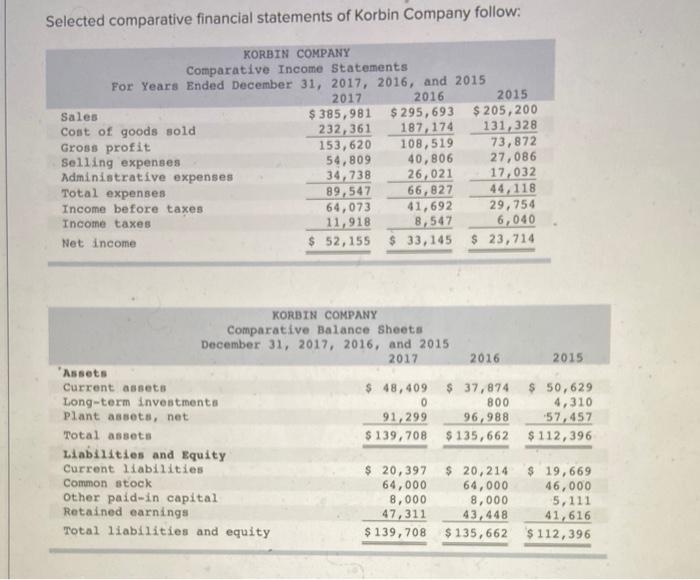

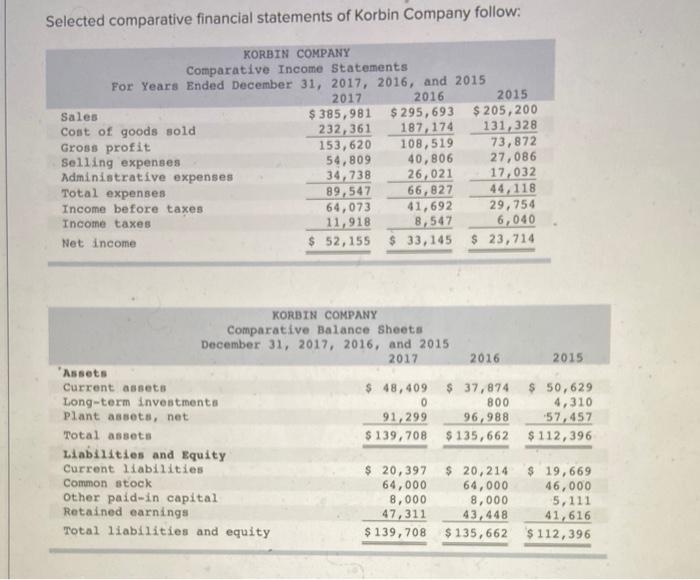

Selected comparative financial statements of Korbin Company follow: KORBIN COMPANY Comparative Income Statements For Years Ended December 31, 2017, 2016, and 2015 2017 2016 2015

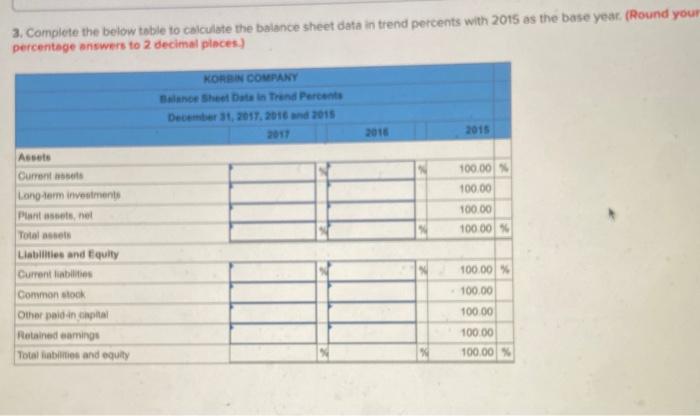

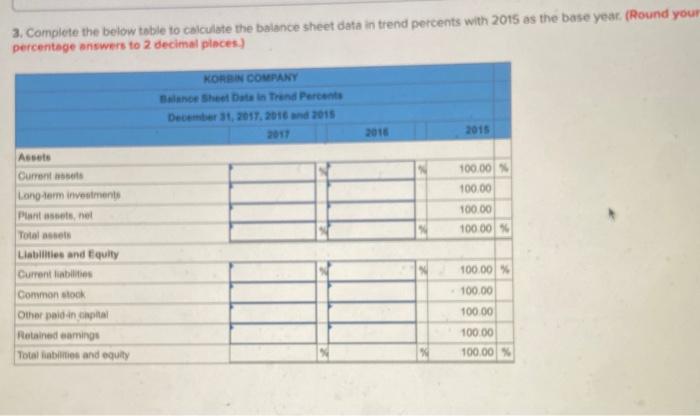

Selected comparative financial statements of Korbin Company follow: KORBIN COMPANY Comparative Income Statements For Years Ended December 31, 2017, 2016, and 2015 2017 2016 2015 Sales $385,981 $ 295,693 $ 205,200 Cost of goods sold 232,361 187,174 131,328 Gross profit 153,620 108,519 73,872 Selling expenses 54,809 40,806 27,086 Administrative expenses 34,738 26,021 17,032 Total expenses 89,547 66,827 44,118 Income before taxes 64,073 41,692 29, 754 Income taxes 11,918 8,547 6,040 Net income $ 52,155 $ 33,145 $ 23,714 KORBIN COMPANY Comparative Balance Sheets December 31, 2017, 2016, and 2015 2017 2016 2015 Assets Current assets $ 48,409 $ 37,874 $ 50,629 Long-term investments 0 800 4,310 Plant assets, net 91,299 96,988 57,457 Total assets $ 139,708 $135,662 $112,396 Liabilities and Equity Current liabilities $ 20,397 $ 20,214 $ 19,669 Common stock 64,000 64,000 46,000 Other paid-in capital 8,000 8,000 5,111 Retained earnings 47,311 43,448 41,616 Total liabilities and equity $ 139,708 $135,662 $ 112,396 3. Complete the below table to calculate the balance sheet data in trend percents with 2015 as the base year. (Round your percentage answers to 2 decimal places) KORAN COMPANY Balance Sheet Data is Trend Percent December 31, 2017, 2016 and 2015 2018 2015 100.00 100.00 10000 10000 Assets Current Long term investments Plansnet Total Liabilities and Equity Current liabilities Common stock Other paid in capital Retained Gaming Total abies and equity 100.00 100.00 100 00 100.00 100,00 %

Selected comparative financial statements of Korbin Company follow: KORBIN COMPANY Comparative Income Statements For Years Ended December 31, 2017, 2016, and 2015 2017 2016 2015 Sales $385,981 $ 295,693 $ 205,200 Cost of goods sold 232,361 187,174 131,328 Gross profit 153,620 108,519 73,872 Selling expenses 54,809 40,806 27,086 Administrative expenses 34,738 26,021 17,032 Total expenses 89,547 66,827 44,118 Income before taxes 64,073 41,692 29, 754 Income taxes 11,918 8,547 6,040 Net income $ 52,155 $ 33,145 $ 23,714 KORBIN COMPANY Comparative Balance Sheets December 31, 2017, 2016, and 2015 2017 2016 2015 Assets Current assets $ 48,409 $ 37,874 $ 50,629 Long-term investments 0 800 4,310 Plant assets, net 91,299 96,988 57,457 Total assets $ 139,708 $135,662 $112,396 Liabilities and Equity Current liabilities $ 20,397 $ 20,214 $ 19,669 Common stock 64,000 64,000 46,000 Other paid-in capital 8,000 8,000 5,111 Retained earnings 47,311 43,448 41,616 Total liabilities and equity $ 139,708 $135,662 $ 112,396 3. Complete the below table to calculate the balance sheet data in trend percents with 2015 as the base year. (Round your percentage answers to 2 decimal places) KORAN COMPANY Balance Sheet Data is Trend Percent December 31, 2017, 2016 and 2015 2018 2015 100.00 100.00 10000 10000 Assets Current Long term investments Plansnet Total Liabilities and Equity Current liabilities Common stock Other paid in capital Retained Gaming Total abies and equity 100.00 100.00 100 00 100.00 100,00 %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started